Table of Contents

- Background: The Road to South Korea

- Five Rounds of Negotiations Leading to the Summit

- First Face to Face Meeting Since 2019

- Critical Issues on the Negotiating Table

- Rare Earth Elements: The Strategic Leverage Point

- Defense and Technology Implications

- US Response and Negotiating Position

- Fentanyl Crisis: A Public Health Imperative

- Agricultural Trade: The Soybean Agreement

- Shipping Levies and Port Fees

- Taiwan: The Most Sensitive Issue

- Technology Export Controls

- Global Peace Initiatives

- Market Reactions and Economic Implications

- Immediate Market Response

- Relief Rally Expectations

- Long Term Structural Concerns

- Preliminary Framework Agreement Analysis

- Malaysia Talks Outcomes

- Negotiation Dynamics

- Strategic Context and Geopolitical Considerations

- China's Economic Blueprint

- US Diversification Strategy

- Relative Negotiating Leverage

- What to Realistically Expect From Thursday's Summit

- Likely Positive Outcomes

- Structural Issues Likely Unresolved

- Risk Factors That Could Derail Progress

- Investment and Business Implications

- Supply Chain Considerations

- Sector Specific Impacts

- Currency and Commodity Markets

- Asset Class Impact Analysis: How Markets Will React

- Gold and Precious Metals: The Safe Haven Paradox

- US Dollar: The Complex Currency Dynamic

- Equity Markets: Sector Specific Winners and Losers

- Chinese Equity Markets: The Contrarian Opportunity

- Commodities Beyond Precious Metals

- Fixed Income Markets: Bond Vigilantes Awakening

- Cryptocurrency Markets: The Digital Wild Card

- Currency Crosses: Beyond the Dollar

- Volatility Indexes: The Fear Gauge Response

- Portfolio Positioning Strategies

- Expert Analysis and Predictions

- Optimistic Scenario

- Cautious Perspectives

- Geopolitical Realities

- Historical Context: Trump Xi Relationship

- November 10 Deadline and Path Forward

- Conclusion: Measured Optimism With Strategic Vigilance

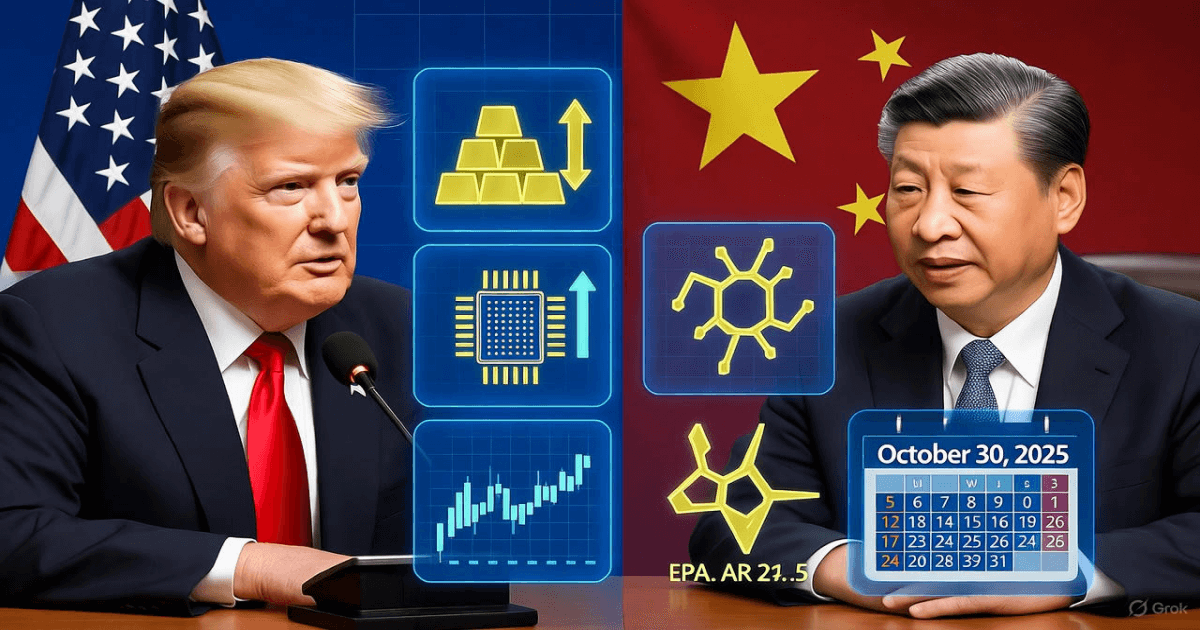

The upcoming Thursday, October 30, 2025 meeting between US President Donald Trump and Chinese President Xi Jinping represents a pivotal moment in global economic relations. Following weekend negotiations in Malaysia that produced a preliminary framework agreement, financial markets are cautiously optimistic about a potential de-escalation in the world's most consequential trade relationship. This comprehensive analysis examines the critical issues at stake, market implications, and realistic expectations for this historic summit.

Background: The Road to South Korea

Five Rounds of Negotiations Leading to the Summit

The preliminary agreement marks the fifth round of negotiations between the two nations, following previous meetings in Geneva in May, London in June, Stockholm in July, and Madrid in September. The weekend talks in Kuala Lumpur, Malaysia, proved crucial in establishing the groundwork for the presidential summit.

The negotiations took place at the skyscraper Merdeka 118 as Trump met with Southeast Asian leaders at a nearby convention center, where he brokered framework trade agreements seeking to diversify US trade away from China. The Chinese delegation was led by Vice Premier He Lifeng, China's top economic official, while the US team included Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer.

First Face to Face Meeting Since 2019

Trump's meeting with Xi this week will be their first face to face sitdown since his return to the White House. The stakes could not be higher as both leaders seek to reset a relationship that has deteriorated significantly since their last in-person meeting during the G20 summit in 2019.

Critical Issues on the Negotiating Table

Rare Earth Elements: The Strategic Leverage Point

The rare earth minerals dispute has emerged as the most contentious issue threatening to derail negotiations. China mines at least 60 percent and processes about 90 percent of the world's rare earth metals, giving Beijing enormous leverage over global technology supply chains.

On October 9, 2025, China announced the strictest rare earth and permanent magnet export controls to date, marking the first time China applied the foreign direct product rule, a mechanism long used by Washington to restrict semiconductor exports to China. These new controls require foreign companies to obtain Beijing's approval to export products containing Chinese rare earth elements.

Defense and Technology Implications

Rare earths are crucial for various defense technologies, including F-35 fighter jets, Virginia and Columbia class submarines, Tomahawk missiles, radar systems, Predator unmanned aerial vehicles, and the Joint Direct Attack Munition series of smart bombs. The restrictions also impact civilian technologies from smartphones and medical imaging equipment to electric vehicles.

Under the new rules starting December 1, 2025, companies with any affiliation to foreign militaries, including those of the United States, will be largely denied export licenses. This represents China's most consequential measure targeting the defense sector to date.

US Response and Negotiating Position

President Trump listed rare earths, fentanyl, soybeans and Taiwan as the US's top issues with China, underlining the divisive topics the two sides plan to tackle at the negotiating table. Trump threatened an additional 100 percent tariff on Chinese products after Beijing announced the expanded controls, as detailed in our analysis of how Trump's China tariffs could reshape global markets.

However, Treasury Secretary Scott Bessent stated in a CBS News interview that the threat of 100 percent tariffs is effectively off the table, and he expected China to delay its rare earth restrictions for a year while they reexamine it.

Fentanyl Crisis: A Public Health Imperative

The fentanyl crisis continues to devastate American communities, making it a non-negotiable priority for the Trump administration. Chinese trade envoy Li Chenggang indicated his belief that the sides had reached consensus on fentanyl, suggesting the US might lift or reduce a 20 percent tariff it had imposed to pressure Beijing to halt the flow of precursor chemicals used to make the deadly drug.

Agricultural Trade: The Soybean Agreement

American farmers, a crucial political base for President Trump, have been severely impacted by Chinese retaliatory tariffs. China last year purchased $13 billion of US beans, more than 20 percent of the entire crop, for animal feed and cooking oil, and the freeze has rocked rural farmers who represent a key political base for the president.

Bessent said he expected the Asian nation to make substantial soybean purchases as well as offer a deferral on sweeping rare earth controls. The reopening of soybean purchases would provide significant political capital for Trump domestically.

Shipping Levies and Port Fees

The nations would also address actions the Trump administration took to impose port service fees on Chinese vessels, which prompted Beijing to put retaliatory levies on US owned, operated, built or flagged vessels. Resolving this issue would reduce costs for both American and Chinese shipping companies.

Taiwan: The Most Sensitive Issue

Trump mentioned that he will discuss Taiwan, stating he would not go there but would talk about it, adding much respect for Taiwan. This represents a delicate balancing act as China considers Taiwan discussions a red line in diplomatic relations.

Adding tension to the summit, Chinese state media reported late Sunday that a group of Chinese H-6K bombers recently flew near Taiwan to practice confrontation drills, with the H-6K being a strategic bomber that can carry nuclear weapons. This military demonstration occurred just days before the scheduled Trump Xi meeting, as covered in our article on Asian markets reacting to renewed US China trade tensions.

Technology Export Controls

While the US has maintained strict semiconductor export controls on China, negotiations may address broader technology transfer issues. Bessent telegraphed a wide ranging agreement between Trump and Xi that would extend a tariff truce, resolve differences over the sale of TikTok, and keep up the flow of rare earth magnets necessary for the production of advanced products from semiconductors to jet engines.

Global Peace Initiatives

The two leaders are also planning to discuss a global peace plan, after Trump said publicly he hoped to enlist Xi's help in resolving Russia's war in Ukraine. US Ambassador to NATO Matthew Whitaker stated that Trump's meeting with Xi will be crucial in securing China's cooperation on sanctions against Russia, noting that the Chinese are buying way too much Russian oil and gas, a topic we explored in our coverage of US sanctions disrupting China's oil imports.

Market Reactions and Economic Implications

Immediate Market Response

Signs of an impending deal lifted sentiment in markets, with risk sensitive currencies like the Australian dollar and New Zealand dollar climbing against the greenback in early trading, outperforming major peers, while havens including the Swiss franc and Japanese yen edged lower.

Relief Rally Expectations

Any agreement would be a relief to international markets even if it does not address underlying issues involving manufacturing imbalances and access to state of the art computer chips. Financial analysts expect markets to respond positively to any signs of de-escalation, though structural issues in the US China economic relationship remain unresolved.

Long Term Structural Concerns

Despite the recent escalation, the upcoming Trump Xi meeting will be key to restoring a measure of calm to the bilateral relations and set the stage for a final negotiating push toward a trade deal in early 2026. However, experts caution that deeper structural disputes involving technology supremacy, market access, and geopolitical competition may never be fully resolved.

Preliminary Framework Agreement Analysis

Malaysia Talks Outcomes

China's top trade negotiator Li Chenggang told reporters the two sides had reached a preliminary consensus, while Trump's treasury secretary Scott Bessent said there was a very successful framework.

Chinese state media Xinhua reported that US and Chinese trade negotiators reached a basic consensus on how to address their respective concerns following talks over the weekend in Kuala Lumpur. Both sides will now report the outcome back to their leaders ahead of the planned summit.

Negotiation Dynamics

Li described the US position as tough, whereas China has been firm in defending its own interests and rights. Both Beijing and Washington believe a stable China US relationship is good for both sides.

Li, whom Bessent called unhinged earlier this month, described the talks as intense and the US position as tough, but hailed progress in the discussions. This characterization suggests that while progress was made, significant tensions remain beneath the surface.

Strategic Context and Geopolitical Considerations

China's Economic Blueprint

Facing sweeping US tech restrictions in recent years, China has pledged to deepen its self reliance on technology over the coming five years, the ruling Communist Party said in a new economic blueprint released Thursday. This long term strategy suggests Beijing is preparing for sustained technological competition regardless of near term trade agreements.

US Diversification Strategy

The negotiations took place as Trump met with Southeast Asian leaders at a nearby convention center, where he brokered a series of framework trade agreements seeking to diversify US trade away from China. This parallel diplomacy with ASEAN nations demonstrates the Trump administration's broader strategy of reducing dependence on Chinese supply chains.

Relative Negotiating Leverage

While both sides retain significant leverage, Beijing appears more willing to walk away from a deal that does not satisfy its objectives, while Trump might want to avoid enforcement of additional tariffs. This asymmetry in negotiating positions could influence the final outcome.

What to Realistically Expect From Thursday's Summit

Likely Positive Outcomes

Based on the preliminary framework and official statements, investors can reasonably expect:

- Tariff De-escalation: The threat of 100 percent tariffs on Chinese goods is effectively off the table, providing immediate relief to businesses and consumers.

- Rare Earth Compromise: China is expected to delay rare earth restrictions for a year while they reexamine it, giving global supply chains critical breathing room.

- Agricultural Wins: Substantial soybean purchases from China would provide a significant political win for Trump and relief for American farmers.

- Fentanyl Cooperation: Progress on fentanyl precursor controls appears likely, potentially leading to reduced tariffs in this area.

- Extended Negotiations: Rather than a comprehensive deal, expect an agreement to continue talks and extend the current tariff truce beyond the November 10 expiration date.

Structural Issues Likely Unresolved

Several fundamental conflicts will almost certainly remain unaddressed:

- Technology Competition: The semiconductor war and broader tech rivalry will continue regardless of trade agreements.

- Manufacturing Imbalances: Deep structural issues in the bilateral trade relationship require years of adjustment.

- Geopolitical Tensions: Taiwan, South China Sea disputes, and competing spheres of influence transcend trade negotiations.

- Market Access: Chinese state subsidies, intellectual property protections, and market access barriers represent long term challenges.

Risk Factors That Could Derail Progress

This will be a high risk, high reward leaders' meeting as both sides try to hit the reset button for the relationship. Several factors could undermine the positive momentum:

- Unexpected Demands: Either leader could introduce new conditions at the summit.

- Domestic Political Pressure: Both face internal constituencies demanding tough stances, as discussed in our analysis of the US government shutdown warning from Goldman Sachs.

- Taiwan Tensions: The recent military exercises near Taiwan demonstrate ongoing geopolitical friction.

- Implementation Details: Agreement in principle often founders on specific implementation mechanisms.

Investment and Business Implications

Supply Chain Considerations

Companies dependent on rare earth minerals should prepare for continued volatility despite any temporary reprieve. China's export controls evolved from restricting fundamental semiconductor materials to advanced interconnect metals, then to functional rare earths used in chipmaking, with the October 2025 round extending to the optical and magnetic layer of the value chain.

Sector Specific Impacts

Technology: Semiconductor manufacturers and AI companies face ongoing uncertainty regarding access to critical materials and Chinese markets. This is particularly relevant for companies like Nvidia, which recently announced $5.5 billion in losses from H20 AI chip export restrictions to China.

Agriculture: American farmers should see improved access to Chinese markets, potentially driving up commodity prices.

Manufacturing: Companies with complex supply chains spanning both countries may see reduced tariff pressures in the near term.

Defense: Military contractors must accelerate development of alternative rare earth supply chains regardless of negotiation outcomes. Companies like Lockheed Martin and others discussed in our article on Trump's October 15 White House dinner with defense contractors remain particularly exposed.

Currency and Commodity Markets

Successful negotiations would likely strengthen risk assets and weaken safe haven currencies. Commodity markets, particularly soybeans and rare earth minerals, will respond rapidly to any agreement specifics.

Asset Class Impact Analysis: How Markets Will React

Gold and Precious Metals: The Safe Haven Paradox

Gold prices face significant downward pressure from any positive summit outcomes. Recent market patterns demonstrate this inverse relationship clearly. When US and China agreed to preliminary frameworks in earlier negotiations, gold experienced sharp selloffs of 2% to 3% as safe haven demand evaporated.

Historical Context: Gold has surged over 22% since Trump's inauguration in January 2025, setting 24 new all time highs and crossing the $4,000 mark. Chinese demand has been a crucial driver, with the People's Bank of China making 11 consecutive monthly purchases and Chinese households significantly increasing gold ETF holdings amid trade war uncertainty.

Summit Impact Scenarios:

Positive Deal Outcome: Gold could decline 2% to 5% immediately, potentially testing the $3,100 support level that traders have identified, as outlined in our gold price forecast and strategy analysis. A trade deal dampens gold's appeal as a safe haven since it thrives during geopolitical and economic uncertainty.

Negative or Stalled Negotiations: Gold could surge past $4,500 per ounce, as CPM Group managing partner Jeffrey Christian predicts. Political and economic concerns would drive prices higher, potentially reaching $5,000 in 2026 according to Bank of America's forecasts.

Silver, Platinum, Palladium: These industrial precious metals show even greater sensitivity to trade outcomes. Silver traded at $36.53 per ounce recently, while platinum hit its highest level since May 2021 at $1,213.08. A successful deal would pressure these metals as industrial demand expectations improve but safe haven buying disappears.

US Dollar: The Complex Currency Dynamic

The US Dollar exhibits conflicting pressures surrounding the Trump Xi meeting, making it one of the most difficult assets to predict with certainty.

Current Position: The Dollar Index (DXY) has been trading around 99.00, showing resilience despite trade uncertainties. The greenback remains the best gauge of trade sentiment according to currency strategists.

Bullish Factors for USD:

- Successful negotiations reduce global economic uncertainty, supporting dollar strength

- Reduced tariff threats decrease inflationary pressures, potentially allowing Federal Reserve flexibility

- Risk on sentiment typically supports dollar against safe haven currencies like yen and Swiss franc

- Recent trading shows the dollar rising 0.2% against rivals when trade deal hopes emerge

Bearish Factors for USD:

- Long term concerns about dollar hegemony as China and other nations diversify reserves

- Structural trade imbalances remain unresolved regardless of summit outcomes

- Federal Reserve rate cut expectations (98.9% probability of 25 basis point cut on October 29) could weaken dollar

- Ongoing US government shutdown (entering 22nd day) erodes confidence in US economic governance

Expected Movement: A positive summit outcome likely produces initial dollar strength of 0.5% to 1% against major currencies, particularly versus commodity currencies like Australian and New Zealand dollars. However, this strength may prove temporary if structural issues remain unaddressed.

Equity Markets: Sector Specific Winners and Losers

Stock markets show the most divergent responses across different sectors, creating both opportunities and risks for investors.

Technology and Semiconductors: Maximum Volatility Expected

The technology sector faces the highest stakes from the summit outcome. The iShares Semiconductor ETF (SOXX) represents an excellent proxy for this sector's performance.

Positive Summit Impact: Semiconductor stocks could surge 5% to 8% on successful negotiations. Leading beneficiaries include:

- Nvidia (NVDA): As the AI hardware leader, reduced tariffs on components and improved market access to China could boost margins significantly

- Intel (INTC) and Marvell Technology (MRVL): Both saw substantial gains during previous trade deal announcements

- AMD, Qualcomm, Broadcom: All heavily exposed to Chinese manufacturing and markets

The removal of rare earth restrictions represents the single most important factor for semiconductor manufacturers. China controls 60% of global rare earth production and 85% of processing capacity. A one year delay in restrictions would provide critical breathing room for supply chain adjustments.

Risk Factors: If negotiations fail, technology stocks face continued pressure from supply chain disruptions and limited market access. The recent Nvidia announcement of $5.5 billion in losses from H20 AI chip export restrictions to China demonstrates the sector's vulnerability.

Agricultural Stocks: Clear Beneficiaries of Détente

The agricultural sector represents one of the clearest beneficiary groups from positive summit outcomes.

Key Winners:

- Deere & Company (DE): Already up 5.5% this week on deal hopes, relies heavily on raw material imports and views China as a lucrative sales market

- Archer Daniels Midland (ADM): Share price up 5.9% this week and 9.9% over 30 days, reversing earlier downgrades. Soybean purchases by China directly impact profitability

- Bunge, Corteva: Both benefit from normalized agricultural trade flows

Market Dynamics: China purchased $13 billion of US soybeans last year, representing over 20% of the entire US crop. The freeze has devastated rural farmers who form a key political base for President Trump. Treasury Secretary Bessent's expectation of substantial soybean purchases provides strong upside catalyst.

The iShares MSCI Agriculture Producers ETF (VEGI) offers diversified exposure to this opportunity, holding 130 stocks with $93 million in assets under management.

Industrial Sector: Manufacturing Renaissance Potential

The Industrial Select Sector SPDR (XLI) stands to benefit significantly from tariff reductions and normalized trade flows.

Positive Factors:

- Reduced tariffs revitalize manufacturing, particularly companies involved in industrial machinery, vehicles, and steel

- Lower trade barriers lead to increased exports and competitive pricing

- $19.4 billion in assets under management provides liquidity for institutional investors

Sub Sector Focus:

- Aerospace and Defense: Benefits from resolved rare earth supply chains

- Machinery: Caterpillar, Cummins, and similar companies see improved export prospects

- Ground Transportation: Normalized shipping costs reduce operational pressures

Energy Sector: The Overlooked Beneficiary

Energy companies represent an underappreciated opportunity from successful negotiations. The Energy Select Sector SPDR Fund (XLE) offers the largest and most liquid exposure.

Catalysts for Energy Stocks:

- Reduced tariffs lead to increased oil and gas exports to China

- US energy producers expand market reach into world's largest energy consumer

- $26.1 billion in assets under management with 19 million shares daily volume provides institutional scale

Geopolitical Dimension: Trump's expected discussion with Xi about China's purchases of Russian oil and gas creates additional complexity, as detailed in our analysis of Saudi Arabia's strategic oil surge. If China redirects some energy purchases from Russia to the United States, American energy producers benefit doubly from both policy and market share gains.

Retail and Consumer Goods: Cost Pressure Relief

Major retailers face substantial cost pressures from Chinese tariffs on imported goods. Successful negotiations provide immediate margin expansion opportunities.

Direct Beneficiaries:

- Nike (NKE), Under Armour (UAA), Lululemon (LULU), Abercrombie & Fitch (ANF): Already experiencing share price increases as tariff moratorium expectations build

- Amazon (AMZN): Experienced 7.4% surge during previous tariff reduction announcements due to reliance on Chinese goods and advertisers

- Walmart (WMT), Target (TGT), Costco (COST): Lower import costs flow directly to improved margins or competitive pricing, as discussed in our article on Walmart's AI alliance and global expansion

E Commerce Platforms: Companies like Shein and Temu face mixed impacts. While normalized tariffs help their business models, the end of de minimis exemptions (allowing goods under $800 to enter duty free) creates new cost pressures. These platforms previously benefited enormously from this loophole, processing up to 4 million daily parcels.

Automotive Sector: Complications and Exceptions

The automotive industry faces unique challenges as vehicles have been explicitly excluded from many tariff reduction proposals.

Headwinds:

- Steel and aluminum tariffs remain at 50%, raising production costs

- Electric vehicle tariffs potentially stay at 100% due to strategic competition concerns

- Legacy automakers with Chinese operations face continued uncertainty

Potential Winners:

- Auto parts suppliers: If broader trade normalization occurs, component manufacturers benefit even if vehicle tariffs remain

- Tesla (TSLA): Unique position with Shanghai gigafactory could benefit from eased tensions despite EV tariff exclusions

Chinese Equity Markets: The Contrarian Opportunity

Hong Kong listed Chinese stocks and mainland Chinese equities represent high risk, high reward plays on summit success.

Recent Performance: Hong Kong's Hang Seng Index has rallied 1.8% to 3% on trade deal hopes, while Chinese stocks listed in the US show similar patterns.

Bull Case Arguments:

- Chinese stocks trade at significant discounts to historical valuations due to trade war concerns

- Successful negotiations remove major overhang on domestic consumption and export sectors

- Government stimulus measures combine with trade détente to supercharge growth

- Strategic sectors like semiconductors, 5G, and green energy benefit from reduced US restrictions

Bear Case Considerations:

- Structural decoupling continues regardless of near term trade agreements

- Capital flight concerns remain for international investors

- Regulatory uncertainties in China create additional risks beyond trade relations

- Delisting threats for Chinese companies on US exchanges persist

Commodities Beyond Precious Metals

Crude Oil: Expected to rise 2% to 4% on successful summit outcome as demand projections improve with eased trade tensions. WTI crude around $62.50 represents attractive entry point if global economic growth concerns dissipate.

Copper: Industrial metal demand closely tied to Chinese economic activity. Successful negotiations boost construction and manufacturing outlook, potentially driving copper prices 3% to 5% higher.

Soybeans: Most directly impacted agricultural commodity. Futures could surge 10% to 15% on confirmed Chinese purchase commitments, representing years of pent up demand.

Rare Earth Elements: Paradoxically, successful negotiations that delay Chinese export restrictions could initially pressure rare earth prices as supply concerns ease. However, long term strategic stockpiling by Western nations may support prices.

Fixed Income Markets: Bond Vigilantes Awakening

US Treasury Yields: The 10 year Treasury yield trading at 4.43% faces upward pressure from successful negotiations. Reduced recession fears and potential inflation from renewed trade flows could push yields toward 4.60% to 4.75%.

Corporate Bonds: Investment grade corporate bonds benefit from reduced business uncertainty. Credit spreads likely tighten 10 to 20 basis points on positive summit outcomes.

High Yield Bonds: Companies heavily exposed to trade dynamics see the most significant spread compression. However, energy and commodity producer bonds in high yield space face mixed impacts from dollar strength.

Cryptocurrency Markets: The Digital Wild Card

Bitcoin (BTC): Trading near $112,000 after gaining nearly 4% this week shows complex dynamics. Some analysts view Bitcoin as digital gold, suggesting it should decline on reduced uncertainty. However, institutional adoption momentum may override trade war impacts.

Alternative Cryptocurrencies: More speculative digital assets show higher volatility to risk sentiment shifts. Successful summit likely produces risk on rotation away from crypto toward traditional equities.

Currency Crosses: Beyond the Dollar

EUR/USD: Trading around 1.1566, the euro faces downward pressure against dollar on positive summit news. Target range of 1.1400 to 1.1500 likely if trade deal materializes.

USD/JPY: Japanese yen near 152.57 per dollar represents one of the weakest levels in months, as discussed in our analysis of Japan's current account surplus amid yen depreciation. Political uncertainty in Japan combines with trade deal optimism to potentially push this pair toward 155.00.

AUD/USD and NZD/USD: Commodity currencies show greatest sensitivity to China trade developments. Australian dollar at $0.6516 could surge to $0.6700 on successful negotiations given Australia's China trade exposure. New Zealand dollar at six month low of $0.57145 offers similar upside potential.

USD/CNY: The Chinese yuan represents the most direct barometer of trade relations. Successful summit should strengthen yuan from current levels, potentially reaching 7.10 to 7.05 range from recent 7.25 area.

Volatility Indexes: The Fear Gauge Response

VIX (CBOE Volatility Index): Expected to decline 15% to 25% on positive summit outcome as equity market uncertainty diminishes. Current elevated readings reflect trade war premium that would quickly dissipate.

VXTLT (Treasury Volatility): Bond market volatility likely increases rather than decreases on successful negotiations, as traders reassess growth and inflation outlook.

Portfolio Positioning Strategies

Conservative Approach:

- Reduce gold holdings by 25% to 50% before summit

- Increase exposure to dividend paying domestic US stocks

- Maintain higher cash levels to capitalize on post summit volatility

Aggressive Growth Strategy:

- Overweight semiconductor ETFs and technology leaders

- Add Chinese equity exposure through Hong Kong listed stocks

- Increase agricultural commodity and stock positions

Balanced Diversification:

- Trim precious metals to 5% of portfolio from 10%

- Equal weight US and international developed market equities

- Maintain 10% to 15% alternative investments including commodities and real assets

Risk Management Essentials: Regardless of strategy, investors should implement stop loss orders on leveraged positions and avoid overconcentration in any single sector. The 90 day temporary nature of any agreement means volatility will return when extension negotiations begin.

Expert Analysis and Predictions

Optimistic Scenario

Trump himself predicted a good deal with China as he spoke with reporters on the sidelines of the Association of Southeast Asian Nations summit in Kuala Lumpur, saying he expected additional leader level follow-up meetings in China and the US. They want to make a deal and we want to make a deal, Trump said.

Bessent said the framework sets up Trump and Xi to have a very productive meeting, adding he thinks it will be fantastic for US citizens, US farmers, and for the country in general.

Cautious Perspectives

Markets will be closely watching the details of the ultimate agreement after nearly a year of head spinning changes to trade and tariff policies between the US and China. Skeptics note that previous agreements have faltered during implementation phases.

The two countries may agree to resume ongoing trade talks rather than a sweeping trade deal, stressing that deeper structural disputes have not been resolved and may never be.

Geopolitical Realities

China's willingness to use its trade heft to advance geopolitical goals should make policymakers in the West wake up to the burgeoning power of China's manufacturing supply chain and its control over certain chokepoint technologies.

Research from the Australian Strategic Policy Institute shows that China leads the US in 57 out of 64 critical technology categories, highlighting the long term competitive challenge facing American policymakers.

Historical Context: Trump Xi Relationship

Trump and Xi met face to face five times during the US president's first term, including a Mar a Lago welcome for Xi and a Trump trip to Beijing. At their most recent in person meeting in June 2019 on the sidelines of a G20 summit, the US and China were seeking a trade deal amid major tariff escalations by both countries.

Trump has long heralded Xi's leadership and touted a warm relationship with his counterpart, whom he's described both as a friend and extremely hard to make a deal with. This complex personal dynamic will play a significant role in the summit's outcome.

November 10 Deadline and Path Forward

The temporary tariff truce expires on November 10, 2025, creating urgency for both sides to reach at least a framework agreement. The talks came on the heels of a fresh surge of tensions in the volatile bilateral relationship and ahead of the November 10 expiration of a temporary tariff truce.

The Thursday summit must produce concrete commitments to extend this deadline and establish a roadmap for continued negotiations. Without such progress, both economies face the prospect of renewed tariff escalations and further supply chain disruptions.

Conclusion: Measured Optimism With Strategic Vigilance

The Trump Xi summit on October 30, 2025 arrives at a critical juncture for the global economy. The preliminary framework agreement reached in Malaysia provides genuine grounds for optimism that both leaders want to avoid a catastrophic breakdown in bilateral relations.

However, investors and business leaders should maintain strategic vigilance. The structural tensions driving US China competition extend far beyond trade disputes into technology leadership, military capabilities, and global influence. No single summit can resolve these fundamental conflicts.

The realistic best case scenario involves:

- Extending the tariff truce for 6 to 12 months

- Establishing working groups on key issues

- Achieving quick wins on soybeans and fentanyl

- Creating a one year breathing space on rare earth restrictions

- Agreeing to additional high level meetings

Markets will likely rally on any positive signals from the summit, but long term investors should prepare for continued volatility in US China relations. The Thursday meeting represents a potential inflection point, not a final resolution.

Asset Allocation Implications: The summit outcome will create significant dispersions in asset class performance. Gold, US Treasuries, and safe haven currencies face downside risk on positive news, while equities (particularly technology, agriculture, and industrials), commodities, and risk currencies offer upside potential. Investors should position portfolios to capture these divergences while maintaining appropriate risk management discipline. Our comprehensive gold price forecast for 2025 provides additional guidance on precious metals positioning.

Both sides will try to hit the reset button for a relationship rattled by the latest round of tit for tat restrictions, while avoiding any big headline concession. Success should be measured not by comprehensive resolution of all disputes, but by establishing a sustainable framework for managing competition while avoiding economic catastrophe.

The stakes for global markets, technology supply chains, and geopolitical stability could not be higher. Thursday's meeting will set the tone for US China relations through 2026 and potentially influence the trajectory of the global economy for years to come. For investors, the key is not predicting the exact outcome but positioning portfolios to respond dynamically to whatever emerges from this historic summit.

As the world watches South Korea this week, the financial implications extend far beyond the immediate tariff discussions. The meeting represents a defining moment for global economic architecture, supply chain resilience, and the balance of power in the 21st century. Whether this summit produces a genuine détente or merely a temporary pause in escalating tensions will become clear in the coming days, but the ripple effects will be felt across every major asset class and in every corner of the global economy.