Table of Contents

- Gold Price Today: Real Time Updates on the $4000 Breakthrough

- Reasons Why Gold Price Hit $4000 in 2025

- Impact of Gold Price Surpassing $4000 on Markets and Economy

- Historical Context: Gold Price Milestones Leading to $4000

- Expert Opinions on Gold Hitting $4000 and Market Reactions

- Gold Price Forecast 2025: Predictions and Outlook Post $4000

- How to Invest in Gold After the $4000 Milestone: Strategies and Tips

Gold has shattered expectations by crossing the $4000 per ounce threshold, marking a pivotal moment in financial markets. On October 7, 2025, gold futures on the COMEX exchange briefly touched $4005.80 before settling slightly below, while spot gold prices hovered just under $4000 at around $3991 to $3993 per ounce. This breakthrough comes amid escalating global uncertainties, driving investors toward safe haven assets. As of October 8, 2025, the momentum continues, with prices stabilizing above $3990 in early trading sessions. This article delves into the details of this historic event, exploring causes, implications, and future outlooks to provide comprehensive insights for investors and market watchers.

Gold Price Today: Real Time Updates on the $4000 Breakthrough

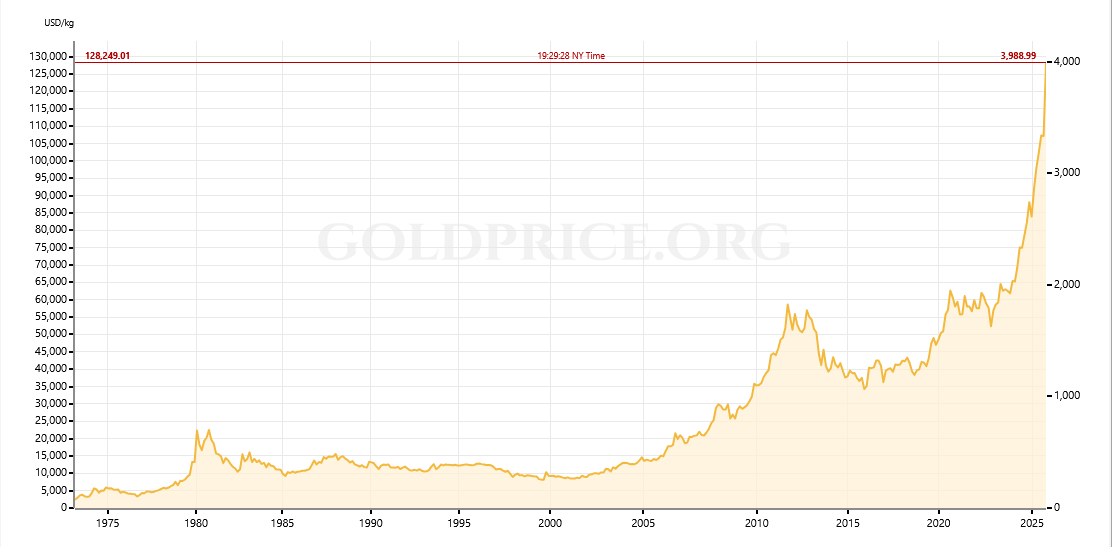

Current gold price today stands at approximately $3993 per ounce for spot gold, following yesterday's unprecedented climb above $4000 in futures trading. The surge began early in the trading day on October 7, with December gold futures the most active contract pushing past the psychological barrier amid high volume. By midday, prices had reached $4003 per troy ounce, reflecting a year to date gain of over 50 percent from January's levels around $2670.

This real time movement underscores gold's role as a barometer for economic health. Intraday charts reveal volatile candlestick patterns, with upward momentum supported by moving averages trending positively. For instance, the 50 day moving average has crossed above the 200 day average, signaling a bullish golden cross formation. Traders monitoring gold price live noted increased buying pressure from institutional investors, pushing the metal to new highs despite minor pullbacks. As markets open on October 8, analysts watch for consolidation or further gains, with resistance levels eyed at $4020 and support near $3950.

Reasons Why Gold Price Hit $4000 in 2025

The ascent of gold to $4000 stems from a confluence of macroeconomic and geopolitical factors. Primarily, the ongoing U.S. government shutdown, now in its second week as of October 7, has delayed critical economic data releases, including payroll reports, heightening uncertainty. This data blackout complicates Federal Reserve policy decisions, with markets pricing in a quarter point interest rate cut later this month. Lower rates diminish the appeal of yield bearing assets, making non interest paying gold more attractive.

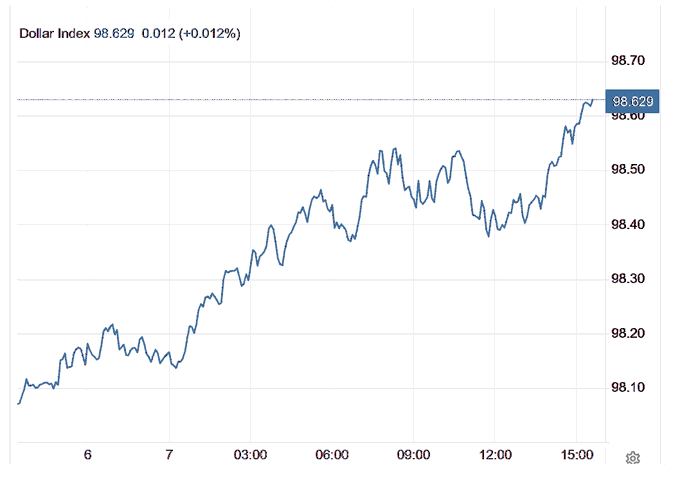

Geopolitical tensions further fuel the rally. Ongoing conflicts in Ukraine and the Middle East, coupled with President Donald Trump's aggressive trade policies and new tariffs imposed since early 2025, have strained global supply chains and boosted inflation concerns. Central banks worldwide, including the People's Bank of China, continue aggressive gold purchases to diversify reserves away from the weakening U.S. dollar. The dollar's decline, exacerbated by Fed easing expectations, enhances gold's value in international terms.

Investor sentiment plays a key role too. Safe haven demand has surged, with gold backed exchange traded funds (ETFs) recording inflows reaching levels not seen since September 2022. Retail investors on Main Street are also participating, with jewelry dealers reporting spikes in sales and valuations of personal gold holdings amid economic pessimism.

Impact of Gold Price Surpassing $4000 on Markets and Economy

The gold price breakthrough above $4000 has rippled across financial markets. Stock indices like the Dow Jones Industrial Average and S&P 500 experienced declines on October 7, as investors shifted toward safer assets amid trade negotiation failures, such as the unproductive meeting between President Trump and Canadian Prime Minister Mark Carney. Commodities broadly felt the effects, with silver surging nearly 60 percent year to date, approaching its 1980 record before a slight retreat.

On the economic front, this surge highlights unease comparable to past crises. Gold's 50 percent plus rise in 2025 outpaces gains during the 2007 2009 recession and the COVID 19 pandemic, rivaling the inflationary spike of 1979. For consumers, higher gold prices translate to sticker shock in jewelry markets, with retailers like Pandora and Signet warning of price hikes due to elevated costs and tariffs. Mining stocks, such as those in Trilogy Metals, saw dramatic gains following government investments in critical minerals.

Broader implications include potential inflationary pressures and shifts in investment portfolios. As gold eclipses $4000, it may draw more capital from equities, potentially dampening stock market recoveries while bolstering precious metals sectors.

Historical Context: Gold Price Milestones Leading to $4000

Gold's journey to $4000 builds on a rally that ignited in 2022, triggered by the freezing of $300 billion in Russian assets amid the Ukraine invasion. This event spurred central bank diversification, propelling prices from under $2000 to current levels. Historically, gold has served as a hedge during turmoil: it doubled during the 1970s inflation era and surged post 2008 financial crisis.

In recent years, prices climbed steadily, breaking $3000 in mid 2025 before accelerating toward $4000. This 50 percent annual gain is the largest since 1979, underscoring parallels with past economic shocks. Unlike previous spikes driven solely by inflation, today's rally incorporates geopolitical risks, trade wars, and monetary policy shifts, making it multifaceted and potentially more sustained.

Expert Opinions on Gold Hitting $4000 and Market Reactions

Experts view the $4000 milestone as a harbinger of prolonged uncertainty. Giovanni Staunovo of UBS Global Wealth Management attributes the surge to U.S. dollar weakness and Fed rate cuts, noting the 2022 Ukraine trigger as foundational. Peter Schiff, a prominent economist, highlighted gold's evening push toward $3990, suggesting spot prices could soon follow futures above $4000.

On social platforms like X, reactions vary: traders like @CHARTISKING discussed short positions at $4014 with stops at $4025 4035, while others lamented stuck shorts from $3200 levels. Analysts predict further upside, with potential for gold to test $4020 amid continued central bank buying and geopolitical strife. However, some warn of overextension, advising caution against chasing highs.

Gold Price Forecast 2025: Predictions and Outlook Post $4000

Looking ahead, gold price forecast for 2025 remains bullish, with many projecting sustained gains. Analysts anticipate prices could reach $4200 by year end if Fed cuts materialize and conflicts persist. ETF inflows and central bank demand suggest room for growth, though a resolution to the U.S. shutdown or trade deals might cap upside.

Long term outlooks point to $5000 within two years, driven by de dollarization trends and inflation hedging. Risks include a stronger dollar from unexpected economic strength or policy shifts. Investors should monitor key indicators like interest rates, geopolitical news, and dollar indices for directional cues.

How to Invest in Gold After the $4000 Milestone: Strategies and Tips

With gold above $4000, investment strategies abound. Physical gold, such as bars or coins, offers tangible security but incurs storage costs. ETFs like GLD provide liquidity without physical handling. Mining stocks amplify exposure but carry operational risks.

For beginners, allocate 5 to 10 percent of portfolios to gold as a hedge. Advanced investors might explore futures or options for leveraged plays. Always diversify and consult financial advisors, noting that past performance does not guarantee future results. Amid this surge, timing entries during pullbacks could optimize returns.

In summary, gold's breach of $4000 encapsulates broader economic anxieties, positioning it as a cornerstone asset in uncertain times. Stay informed as markets evolve.