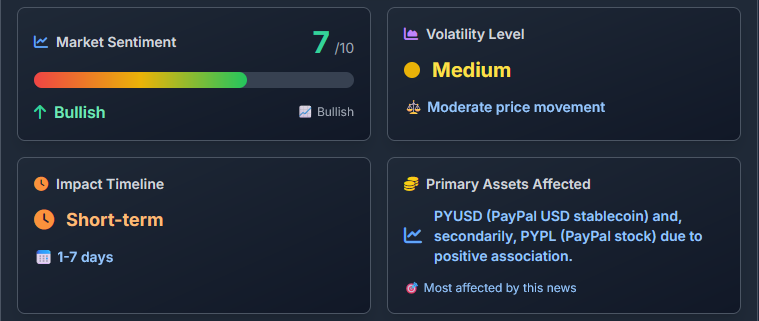

In a testament to the accelerating fusion of traditional finance and blockchain technology, PayPal's proprietary stablecoin, PYUSD, has shattered expectations by surpassing a $2.5 billion market capitalization. This explosive growth, which has seen the token's supply double in just the past month, underscores PayPal's aggressive pivot toward digital assets and positions the payments giant as a key player in the burgeoning stablecoin ecosystem.

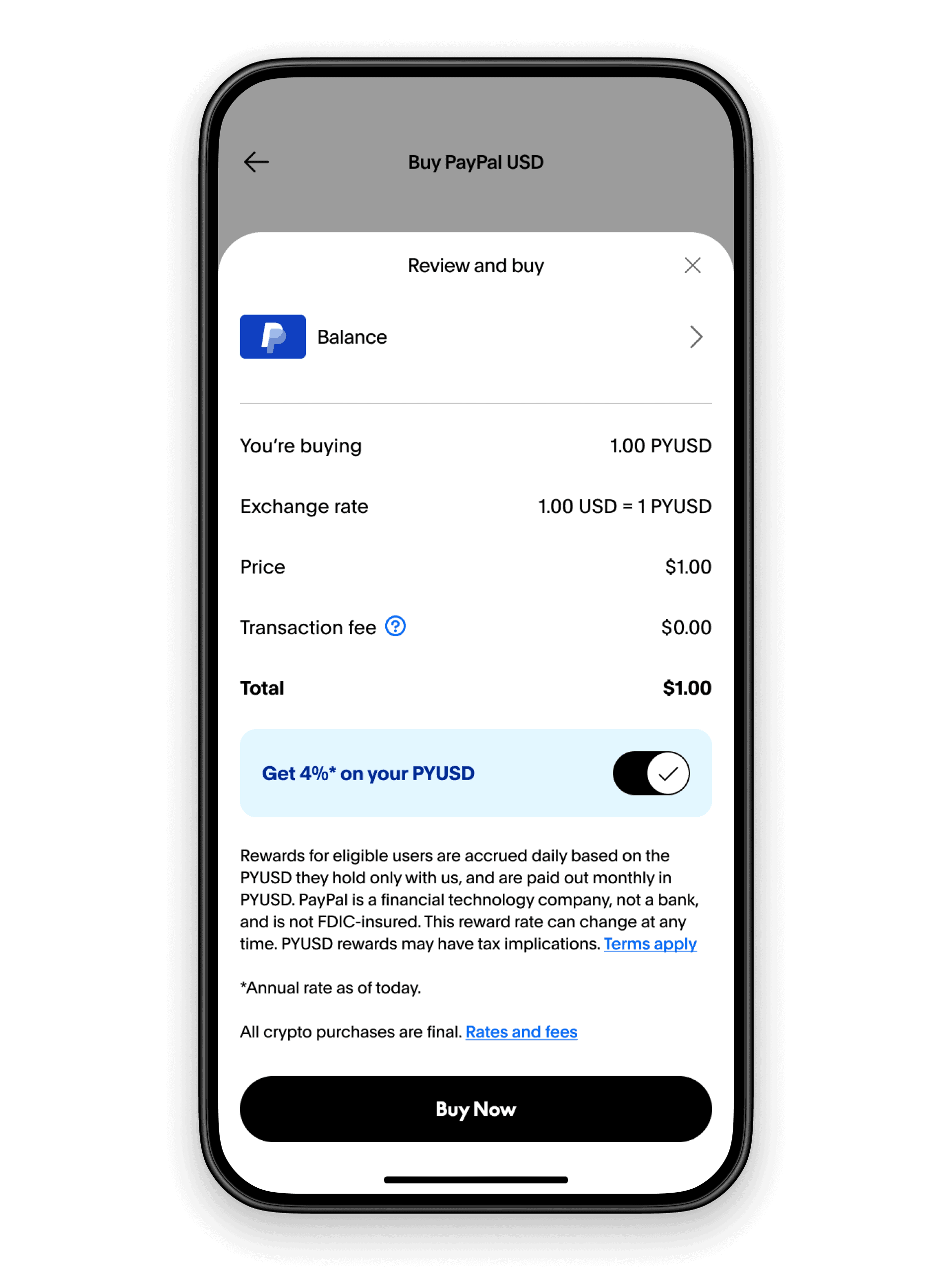

Launched in August 2023 on the Ethereum blockchain, PYUSD was designed as a fully backed, dollar-pegged digital currency to bridge the gap between fiat stability and crypto's speed and efficiency. Pegged 1:1 to the U.S. dollar and redeemable at any time, it quickly gained traction among users seeking low-volatility entry points into decentralized finance (DeFi). What began as a modest experiment has evolved into a powerhouse: from a low of $498 million at the start of the year to its current valuation, PYUSD's market cap has ballooned by over 400 percent, outpacing many rivals in the stablecoin arena.

The catalyst for this recent surge? A strategic partnership with Spark, a leading stablecoin infrastructure provider, which has injected fresh liquidity and expanded PYUSD's reach. Announced just days ago, the collaboration enables PayPal to issue and manage up to $1 billion in PYUSD liquidity more seamlessly, leveraging Spark's tools for issuance, redemption, and DeFi integrations. This move not only validates Spark's platform but also catapults PayPal ahead of legacy competitors like Visa and Mastercard, who have dipped toes into crypto partnerships but lag in full stablecoin issuance.

PYUSD's ascent isn't happening in isolation. The broader stablecoin market has swelled to $263 billion in global supply, up $30 billion in recent months, fueled by rising institutional interest and regulatory clarity in key jurisdictions. On platforms like CoinMarketCap, PYUSD now ranks as the 45th-largest cryptocurrency by market cap, with a circulating supply exceeding 2.5 billion tokens—all backed by equivalent USD reserves held in custody by Paxos Trust Company. Trading at a steady $1.00, the token boasts minimal deviation from its peg, thanks to robust arbitrage mechanisms and real-time transparency reports.

For PayPal users, the benefits are tangible. PYUSD is natively integrated into the Venmo app, allowing seamless transfers, payments, and even yield-earning opportunities in DeFi protocols. Over the past year, transaction volumes have spiked 113 percent, reflecting heightened adoption among retail investors wary of volatile assets like Bitcoin or Ethereum. "Stablecoins like PYUSD are the on-ramp we've all been waiting for," noted a PayPal spokesperson in a recent statement. "They combine the reliability of the dollar with the innovation of blockchain, empowering users to move money globally without the friction of traditional rails."

This milestone arrives at a pivotal moment for the crypto sector. With U.S. regulators inching toward clearer frameworks such as potential stablecoin legislation in Congress PYUSD's success could accelerate mainstream acceptance. Analysts speculate it may spark deeper integrations with PayPal's core services, including merchant payouts and cross-border remittances, potentially boosting the company's revenue streams amid slowing growth in its legacy business.

Yet challenges loom. Competition from behemoths like Tether (USDT) and Circle's USDC remains fierce, with the former dominating over 70 percent of the market. PYUSD must continue innovating perhaps through expansions to Solana or other blockchains to capture more share. Still, its rapid climb signals a broader trend: legacy fintech firms are no longer spectators in the crypto revolution; they're scripting its next chapter.

As PYUSD eyes further gains, investors in PayPal stock (PYPL) will watch closely. Shares rose 2.3 percent in after-hours trading following the latest supply update, hinting at market optimism. For now, this $2.5 billion benchmark isn't just a number it's a blueprint for how digital dollars could redefine everyday finance.