Table of Contents

- Introduction: A Geopolitical Oil Play Unfolds

- The Kingdoms Production Push: Market Share and OPEC Discipline

- Financial Imperatives: Funding Saudis Ambitious Vision

- A Tailwind for Trump: Easing Pressures in the US

- OPEC Plus Moves Forward: Upcoming Decisions and Potential Perils

- Conclusion: Oils Enduring Role in Global Power Dynamics

Introduction: A Geopolitical Oil Play Unfolds

In a move that underscores the intricate dance between geopolitics and global energy markets, Saudi Arabia has ramped up its oil production. This drives down crude prices. It also provides a timely political lift to President Donald Trump. As the worlds leading oil exporter navigates a shifting landscape of competitors and internal challenges, this aggressive strategy reshapes supply dynamics. It offers relief to American consumers just as the holiday season approaches.

The Kingdoms Production Push: Market Share and OPEC Discipline

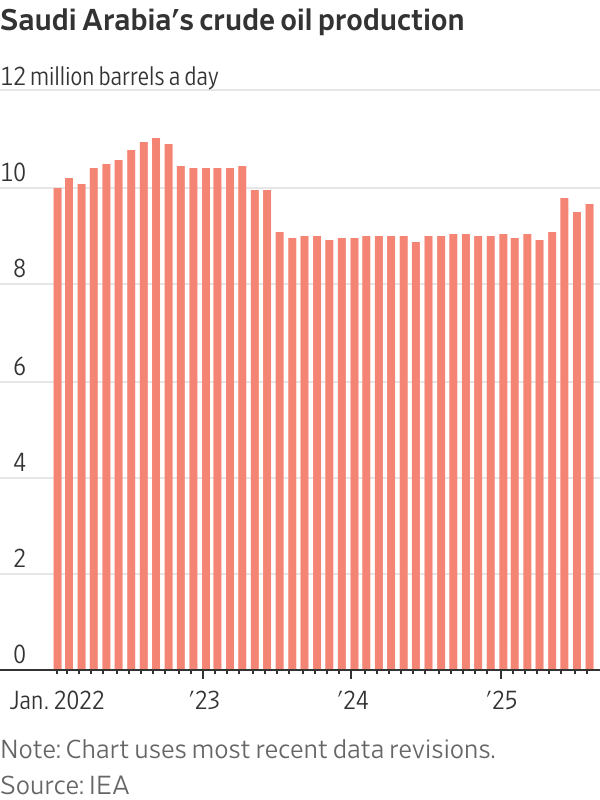

The kingdoms decision to boost output comes amid a year of softening prices. This is a direct consequence of the increased supply flooding the market. While Riyadh frames the adjustment as standard market stabilization, industry analysts see a multifaceted play at work. Saudi Arabia aims to claw back market share eroded by rising production in non OPEC nations like Brazil and Guyana. It also faces the resilient US shale sector, which has proven adept at adapting to price volatility.

Beyond territorial gains, the surge serves as a firm reminder to fellow OPEC members to adhere to production quotas. Several allies have historically overproduced. This dilutes the cartels ability to influence prices effectively. By flooding the market, Saudi Arabia pressures these partners to fall in line. This reinforces its position as the de facto leader within OPEC plus.

Financial Imperatives: Funding Saudis Ambitious Vision

Financially, the strategy is a high stakes gamble designed to bolster the kingdoms coffers. With ambitious infrastructure mega projects such as the futuristic NEOM city grappling with ballooning costs and setbacks, additional revenue from higher volumes is crucial. Even at lower per barrel prices, the sheer scale of Saudi output ensures substantial inflows. These funds support visions of economic diversification.

A Tailwind for Trump: Easing Pressures in the US

For the United States, the ripple effects are particularly favorable. Lower oil prices translate to cheaper gasoline at the pump. This eases inflationary pressures and puts more money back into consumers pockets. This development arrives as a welcome tailwind for the Trump administration. It has long championed energy independence and lower fuel costs as hallmarks of its economic agenda. Strategists note that the timing could not be better. It potentially amplifies the presidents narrative of strong global partnerships yielding tangible benefits for American households.

OPEC Plus Moves Forward: Upcoming Decisions and Potential Perils

OPEC plus is poised to formalize yet another production hike at its upcoming meeting this weekend. This signals a continued commitment to this path. However, the approach is not without peril. Overproduction risks prolonging a price slump. This could squeeze margins for higher cost producers worldwide, including some US shale operators. If prices dip too far, it might even provoke retaliatory moves from rivals. This complicates the kingdoms long term market dominance.

Conclusion: Oils Enduring Role in Global Power Dynamics

As global demand teeters on the edge of recovery from lingering supply chain disruptions, Saudi Arabias bold pivot highlights the enduring power of oil in international relations. For investors eyeing energy stocks, the immediate horizon suggests volatility. But the broader trend points to a more competitive, price conscious market. With Trump at the helm, Washingtons response likely a blend of quiet diplomacy and public praise could further solidify US Saudi ties. This ensures that energy security remains a cornerstone of bilateral relations.

This evolving story reminds us that in the oil game, every barrel pumped carries layers of strategy. These range from boardrooms in Riyadh to ballot boxes in swing states. As prices stabilize or dip further, the world watches to see if this calculated risk pays dividends or demands a course correction.