Table of Contents

- What is xAI? Understanding Elon Musk's AI Company

- Details of xAI $20 Billion Funding Round 2025

- Nvidia's Role as Equity Investor in xAI Chip Deal

- Colossus 2 Supercluster: xAI's Nvidia-Powered AI Infrastructure

- Market Impact: Nvidia Stock Reaction to xAI Investment

- Broader Implications for AI Industry and Competition

- Future Outlook: xAI and Nvidia Partnership Prospects

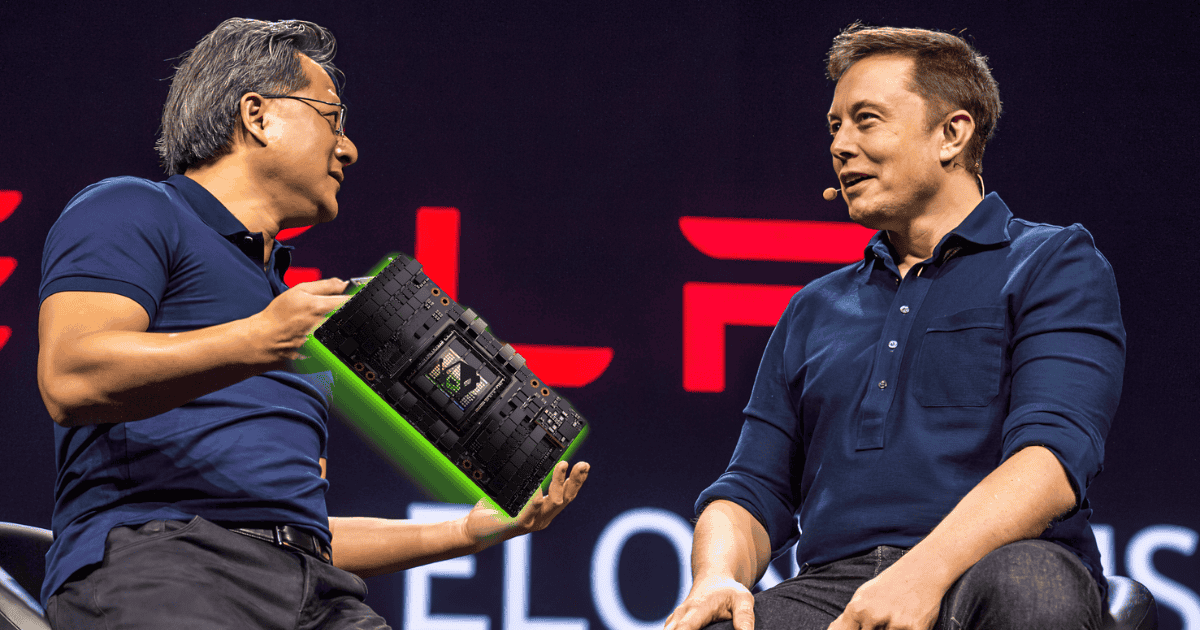

In a significant development shaking up the artificial intelligence landscape, Nvidia has emerged as a key equity investor in Elon Musk's xAI. This move comes as xAI nears completion of a massive $20 billion capital raise, intricately tied to Nvidia's cutting-edge graphics processing units. The deal underscores the deepening synergies between chip manufacturers and AI startups, fueling speculation about accelerated advancements in AI technology. As investors and industry watchers digest this news, it highlights Nvidia's strategic positioning in the booming AI market, where demand for high-performance computing continues to surge.

This partnership not only bolsters xAI's ambitious projects but also reinforces Nvidia's dominance in supplying hardware for next-generation AI systems. With the funding round expected to close soon, the implications ripple across financial markets, tech sectors, and beyond.

What is xAI? Understanding Elon Musk's AI Company

xAI, founded by Elon Musk in 2023, positions itself as a challenger to established AI players like OpenAI and Google DeepMind. The company's mission is to "understand the true nature of the universe" through advanced AI models, with a focus on developing truthful and maximally curious AI systems. Unlike competitors, xAI emphasizes rapid iteration and integration with Musk's broader ecosystem, including Tesla and SpaceX.

Since its inception, xAI has made headlines with its Grok chatbot, powered by proprietary large language models. The startup has already secured multiple funding rounds, building a valuation that rivals top AI firms. This latest infusion of capital marks a pivotal step in scaling its infrastructure, particularly for training massive AI models that require enormous computational power.

Details of xAI $20 Billion Funding Round 2025

xAI is on the verge of securing a $20 billion funding round, comprising both equity and debt components. This exceeds initial plans, reflecting strong investor confidence in Musk's vision. The round is structured to support xAI's aggressive expansion, with a significant portion allocated to hardware acquisitions.

Sources indicate that the financing will directly fund the procurement of Nvidia GPUs for xAI's Colossus 2 supercluster. This follows previous rounds, such as the $6 billion Series C in December 2024, which included investments from firms like A16Z, BlackRock, and Fidelity. The current deal elevates xAI's post-money valuation potentially beyond $40 billion, positioning it among the most valuable private AI companies globally.

Key highlights of the round include:

- Equity Portion: Attracting major tech investors, with Nvidia leading.

- Debt Component: Likely tied to asset-backed financing for data center builds.

- Timeline: Expected to finalize in the coming weeks, amid heightened AI investment fervor.

This funding comes at a time when AI startups are drawing record capital, with the private market seeing valuations soar to $1.3 trillion across top players like OpenAI and Anthropic.

Nvidia's Role as Equity Investor in xAI Chip Deal

Nvidia is committing up to $2 billion in equity to xAI, marking a strategic investment that goes beyond mere supplier relationships. This equity stake allows Nvidia to accelerate the adoption of its chips while gaining exposure to xAI's innovative AI developments. The chipmaker's involvement is part of a broader strategy to foster ecosystems around its hardware, similar to past investments in AI ventures.

In addition to equity, the deal ensures priority access to Nvidia's latest GPUs, crucial for xAI's compute-intensive projects. This cross-holding arrangement exemplifies the "circular deals" prevalent in the AI sector, where hardware providers invest in customers to secure long-term demand. Nvidia's participation follows its earlier involvement in xAI's Series C, alongside rival AMD.

Analysts view this as a win-win: xAI gains capital and tech muscle, while Nvidia locks in billions in chip sales.

Colossus 2 Supercluster: xAI's Nvidia-Powered AI Infrastructure

At the heart of this funding is xAI's Colossus 2, an expanded supercluster set to house 550,000 Nvidia chips. This massive data center, building on the original Colossus with 100,000 GPUs, represents one of the largest AI training facilities worldwide. The project, located in Memphis, Tennessee, is nearing completion and will consume vast amounts of power and resources.

The $18 billion-plus investment in Nvidia chips for Colossus 2 underscores the scale of xAI's ambitions. These GPUs are essential for training Grok models, enabling breakthroughs in multimodal AI and real-world applications. Musk has emphasized that this infrastructure will propel xAI to catch up and surpass competitors in AI capabilities.

Challenges include energy demands and supply chain logistics, but the funding round addresses these by tying capital directly to hardware procurement.

Market Impact: Nvidia Stock Reaction to xAI Investment

The announcement has sparked positive reactions in financial markets, with Nvidia's stock poised for gains amid renewed AI hype. As a primary beneficiary, Nvidia benefits from guaranteed demand, potentially adding billions to its revenue pipeline. Shares of Nvidia (NVDA) have shown volatility but upward trends in pre-market trading following the news.

Broader market implications include boosted investor sentiment in AI-related stocks. However, concerns about "circular investments" have arisen, where AI firms and chipmakers interdependent deals inflate valuations. Critics argue this could lead to bubbles, though proponents see it as essential for innovation.

For xAI, the funding enhances its competitive edge, potentially impacting stocks of rivals like Microsoft (backed by OpenAI) and Alphabet.

Broader Implications for AI Industry and Competition

This deal intensifies competition in the AI space, where access to compute resources is a key differentiator. xAI's rapid scaling challenges incumbents, fostering innovation in areas like autonomous systems and scientific discovery.

Nvidia's investment strategy diversifies its portfolio, reducing reliance on major clients like Microsoft and Amazon. It also highlights the growing role of private funding in AI, with $30 billion infrastructure funds involving Nvidia and xAI.

Regulatory scrutiny may increase, given the concentration of power in few hands, but the immediate effect is accelerated AI progress.

Future Outlook: xAI and Nvidia Partnership Prospects

Looking ahead, this collaboration could yield groundbreaking AI advancements, with xAI leveraging Nvidia's Blackwell architecture for future models. Musk's integration plans with Tesla's robotics and autonomous driving could create new revenue streams.

For investors, monitoring xAI's path to profitability and potential IPO will be crucial. Nvidia, meanwhile, continues to solidify its market leadership, with analysts forecasting sustained growth driven by AI demand.

In summary, Nvidia's equity investment in xAI's $20 billion round signals a new era of symbiotic relationships in tech, promising transformative impacts on the global economy.