Table of Contents

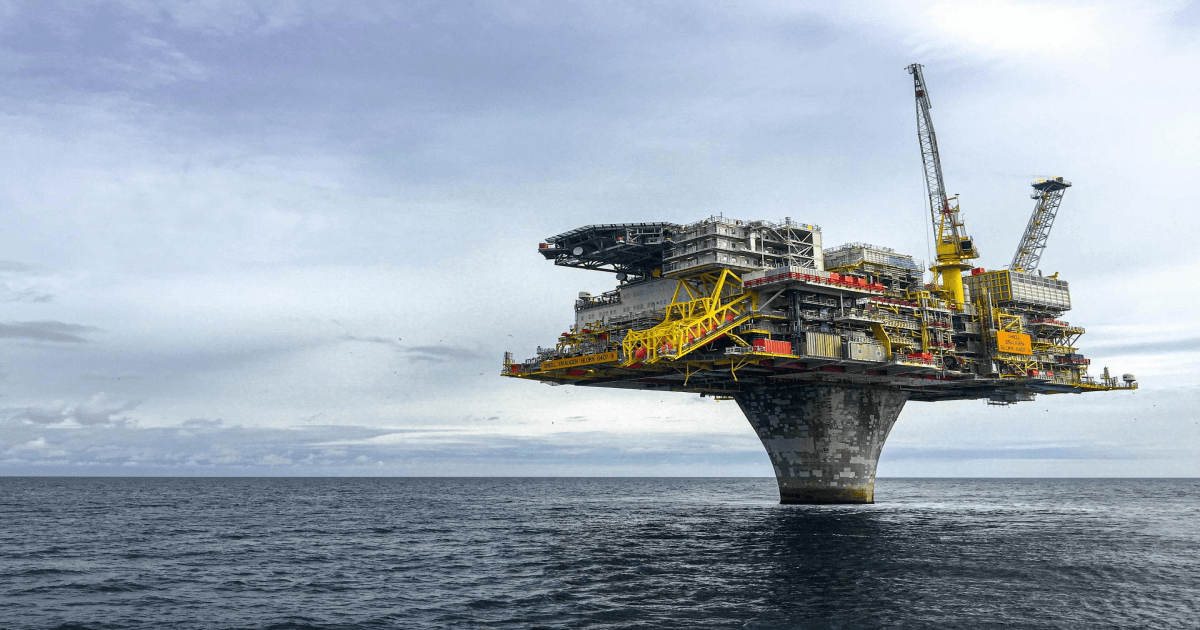

The latest US sanctions on a key Chinese oil terminal are reshaping global crude flows, threatening Sinopec’s refining operations, and adding fresh volatility to oil markets already pressured by OPEC+ supply decisions and trade tensions.

US Sanctions Disrupt China’s Oil Imports: Impact on Sinopec, Rizhao Terminal, and Global Crude Prices

The United States Treasury Department has imposed sanctions on the Rizhao Shihua Crude Oil Terminal, a facility that handles nearly 9 percent of China’s crude imports. The move is part of Washington’s broader crackdown on Iranian oil exports, as the terminal was accused of receiving shipments from Iran’s so-called "shadow fleet" of tankers. Analysts warn that the sanctions could force refinery run cuts of up to 250,000 barrels per day, particularly at state-owned refineries connected to the terminal by pipeline, including those operated by Sinopec, China’s largest refiner.

This escalation marks a significant shift in US policy, targeting not only independent "teapot" refiners but also infrastructure linked to state-owned giants. The sanctions come just weeks before planned talks between President Donald Trump and President Xi Jinping, further complicating already strained US China trade relations.

Impact on Sinopec and Chinese Refining Capacity

Sinopec, which relies heavily on Rizhao for crude imports, faces immediate operational challenges. The diversion of cargoes has already begun, with Unipec, Sinopec’s trading arm, rerouting a 2 million barrel supertanker away from Rizhao to alternative ports such as Ningbo and Zhoushan.

Industry experts note that the sanctions could disrupt one fifth of Sinopec’s crude imports, forcing the company to adjust its refining strategy. Reduced throughput at Shandong refineries risks creating a regional fuel supply imbalance, potentially tightening gasoline and diesel availability in northern China.

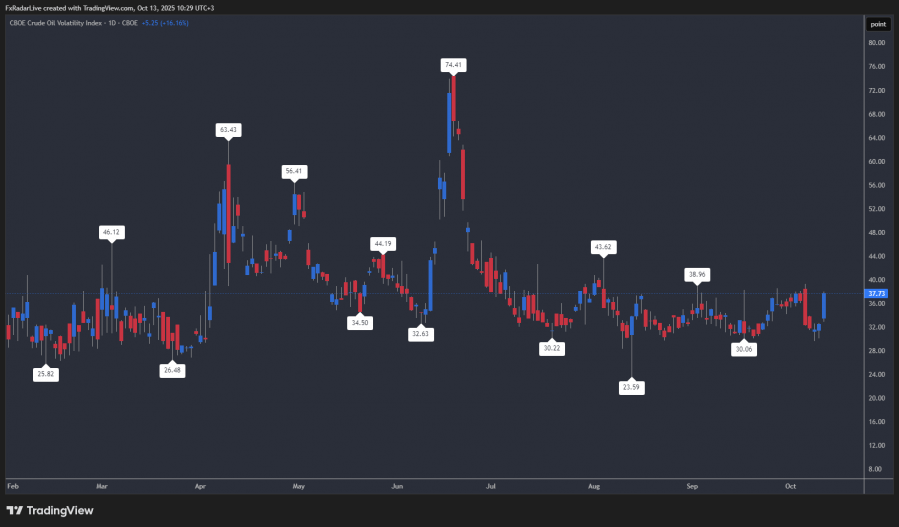

Oil Market Volatility and Price Trends

The sanctions arrive at a time when global oil markets are already under pressure. West Texas Intermediate (WTI) recently slumped below 60 dollars per barrel, its lowest since May, amid fears of a supply surplus and renewed tariff threats between Washington and Beijing. However, prices rebounded after signals of potential easing in trade tensions, with Brent crude climbing above 63 dollars.

At the same time, OPEC+ is preparing to increase production quotas, adding to the bearish outlook. Analysts warn that the combination of rising supply, weakening demand, and geopolitical sanctions could create a volatile trading environment for the remainder of 2025.

Geopolitical and Economic Implications

The sanctions highlight Washington’s determination to curtail Iran’s oil revenues by targeting its largest customer, China. For Beijing, the move underscores the vulnerability of its energy security, as nearly 70 percent of China’s crude oil is imported. The disruption at Rizhao could accelerate China’s efforts to diversify supply sources, strengthen ties with Russia and Middle Eastern producers, and expand strategic petroleum reserves.

For global investors, the sanctions add another layer of uncertainty to an already fragile energy market. Refining margins, freight rates, and shipping insurance costs are all expected to rise as crude flows are redirected.

Outlook for Investors and Energy Markets

Financial markets should prepare for heightened volatility in oil futures, energy equities, and shipping stocks. Traders will closely monitor Sinopec’s response, OPEC+ production decisions, and the trajectory of US China trade negotiations.

If sanctions remain in place, analysts expect Chinese refiners to cut runs, increase imports from Russia, and seek alternative crude grades. This could reshape global trade flows, with ripple effects across Asia, Europe, and the Middle East.

Conclusion:

The US sanctions on China’s Rizhao oil terminal represent a turning point in the geopolitics of energy. By directly targeting Sinopec-linked infrastructure, Washington has disrupted one of the world’s largest crude import hubs. For investors, refiners, and policymakers, the coming weeks will be defined by uncertainty, as the balance between supply, demand, and geopolitics continues to shift.