Table of Contents

- Gold Price Outlook & Trading Strategy for the Week

- Gold Technical Strategy: 1H, 4H & Daily Chart Analysis

- Gold Market Fundamentals: Drivers Behind the Price Action

- Gold Support & Resistance Levels to Watch

- Weekly Gold Strategy: Buy on Dips vs. Sell on Rallies

- Final Thoughts on Gold Price Forecast

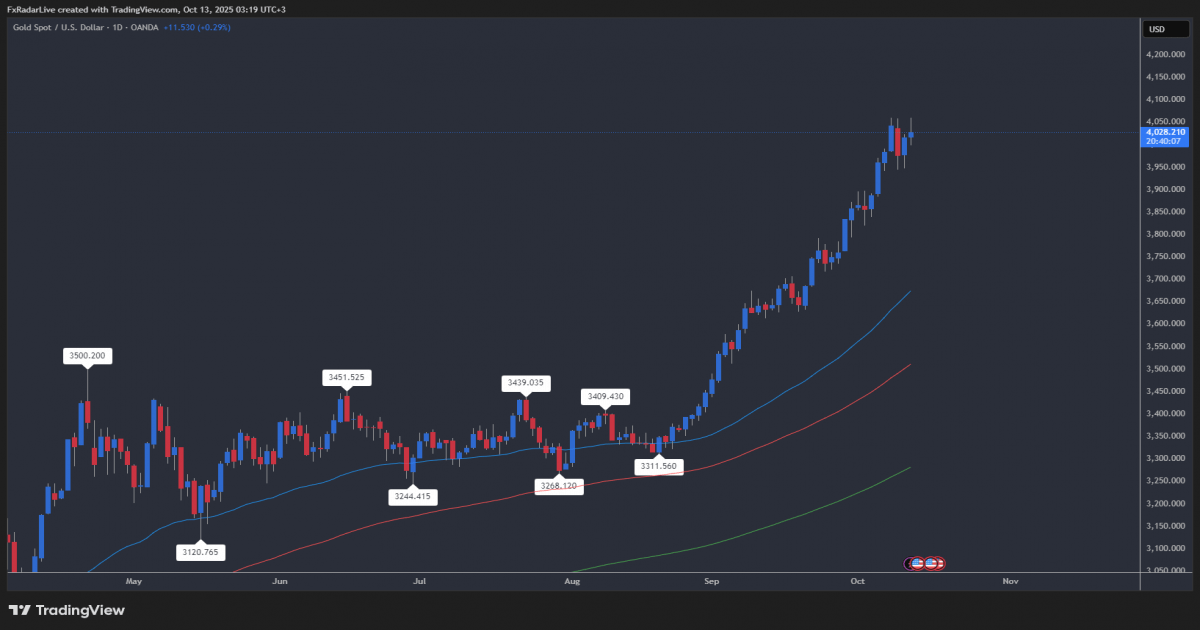

Short-Term Gold Forecast: Key Price Levels & Market Strategy Gold prices remain at the center of global financial attention as the metal trades near record highs above 3,950 dollars per ounce. The coming week is expected to bring heightened volatility, with traders closely watching technical signals and macroeconomic catalysts.

Gold Price Outlook & Trading Strategy for the Week

Recent sessions have seen gold extend its winning streak, supported by expectations of Federal Reserve rate cuts and a weaker US dollar. According to fresh market analysis, futures markets are now pricing in a 93 percent probability of a rate cut in October, which continues to underpin safe haven demand. At the same time, analysts warn of potential profit taking after the sharp rally that pushed gold above the psychological 4,000 dollar level last week (related analysis from MSN and FXEmpire).

Gold Technical Strategy: 1H, 4H & Daily Chart Analysis

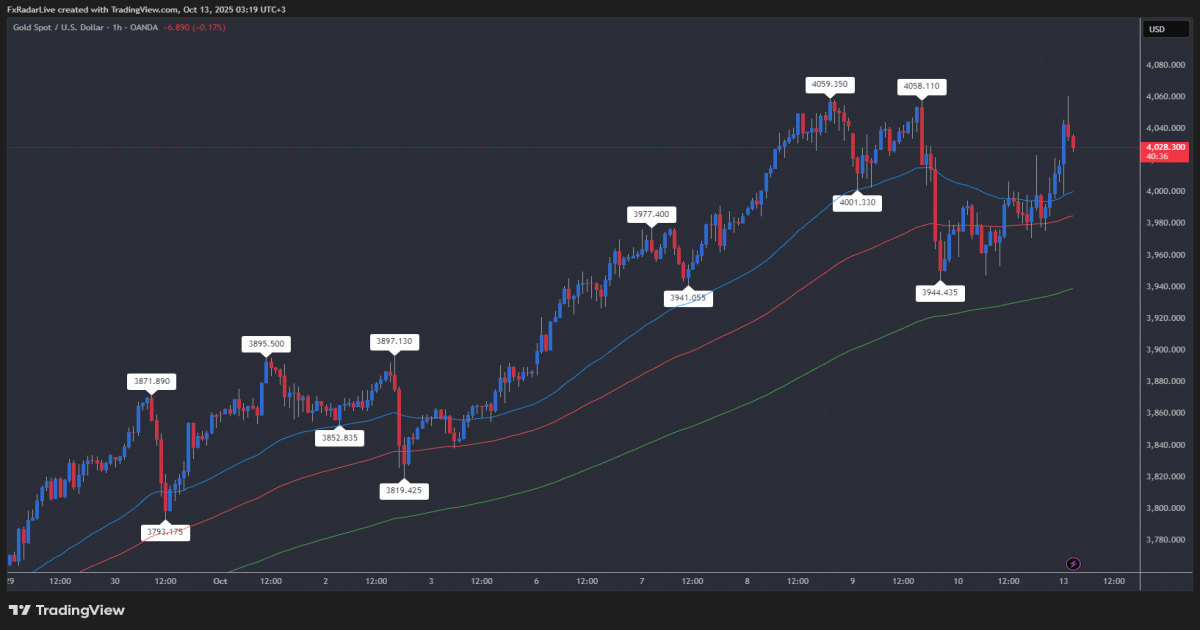

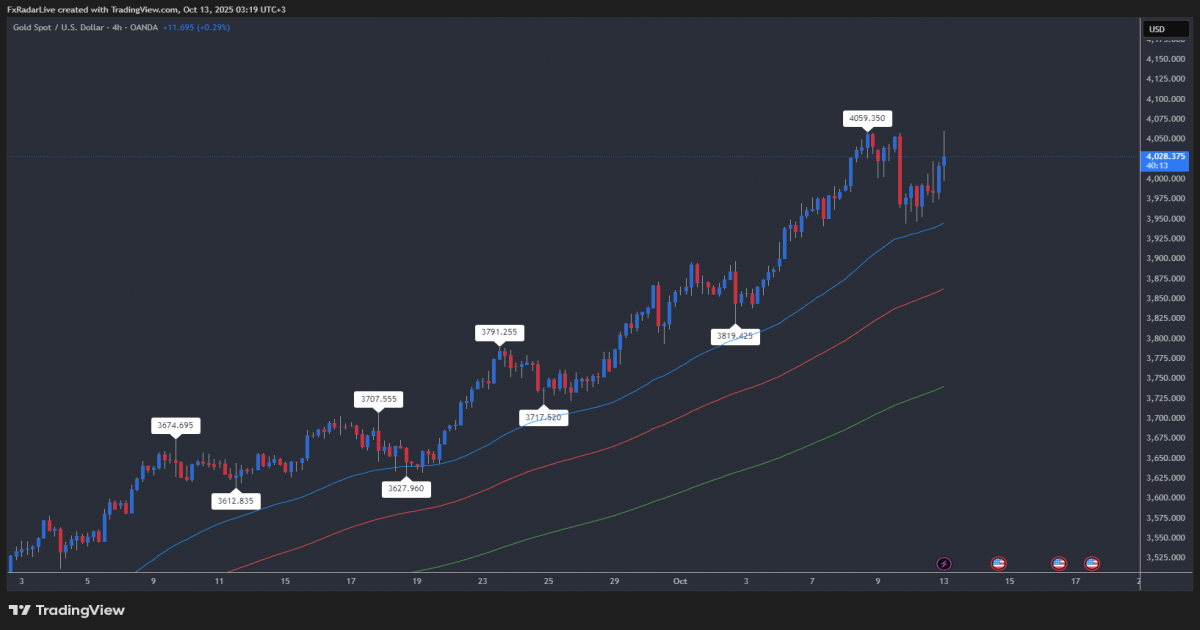

The uploaded charts provide a clear picture of gold’s momentum across multiple timeframes:

-

1H Chart: Gold shows consolidation after testing resistance near 4,015. The EMA 50 (blue) is trending above the EMA 100 (red) and EMA 200 (green), confirming short term bullish momentum. However, intraday pullbacks toward 3,972 and 3,940 remain possible.

-

4H Chart: The medium term structure highlights a sequence of higher highs and higher lows. The EMAs are aligned in bullish order, with the 50 above the 100 and 200. Key support lies at 3,902, while resistance is seen at 4,035 and 4,055.

-

Daily Chart: The broader trend remains strongly bullish. After a period of consolidation between April and August, gold broke higher in September and October, reaching above 2,050 on the daily scale earlier this year and now extending toward 4,000. The EMAs confirm long term strength, with the 200 day average acting as a solid base.

Gold Market Fundamentals: Drivers Behind the Price Action

Several macroeconomic and geopolitical factors are expected to influence gold prices in the next few days:

-

Federal Reserve Policy: Markets anticipate a dovish stance, with rate cuts likely before year end. Lower yields reduce the opportunity cost of holding gold.

-

US Dollar Weakness: The dollar has retreated from recent highs, further supporting gold demand.

-

Geopolitical Risks: Ongoing global tensions and concerns over government spending in the US continue to drive safe haven flows.

-

Seasonal Demand: In India, festive demand is expected to provide additional physical support for bullion (see Daily Excelsior).

Gold Support & Resistance Levels to Watch

-

Immediate Resistance: 4,015 and 4,055

-

Immediate Support: 3,972 and 3,902

-

Critical Zone: A sustained break above 4,055 could open the path toward 4,100, while a drop below 3,902 may trigger deeper corrections toward 3,850.

Weekly Gold Strategy: Buy on Dips vs. Sell on Rallies

Analysts suggest a buy on dips strategy for swing traders, as the broader trend remains bullish. However, intraday traders may consider a sell on rise approach near resistance levels, given the possibility of short term corrections (strategy outlined by MSN). Risk management remains crucial, with stop losses recommended below 3,900 for long positions.

Final Thoughts on Gold Price Forecast

Gold remains in a powerful uptrend, supported by macroeconomic uncertainty and technical strength across all timeframes. While short term pullbacks are possible, the overall bias for the next 1 to 4 days remains bullish, with upside potential toward 4,100 if momentum continues. Traders should monitor Federal Reserve commentary, US inflation data, and geopolitical developments for fresh catalysts.