Table of Contents

- A Record-Setting Moment for America's Fiscal Health

- The Forces Driving America's Soaring Debt

- Debt-to-GDP Ratio: A Red Flag for Economic Sustainability

- The Cost to Every American

- From Rating Agencies to Global Markets: Mounting Repercussions

- Could Fiscal Discipline Avert a Crisis?

- What Lies Ahead for the Dollar and Global Markets

- America's Fiscal Reckoning Has Begun

A Record-Setting Moment for America's Fiscal Health

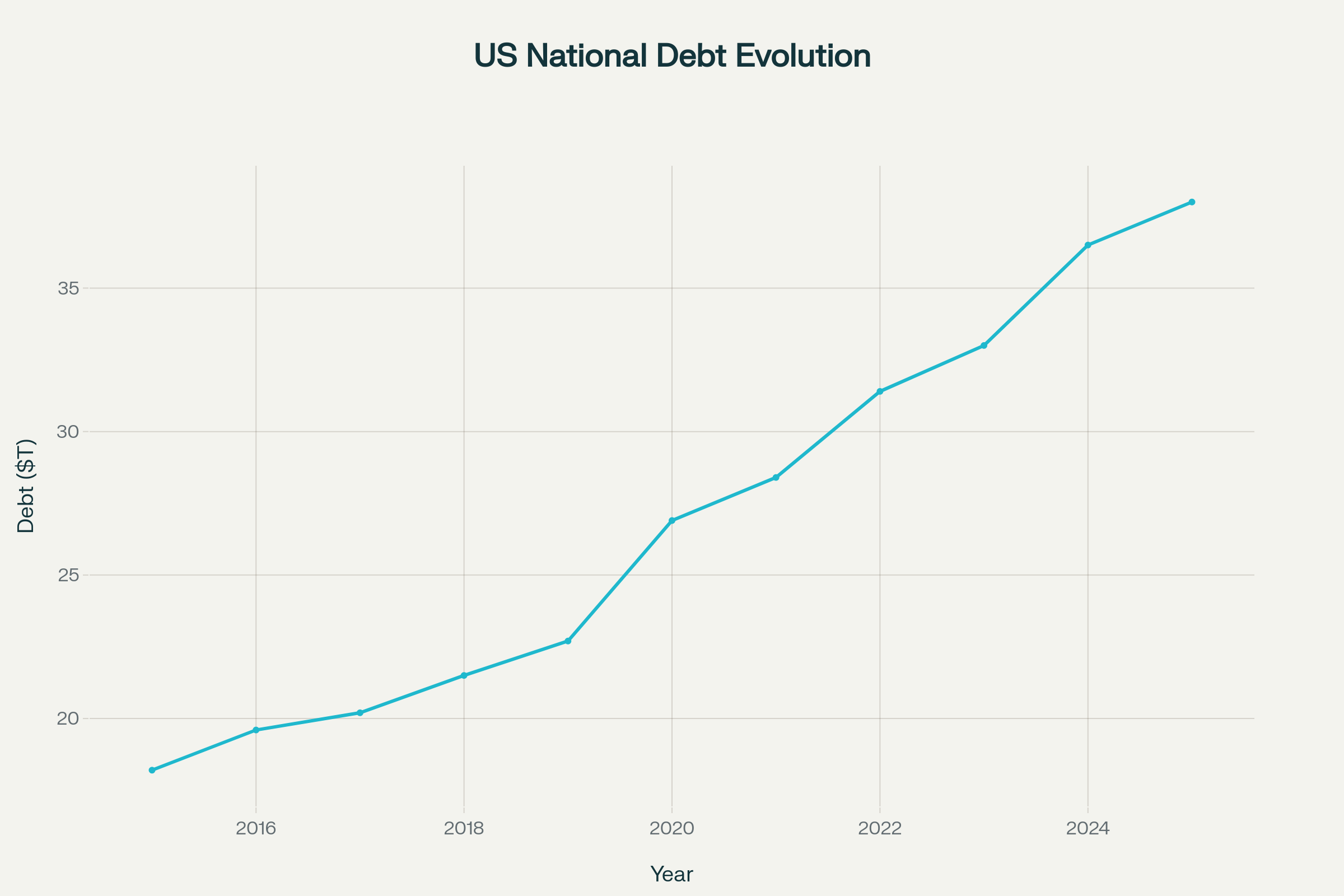

For the first time in U.S. history, the national debt has surpassed $38 trillion, marking a new and troubling milestone for the world's largest economy. According to data from the U.S. Treasury Department, the debt reached $38.02 trillion as of October 21, 2025, representing a staggering $500 billion increase in just one month or roughly $23 billion per day. This rapid surge underscores the intensifying fiscal challenges facing policymakers in Washington.

Episodes of market turbulence have shown how debt shocks can trigger volatility across major asset classes.

The Forces Driving America's Soaring Debt

The primary drivers behind this accelerating debt accumulation are high entitlement spending, rising interest costs, and persistent budget deficits. The federal deficit for fiscal year 2025 closed at approximately $1.8 trillion, fueled by expanding expenditures on Social Security, Medicare, and defense, while tax revenues have remained relatively stagnant.

The US Banking Sector faces new credit risks as debt levels rise and fiscal pressures mount.

Compounding the issue, the Federal Reserve's sustained high-interest-rate environment has doubled the average government borrowing cost since 2021 from 1.6% to about 3.4%, pushing annual interest payments above $1.2 trillion, equal to 17% of the federal budget. These costs are expected to rise further as maturing low-yield debt is refinanced at higher rates.

Debt-to-GDP Ratio: A Red Flag for Economic Sustainability

The U.S. debt-to-GDP ratio currently stands around 123%, a level that economic experts view as unsustainable for long-term fiscal stability. The Congressional Budget Office projects that this ratio will climb to 120% by 2035 and could reach 156% by 2055, well above levels deemed manageable for developed economies.

This means that the United States is spending more money servicing debt than it invests in growth-oriented initiatives such as infrastructure, innovation, or small business financing, creating what analysts describe as a “fiscal drag” on economic expansion.

Gold prices have surged again, amid forecasts of historic highs (Bank of America forecasts).

The Cost to Every American

On a per capita basis, the national debt equals about $111,000 per U.S. citizen. This number illustrates not only the burden on future taxpayers but also the growing intergenerational inequality that threatens economic mobility for younger Americans.

Michael Peterson, CEO of the Peter G. Peterson Foundation, emphasized that “the pace we’re on is twice as fast as the rate of debt growth since 2000,” warning that the U.S. is adding debt faster than ever before.

From Rating Agencies to Global Markets: Mounting Repercussions

Credit rating agency Moody’s recently downgraded the U.S. sovereign rating from AAA to AA1, citing legislative gridlock, persistent fiscal deficits, and ballooning interest obligations. This downgrade has already started to ripple through global bond markets, contributing to higher yields on U.S. Treasuries and further tightening credit conditions worldwide.

Wall Street draws parallels with Argentina's crisis, showing how fiscal imbalances can affect investor confidence globally.

International investors now face growing uncertainty over whether Washington can rein in its structural deficits. As debt ballooned, total U.S. debt across all sectors — government, corporate, financial, and household — has reached approximately $98.8 trillion, equal to 324% of GDP, reflecting the most leveraged condition since the Great Depression.

Could Fiscal Discipline Avert a Crisis?

Economists and market strategists agree that the U.S. is approaching a crucial turning point. Kent Smetters of the Penn Wharton Budget Model cautioned that unchecked debt growth “leads to higher inflation and weaker long-term productivity.” If policymakers fail to enact credible fiscal reforms, such as restraining discretionary spending, revising entitlement formulas, or restructuring tax incentives, the U.S. could face a downward spiral of rising borrowing costs and eroding investor confidence.

What Lies Ahead for the Dollar and Global Markets

With mounting debt and diminished fiscal flexibility, pressure on the U.S. dollar's reserve currency status may intensify. Foreign investors, especially in emerging economies, are diversifying away from U.S. assets amid concerns about debt sustainability. Meanwhile, gold prices surged earlier this year as investors sought hedges against fiscal instability.

Asian Markets reactions indicate broader global implications as trade tensions with China remain prominent.

Nevertheless, the U.S. still maintains a deep and liquid bond market, supported by institutional trust and global demand for safe-haven assets, factors that shield the dollar from immediate volatility. However, continued fiscal recklessness could eventually test those limits.

America's Fiscal Reckoning Has Begun

The United States stands at the threshold of a new economic era, one defined by mounting debt, rising interest costs, and waning fiscal credibility. Without decisive policy action, the cost of inaction could be devastating: slower growth, inflationary pressures, and diminished economic leadership on the global stage. For investors, businesses, and policymakers alike, the message from the bond market is clear. America's financial clock is ticking louder than ever.