Table of Contents

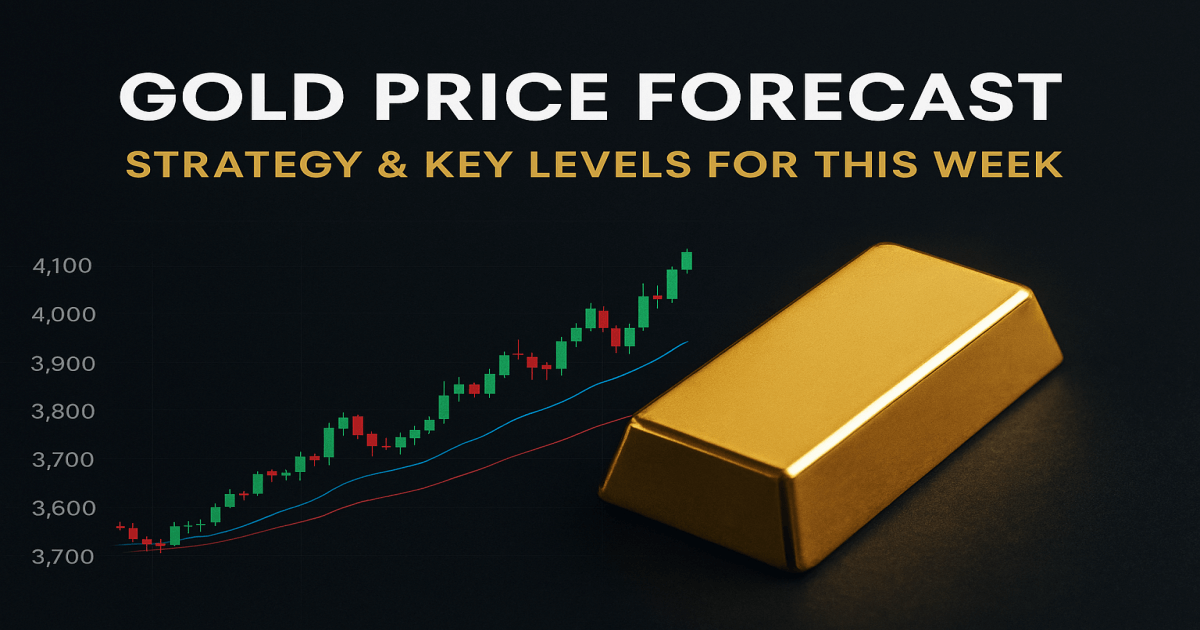

Global investors are turning their attention to precious metals as Bank of America projects a historic rally, with the gold price expected to reach $5000 per ounce and the silver price climbing to $65 per ounce by 2026. This bold forecast reflects growing concerns over U.S. fiscal imbalances, inflationary pressures, and heightened demand for safe haven assets.

Gold Price Outlook 2026: Why Analysts See $5000 Ahead

The gold price forecast from Bank of America highlights a powerful mix of macroeconomic and geopolitical drivers. Gold has already surpassed the $4000 per ounce milestone in October 2025, supported by:

-

Rising U.S. fiscal deficits and debt levels that weaken investor confidence in the dollar.

-

Aggressive central bank gold purchases, particularly from emerging markets seeking to diversify reserves.

-

ETF inflows at record highs, with funds like SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) attracting billions in new capital.

For more on central bank gold buying, see Gold Price Hits $4000.

Analysts note that even with potential short term corrections, the long term trajectory remains bullish. A projected 14 percent increase in gold investment demand in 2026 could be the catalyst that drives the gold price to $5000 per ounce.

Silver Price Forecast: $65 by 2026

While gold dominates headlines, the silver price outlook is equally compelling. Bank of America expects silver to reach $65 per ounce by 2026, supported by:

-

Industrial demand growth, particularly from solar energy, electric vehicles, and electronics.

-

Tight supply conditions, as mining output struggles to keep pace with demand.

-

Safe haven appeal, with silver benefiting from the same macroeconomic uncertainties that drive gold.

For a deeper look at industrial demand, see Pakistan's Solar Irrigation Surge.

Silver has already crossed the $50 threshold in 2025, and analysts believe the momentum could accelerate as green energy policies expand global consumption.

Key Drivers Behind Precious Metals Rally

Several structural factors are converging to support higher gold and silver prices:

-

U.S. policy uncertainty: Fiscal deficits, trade tensions, and unconventional monetary strategies are fueling investor caution.

-

Weaker U.S. dollar: A declining dollar boosts the appeal of dollar denominated commodities like gold and silver.

-

Inflation resilience: With inflation hovering around 3 percent, precious metals remain a hedge against eroding purchasing power.

-

Geopolitical risks: Ongoing global conflicts and trade disputes are pushing investors toward safe haven assets.

For more on the dollar's impact, see Gold Price Forecast.

Investment Strategies for Gold and Silver

For investors seeking exposure to the gold price rally, options include:

-

Physical gold and silver bullion for long term wealth preservation.

-

Exchange traded funds (ETFs) such as GLD, IAU, and SLV for liquidity and accessibility.

-

Mining stocks that provide leveraged exposure to rising metal prices.

For a list of recommended ETFs, see Asian Markets React to Renewed US China Trade.

Diversification remains key, as analysts caution that short term volatility could create pullbacks even within a strong upward trend.

Conclusion: Precious Metals Enter a New Supercycle

The latest Bank of America gold and silver forecasts suggest that precious metals are entering a new supercycle. With gold potentially hitting $5000 per ounce and silver reaching $65 per ounce by 2026, investors are positioning themselves for what could be one of the most significant commodity rallies in decades.

For those tracking gold price trends and silver price forecasts, the coming years may redefine the role of precious metals in global financial markets.