Table of Contents

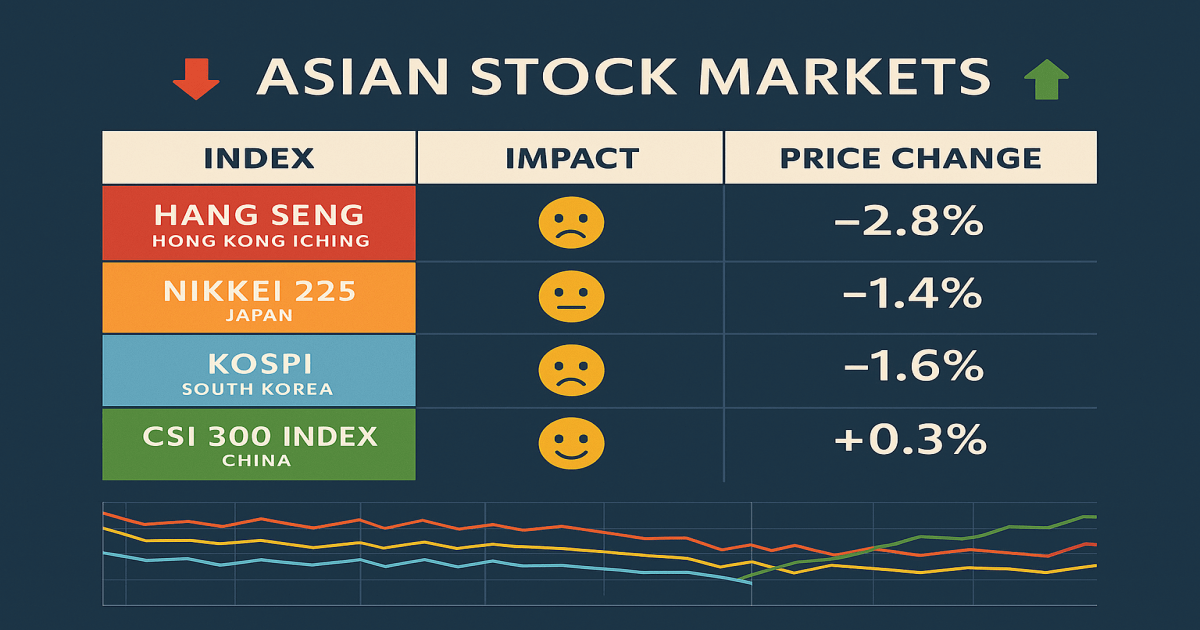

The start of the trading week in Asia was marked by heightened volatility as US China trade tensions escalated once again. Following new tariff threats from Washington and retaliatory measures from Beijing, investors shifted away from risk assets, triggering declines across major Asian indices.

According to fresh reports, China’s Ministry of Commerce declared that the country is not afraid of a trade war, responding to President Donald Trump’s pledge to impose additional tariffs on Chinese imports. This rhetoric has reignited fears of a prolonged economic standoff between the world’s two largest economies.

Hang Seng Index Declines Amid Investor Caution

The Hang Seng Index in Hong Kong opened lower, reflecting investor anxiety over the deteriorating trade relationship. Market participants noted that sectors most exposed to global supply chains, such as technology and manufacturing, were hit hardest.

-

Hang Seng Index performance: The index recorded a significant drop as capital outflows intensified.

-

Investor sentiment: Concerns over corporate earnings and export demand weighed heavily on Hong Kong equities.

-

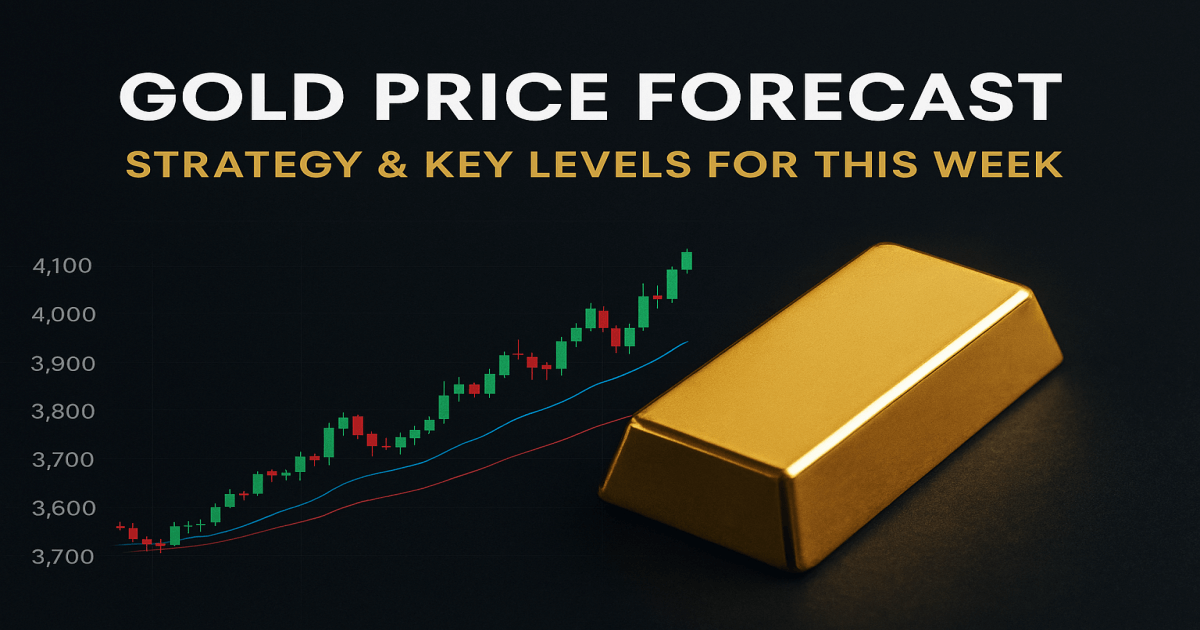

Safe haven flows: Gold and the Japanese yen saw increased demand as investors sought protection from market turbulence.

CSI 300 Index Shows Relative Stability

In contrast, the CSI 300 Index in mainland China managed to hold steady, with selective gains in state-backed firms and domestic consumption stocks. Analysts suggest that Beijing’s policy support measures, including liquidity injections and targeted fiscal spending, helped cushion the blow.

-

CSI 300 resilience: Despite global headwinds, the index benefited from domestic investor confidence.

-

Policy support: The People’s Bank of China signaled readiness to stabilize markets through monetary easing.

-

Sector performance: Consumer staples and renewable energy stocks outperformed, highlighting China’s pivot toward internal growth drivers.

Global Market Impact and Investor Strategies

The ripple effects of the renewed trade conflict were felt across global markets. Reports indicated that Wall Street experienced its sharpest one day drop since April, while European indices also turned negative. The synchronized selloff underscores the interconnected nature of global finance.

For investors, the key strategies in this environment include:

-

Diversification across asset classes to mitigate regional risks

-

Increased allocation to safe haven assets such as gold and US Treasuries

-

Monitoring central bank policies in both the US and China for signals of further intervention

Outlook for Asian Financial Markets

The outlook remains uncertain as trade negotiations show little progress. Analysts warn that prolonged tensions could disrupt global supply chains, weaken corporate earnings, and slow economic growth across Asia. However, opportunities may emerge in sectors less exposed to trade volatility, such as domestic consumption, healthcare, and renewable energy.

Investors are advised to remain vigilant, closely track policy announcements, and adjust portfolios to balance risk and opportunity.

Most Affected Asian Indices