Table of Contents

Japan's economy demonstrated resilience in August 2025 with a substantial current account surplus, even as the yen faced intensified pressure against the US dollar. According to recent data from the Ministry of Finance, the surplus stood at 3.776 trillion yen, surpassing market expectations and highlighting key trade dynamics. This development coincides with a notable yen depreciation, pushing the USD JPY exchange rate toward higher levels. Investors and analysts are closely monitoring these trends for insights into Japan's fiscal health and global market implications.

Japan Current Account Surplus August 2025 Key Figures and Analysis

The Ministry of Finance reported that Japan's current account surplus for August 2025 totaled 3.776 trillion yen, marking a 4.8 percent decline from the previous year but exceeding forecasts of 3.540 trillion yen. This figure also represented an increase from July's 2.684 trillion yen surplus, underscoring a positive momentum in external balances.

Breaking down the components, exports grew by 0.4 percent year on year to 8.359 trillion yen, while imports fell by 6.0 percent to 8.253 trillion yen. This shift resulted in a trade surplus of 105.9 billion yen, driven primarily by reduced import costs amid global commodity fluctuations. The capital account showed a deficit of 16.3 billion yen, contrasted by a financial account surplus of 1.838 trillion yen. These metrics reflect Japan's ongoing ability to maintain a high level nominal current account surplus, as noted in broader economic outlooks from institutions like the Bank of Japan.

Analysts attribute this performance to modest export growth in sectors such as manufacturing and technology, coupled with import declines influenced by energy price stabilizations. For those searching for Japan current account surplus August 2025 details, this data points to sustained external strength despite domestic challenges.

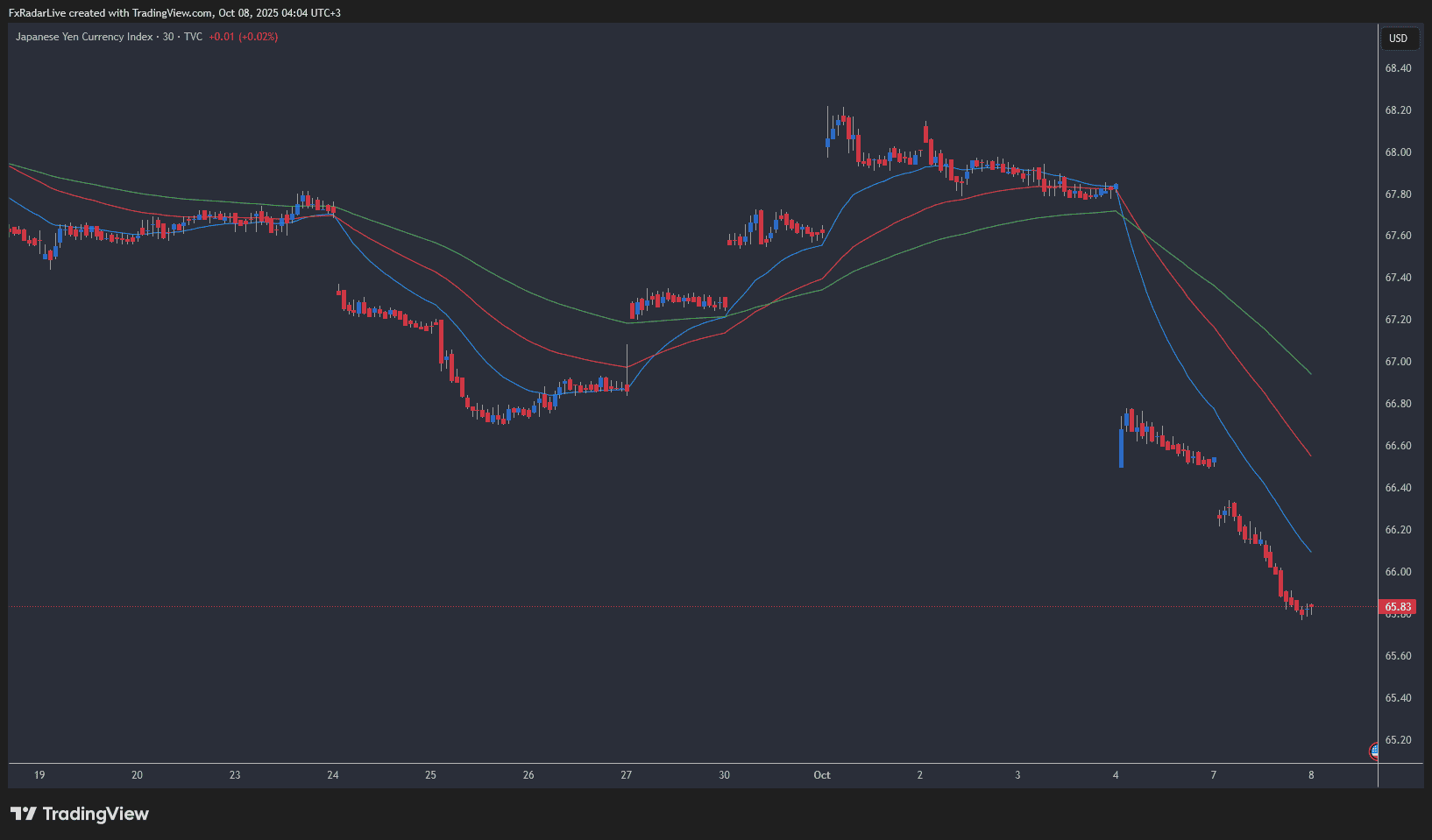

Yen Depreciation Trends and USD JPY Exchange Rate Movements

The yen's depreciation has accelerated in recent weeks, with the USD JPY pair extending its upward trajectory. Following political developments, including Sanae Takaichi's election as leader of the Liberal Democratic Party, the yen weakened sharply, boosting dollar strength. Market data indicates the pair has gained over 2.7 percent in a four day streak, approaching levels near 152.30 and testing August highs beyond 151.00.

Factors contributing to this yen depreciation include fiscal uncertainty under Japan's new government, bets on fiscal easing, and divergent monetary policies between the Bank of Japan and the US Federal Reserve. Higher US interest rates relative to Japan's low rate environment have exacerbated the decline, with the yen dropping over 50 percent against the dollar since early 2021 in cumulative terms. For queries on yen depreciation 2025 or USD JPY forecast, experts anticipate further pressure if the Bank of Japan maintains its cautious stance on rate hikes.

This movement has implications for carry trades and investor sentiment, with the yen's weakness potentially benefiting exporters but raising concerns over import driven inflation.

Economic Implications for Japan and Global Markets

The interplay between Japan's robust current account surplus and yen depreciation signals mixed economic prospects. On one hand, the surplus bolsters Japan's position as a net lender globally, supporting financial stability and funding overseas investments. However, persistent yen weakness could erode purchasing power and complicate inflation targets, as highlighted in analyses from sources like Trading Economics and Forex.com.

Globally, these dynamics influence currency markets, with USD JPY surge affecting trade balances in Asia and beyond. Investors tracking Japan economic outlook 2025 should note potential risks from US data releases and Bank of Japan policy shifts, which may drive volatility. Overall, while the August surplus provides a buffer, sustained yen depreciation underscores the need for strategic fiscal measures to ensure long term growth.