Table of Contents

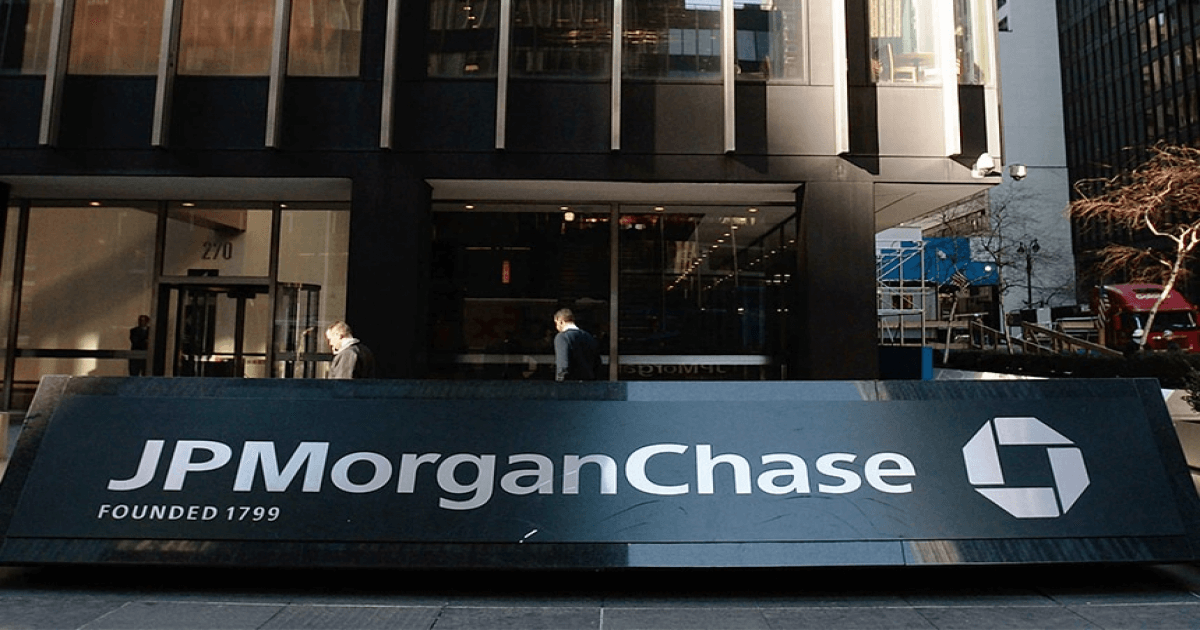

JPMorgan Chase has announced a landmark $10 billion investment into industries critical to US national security, as part of a broader $1.5 trillion Security and Resiliency Initiative. The move positions the bank at the center of America’s economic and technological future.

JPMorgan Chase, the largest US bank by assets, has unveiled a decade long plan to invest $10 billion directly into companies that are considered vital for national security and economic resilience. This initiative is part of the bank’s $1.5 trillion Security and Resiliency Initiative, which aims to strengthen industries that underpin America’s competitiveness in the global economy.

Key Industries Targeted by JPMorgan Chase

The bank’s investment strategy focuses on four high growth and high security sectors:

-

Defense and Aerospace: Strengthening US defense capabilities and supporting advanced aerospace innovation.

-

Frontier Technologies: Investments in artificial intelligence, quantum computing, and cybersecurity, which are essential for future technological dominance.

-

Energy Technology: Funding projects in battery storage, clean energy, and grid resilience to ensure energy independence.

-

Supply Chain and Advanced Manufacturing: Reducing reliance on foreign suppliers by investing in critical minerals, robotics, and semiconductor production.

Jamie Dimon’s Vision for US Resilience

JPMorgan CEO Jamie Dimon emphasized that America has become too dependent on unreliable foreign sources for critical minerals, pharmaceuticals, and advanced technologies. He stated that economic resilience is inseparable from national security, highlighting the need to remove regulatory barriers and accelerate domestic innovation.

Dimon also pointed out that the initiative will help ensure reliable access to life saving medicines, strengthen defense systems, and build energy infrastructure capable of meeting AI driven demand.

Broader Economic and Geopolitical Context

The announcement comes amid heightened US China tensions, particularly over rare earth minerals and advanced technologies. Recent tariff escalations and export restrictions have underscored the urgency of securing domestic supply chains.

By committing $10 billion in direct equity and venture capital investments, JPMorgan is not only financing growth but also taking ownership stakes in companies that will shape the future of the US economy.

Implications for Investors and the Financial Market

-

Stock Market Impact: JPMorgan shares rose following the announcement, reflecting investor confidence in the bank’s long term strategy.

-

Private Equity and Venture Capital: The initiative signals a major shift in how large financial institutions engage with critical industries, blending traditional banking with venture style investments.

-

National Security Investments: Defense, energy, and technology stocks are expected to benefit from increased capital inflows.

Conclusion

JPMorgan Chase’s $10 billion investment marks a historic commitment to US economic resilience and technological leadership. By targeting defense, energy, frontier technologies, and supply chain security, the bank is positioning itself as a key driver of America’s future prosperity. For investors, policymakers, and industry leaders, this initiative signals a new era where finance and national security converge to shape global competitiveness.