Table of Contents

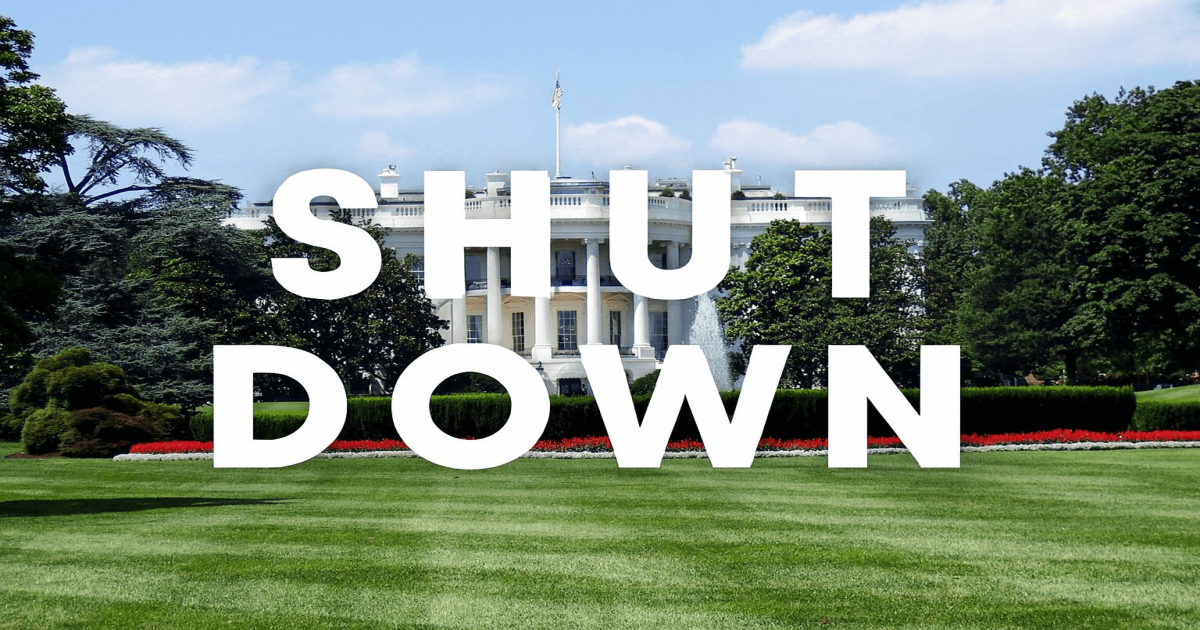

Goldman Sachs warns that the ongoing US government shutdown could become one of the longest in history, with severe consequences for economic growth, financial markets, and investor confidence. Analysts project billions in lost GDP each week, rising unemployment, and heightened volatility across global markets.

Goldman Sachs has raised alarms that the current US government shutdown could extend far longer than previous episodes, potentially ranking among the most disruptive in American history. According to the bank’s chief political economist Alec Phillips, the standoff in Washington is not only a political crisis but also a looming economic threat that could weigh heavily on growth, employment, and financial stability.

Economic Impact of a Prolonged Shutdown

Fresh data from the White House Council of Economic Advisers underscores the scale of the risk. The US economy could lose 15 billion dollars in GDP for every week the shutdown continues, with an estimated 43,000 additional job losses if it lasts a month. These figures do not include the 1.9 million federal civilian workers already affected, many of whom are either furloughed or working without pay.

The longer the shutdown drags on, the greater the pressure on consumer spending, small businesses dependent on federal contracts, and critical services such as air travel and social security payments.

Market Reactions and Investor Sentiment

Despite the political gridlock, Wall Street has shown surprising resilience in the early days of the shutdown. The S&P 500 index rose modestly on the first trading day of October, while the VIX volatility index ticked up only slightly. However, analysts caution that markets may not remain calm if the shutdown extends into weeks, especially as uncertainty grows over fiscal policy and debt obligations.

One clear signal of investor anxiety is the surge in gold prices, which recently crossed 4,000 dollars per ounce, reflecting a flight to safe-haven assets amid concerns about US political stability.

Global Implications of the US Shutdown

The United States remains the world’s largest economy, and a prolonged shutdown could ripple across global markets. Treasury yields have eased, the US dollar has weakened, and international investors are closely monitoring the situation. Emerging markets, which rely heavily on dollar liquidity, could face heightened volatility if the shutdown undermines confidence in US fiscal management.

Political Stalemate Driving Uncertainty

At the heart of the shutdown is a bitter dispute in Congress over funding priorities, particularly surrounding healthcare subsidies. The administration has framed the issue as a matter of fiscal responsibility, while opponents argue that the standoff is politically motivated. With no clear resolution in sight, Goldman Sachs warns that the duration of this shutdown could surpass previous records, amplifying risks for both the domestic and global economy.

Outlook for Investors and Businesses

For investors, the key takeaway is that duration matters. A short shutdown may have limited impact, but a prolonged one could erode growth, weaken consumer confidence, and trigger broader market instability. Businesses reliant on federal contracts, airlines, and consumer-facing sectors are particularly vulnerable.

Goldman Sachs advises clients to prepare for heightened volatility, diversify portfolios, and monitor safe-haven assets such as gold and US Treasuries.

Conclusion: A Defining Test for US Economic Stability

The unfolding government shutdown is more than a political standoff. It is a critical test of US economic resilience and a potential inflection point for global markets. With Goldman Sachs warning of one of the longest shutdowns in history, the coming weeks will be decisive in determining whether the US economy can withstand the political deadlock or whether prolonged paralysis will trigger deeper financial disruption.