Table of Contents

The Trump administration has announced a proposal to ban Chinese airlines from using Russian airspace on flights to and from the United States. The move is designed to address what US carriers describe as a major competitive imbalance, since American airlines have been barred from Russian skies since 2022 while Chinese carriers continue to benefit from shorter and cheaper routes. This policy shift could reshape global aviation routes, intensify US China trade tensions, and impact airline stocks on Wall Street.

US Aviation Policy and the Russia Airspace Ban

Since the outbreak of the Ukraine conflict in 2022, US and European airlines have been prohibited from flying over Russian territory. This has forced longer flight times, higher fuel costs, and reduced profitability for carriers such as Delta Air Lines (Wikipedia), United Airlines (Wikipedia), and American Airlines (Wikipedia). In contrast, Chinese airlines including Air China, China Eastern, and China Southern have continued to use Russian airspace, giving them a significant cost advantage on transpacific routes.

The proposed ban would level the playing field by preventing Chinese carriers from exploiting this route advantage. According to the US Department of Transportation, the measure is intended to restore fair competition in international aviation.

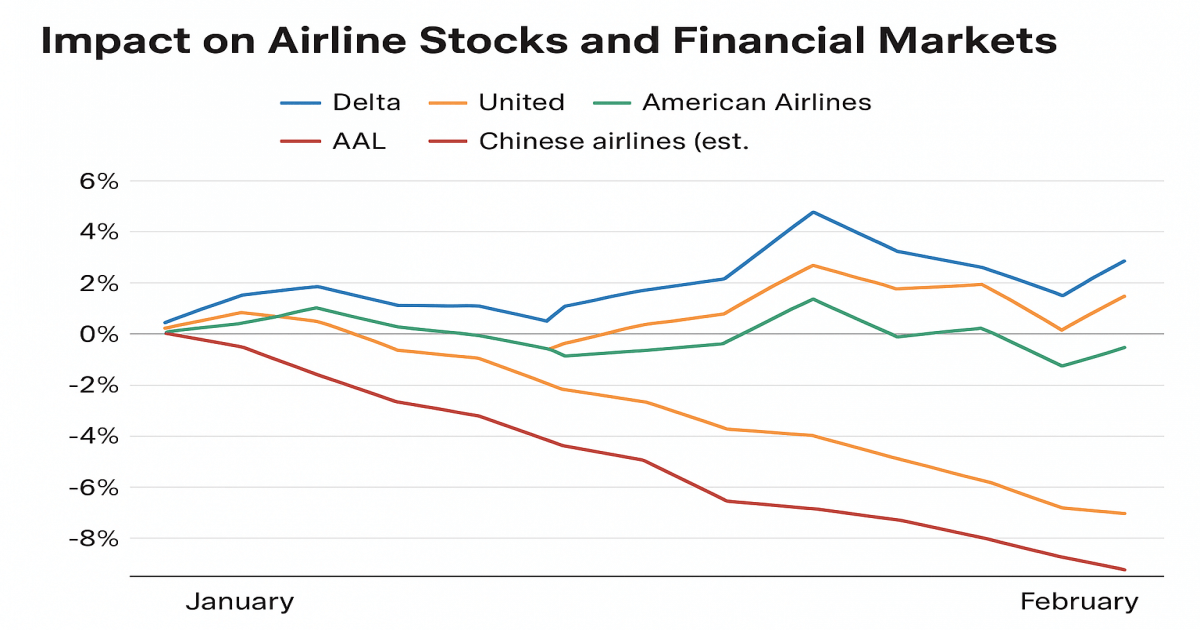

Impact on Airline Stocks and Financial Markets

The announcement has already triggered volatility in airline stocks. Delta Air Lines (DAL) rose 4.25 percent to 59.55 USD, reflecting investor optimism that the policy could reduce competitive pressure on US carriers. United Airlines (UAL) also gained 3.31 percent to 101.34 USD, while American Airlines (AAL) slipped 1.6 percent to 11.62 USD, as analysts remain cautious about its higher debt levels and weaker balance sheet compared to rivals.

Chinese airline stocks listed in Hong Kong and Shanghai are expected to face downward pressure, as longer routes will increase operational costs and reduce profitability. The policy could also affect Boeing (BA), which has already been hit by Chinese restrictions on aircraft imports, and oil prices, since longer flight times mean higher global jet fuel demand.

Geopolitical and Trade War Implications

This aviation dispute is part of the broader US China trade war escalation in 2025, which has already seen tariffs of up to 145 percent on Chinese imports and retaliatory measures from Beijing. Analysts warn that restricting Chinese airlines could provoke countermeasures, potentially targeting US carriers operating in Asia or further limiting Boeing’s access to the Chinese market.

The geopolitical dimension is critical. By restricting Chinese airlines, Washington is signaling that aviation is now a frontline in the US China rivalry, alongside technology, energy, and defense.

What Investors Should Watch

-

Airline Stocks: Delta and United are positioned to benefit most from the policy shift, while American Airlines remains vulnerable.

-

Boeing: Already under pressure from Chinese import bans, Boeing could face further headwinds if Beijing retaliates.

-

Energy Markets: Longer flight paths may increase global jet fuel demand, potentially supporting oil prices.

-

Chinese Carriers: Air China, China Eastern, and China Southern will likely see higher costs and weaker margins.

Conclusion: Aviation and Markets Enter a New Phase

The proposed ban on Chinese airlines overflying Russia is more than an aviation policy. It is a strategic move in the US China economic conflict, with direct consequences for global trade, airline competition, and stock market performance. Investors should closely monitor airline equities, energy prices, and geopolitical developments as this policy unfolds.

In summary, Delta and United stocks are gaining momentum, American Airlines remains under pressure, and Chinese carriers face a new wave of challenges. This development underscores how deeply intertwined geopolitics and financial markets have become in 2025.

Impact Rating: Bullish for US Airlines, Bearish for Chinese Carriers

On a scale from 1 (very bearish) to 10 (very bullish), this policy announcement scores:

-

8/10 for US airlines like Delta Air Lines (DAL), United Airlines (UAL), and American Airlines (AAL), due to reduced competition and improved route parity.

-

3/10 for Chinese airlines such as Air China, China Eastern, and China Southern, as longer routes and higher costs threaten margins.

This rating reflects investor sentiment and strategic positioning in the wake of the proposed ban.