Table of Contents

- Federal Reserve Interest Rate Cuts: The Current Landscape

- Historical Pattern of Market Volatility During Rate Cut Cycles

- Economic Indicators Driving Fed Policy Decisions Today

- Investment Strategy for Navigating Rate Cut Environments

- Stock Market Sectors Positioned to Benefit from Lower Rates

- Federal Reserve Forward Guidance and Market Expectations

- Managing Portfolio Risk During Economic Uncertainty

- Preparing Your Portfolio for Rate Cut Volatility

The Federal Reserve's recent pivot toward monetary easing has sent ripples through financial markets, but historical patterns suggest investors should prepare for significant volatility rather than celebrate. As Fed Chair Jerome Powell navigates the delicate balance between supporting employment and controlling inflation, a troubling correlation emerges from past rate cutting cycles that demands attention from market participants.

Federal Reserve Interest Rate Cuts: The Current Landscape

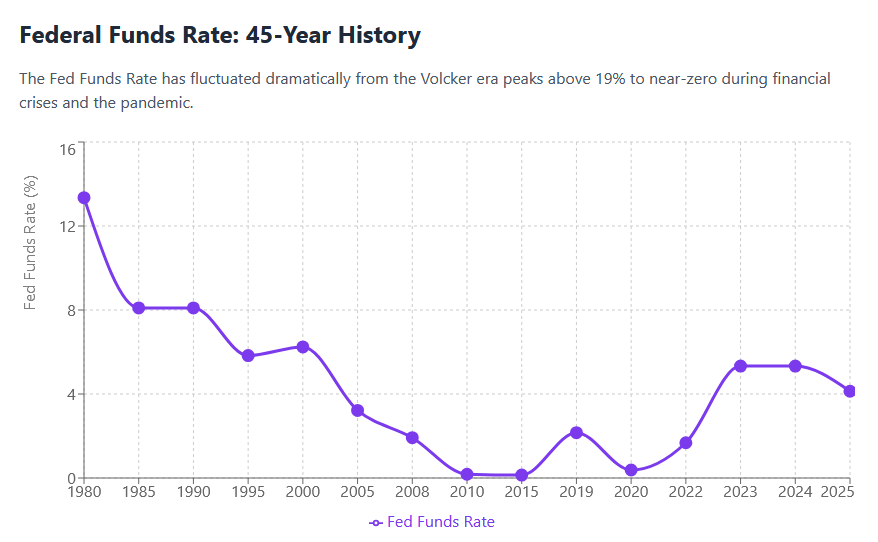

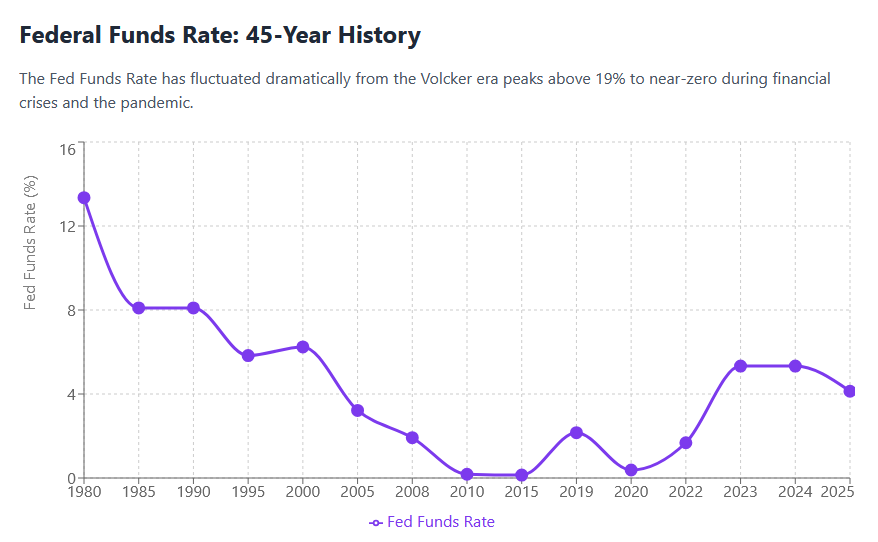

In September 2025, the Federal Reserve implemented its first interest rate reduction since December 2024, lowering the federal funds rate by 25 basis points to a range of 4.0% to 4.25%. This decision marked a significant turning point in monetary policy, driven primarily by mounting concerns about labor market weakness rather than victory over inflation.

Powell's recent communications have emphasized the Fed's growing unease about employment trends. At a National Association for Business Economics event in October 2025, he acknowledged rising downside risks to unemployment, signaling that the central bank's dual mandate has shifted toward prioritizing job market stability. The unemployment rate has climbed to 4.3%, a level not witnessed since September 2017 outside of pandemic disruptions.

Market expectations now point toward additional rate cuts before year end. The CME FedWatch Tool indicates near certainty for another 25 basis point reduction at the October 28 meeting, with strong probability for a December cut as well. This would bring cumulative easing to approximately one full percentage point by the close of 2025. Similar to Goldman Sachs's warnings about the government shutdown, uncertainty around Fed policy continues to impact market sentiment.

Historical Pattern of Market Volatility During Rate Cut Cycles

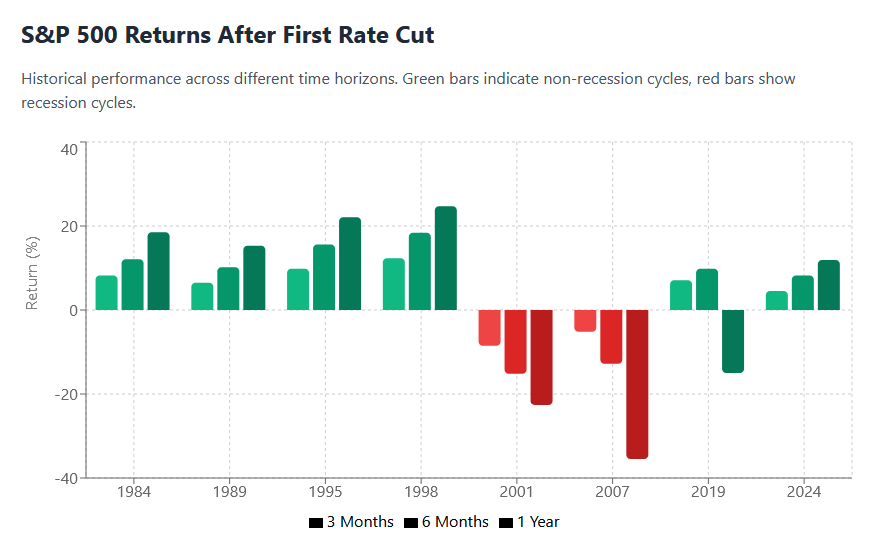

The relationship between Fed rate cuts and stock market performance reveals a consistently uncomfortable truth: rate cutting cycles have historically coincided with substantial market corrections. Analysis of the 21st century shows four distinct easing cycles, and three resulted in severe bear markets for major indices.

The 2019 cycle provides a particularly instructive example. When Powell initiated rate reductions in August 2019, markets initially responded positively. However, by March 2020, the Nasdaq Composite had plummeted 15%, the S&P 500 declined 24%, and the Dow Jones Industrial Average suffered a 30% collapse. Similar patterns emerged during earlier cycles in 2001 and 2007, when rate cuts preceded rather than prevented market downturns.

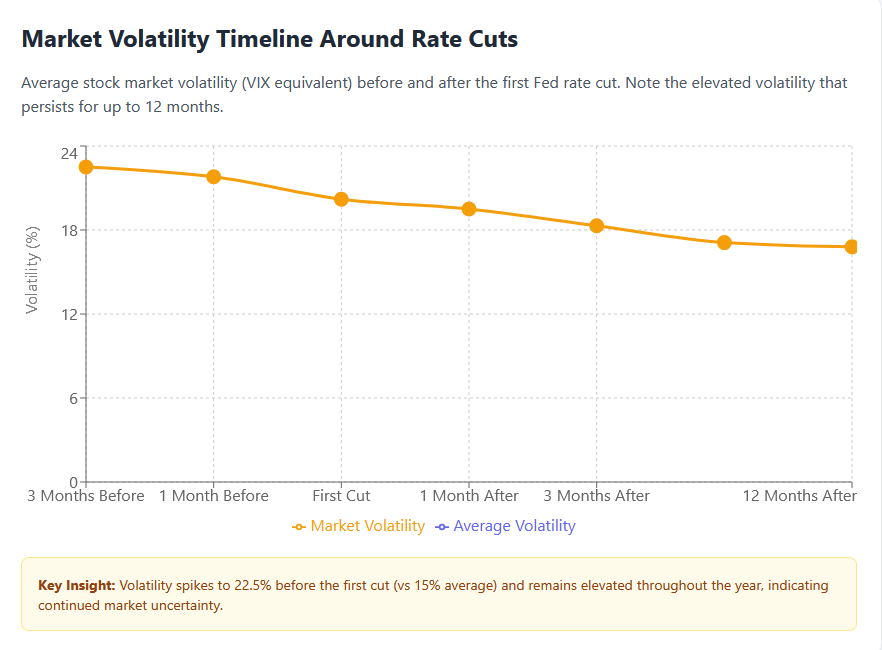

Recent data from Northern Trust confirms this volatility thesis. Their research demonstrates that stock market volatility measures surge above average in the three months preceding the first rate cut and remain elevated throughout the subsequent year. In the month immediately before the initial cut, volatility averaged 22.5% compared to the typical market baseline of approximately 15%.

This heightened uncertainty reflects a fundamental reality: the Federal Reserve typically reduces rates when economic conditions deteriorate. Rate cuts are medicine for an ailing economy, not a celebration of health. The central bank acts when recession risks materialize, labor markets weaken, or deflationary pressures emerge.

Economic Indicators Driving Fed Policy Decisions Today

Current economic data presents Fed policymakers with conflicting signals that complicate the path forward. On one hand, GDP growth has demonstrated surprising resilience, with third quarter 2025 estimates showing an annualized expansion of 3.8%. Consumer spending remains solid, and corporate earnings have largely exceeded analyst expectations.

Conversely, employment metrics paint a concerning picture. The August jobs report revealed only 22,000 positions added, dramatically below economist forecasts. Year to date through August, the economy has created just 598,000 jobs compared to 1.4 million during the same period in 2024. This represents a sharp deceleration in hiring momentum.

Inflation dynamics add another layer of complexity. The Fed's preferred measure, core Personal Consumption Expenditures, currently runs at 2.9%, stubbornly above the 2% target. Much of this elevated reading stems from tariff related price increases rather than underlying demand pressures. Similar to concerns raised in our analysis of Trump's China tariffs reshaping global markets, Powell has explicitly distinguished between tariff driven inflation and intrinsic inflationary momentum, providing justification for rate cuts despite above target readings.

The government shutdown beginning in October has further clouded the economic picture by delaying critical data releases. This information vacuum increases the likelihood of additional rate cuts as the Fed adopts a risk management approach in the absence of complete labor market intelligence.

Investment Strategy for Navigating Rate Cut Environments

Portfolio positioning during rate cutting cycles requires balancing short term volatility with long term opportunities. Historical evidence demonstrates that while initial market reactions can be severe, patient investors who maintain exposure through turbulence have consistently benefited over multi year horizons.

BlackRock's analysis indicates that large cap stocks have outperformed small cap counterparts during previous easing cycles, averaging stronger 12 month returns following the first rate cut. This performance differential reflects large companies' superior access to capital markets and more diversified revenue streams that provide resilience during economic uncertainty.

Fixed income strategies merit particular attention as rates decline. The traditional approach of extending duration carries risks given that long term Treasury yields may not track short term rate cuts. BlackRock strategists recommend focusing on the intermediate portion of the yield curve, specifically two to seven year maturities, where yields remain attractive without excessive duration risk. Investment grade corporate bonds offer additional yield pickup over Treasuries while credit spreads remain historically tight.

Alternative assets present diversification opportunities during volatile periods. Commodities, particularly gold, have historically served as effective portfolio stabilizers during rate cutting cycles. As we've covered in our gold price forecast analysis, real assets and certain alternative strategies demonstrate low correlation to traditional equities, potentially smoothing portfolio returns when stock volatility accelerates.

Cash positions require reconsideration as money market yields decline alongside Fed cuts. While cash yielded over 5% during the higher for longer environment, these returns will erode with continued easing. Investors maintaining elevated cash allocations should strategically redeploy into assets offering better risk adjusted return potential.

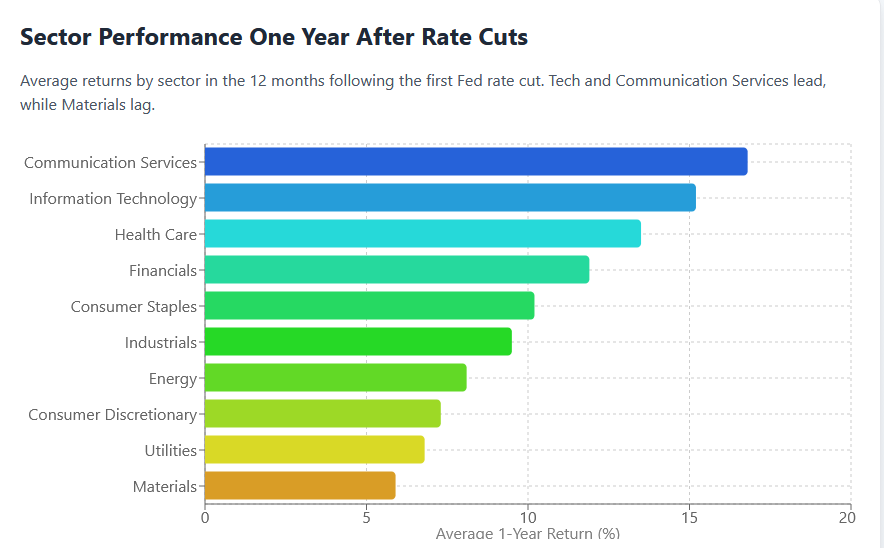

Stock Market Sectors Positioned to Benefit from Lower Rates

Sector performance during rate cutting cycles varies significantly based on the underlying economic catalyst. In non recessionary easing scenarios, where the Fed reduces rates preemptively to extend economic expansion, risk assets including technology and growth oriented sectors have historically led returns.

Interest rate sensitive industries traditionally benefit from declining borrowing costs. Real estate investment trusts see improved fundamentals as financing costs decrease and property valuations receive support from compressed cap rates. Utilities, despite strong 2025 performance driven by data center power demand, typically appreciate as their dividend yields become more attractive relative to falling bond yields.

However, 2025 has witnessed an unusual pattern where defensive sectors have underperformed despite rate cuts. Consumer staples, healthcare, and traditional defensive plays have lagged growth sectors as investors focus on companies demonstrating robust earnings momentum. This divergence suggests market participants currently view the rate cutting cycle as mid cycle adjustment rather than late cycle recession prevention.

Financial sector performance depends critically on net interest margin dynamics. While lower rates reduce lending profitability, banks may benefit from increased loan demand and stronger investment banking activity as capital markets activity accelerates with improved liquidity conditions. As discussed in our coverage of JPMorgan Chase's $10 billion investment, regional banks with significant commercial real estate exposure face headwinds, while diversified money center banks demonstrate greater resilience.

Technology companies with high growth rates but limited current profitability stand to gain substantially from lower discount rates applied to future cash flows. The artificial intelligence investment cycle continues driving capital expenditure across cloud infrastructure, benefiting semiconductor manufacturers and enterprise software providers regardless of near term rate movements.

Federal Reserve Forward Guidance and Market Expectations

Powell's recent communications emphasize flexibility and data dependence rather than committing to a predetermined path. At his September press conference, he explicitly stated that the Fed will set policy based on evolving economic conditions and the balance of risks. This meeting by meeting approach introduces uncertainty that markets find difficult to price efficiently.

Fed officials' Summary of Economic Projections released in September shows wide dispersion in rate expectations. Seven of 19 officials indicated no further cuts needed this year, while others supported multiple additional reductions. This divergence reflects genuine uncertainty about economic trajectory and appropriate policy responses.

The dot plot median suggests approximately two more quarter point cuts before 2025 concludes, followed by slower easing into 2026 and 2027. However, market pricing via futures contracts often diverges from Fed projections, currently anticipating slightly more aggressive easing than policymakers signal.

Powell's acknowledgment that the neutral rate likely sits higher than pre pandemic levels carries important implications. If the long run equilibrium federal funds rate rests near 3% rather than the previous 2.5% estimate, the Fed has less distance to travel in this easing cycle. This higher neutral rate suggests tighter financial conditions persist even after cuts, potentially limiting the economic boost from monetary easing.

Managing Portfolio Risk During Economic Uncertainty

Prudent risk management becomes paramount when historical patterns warn of potential turbulence ahead. Diversification across asset classes, geographies, and strategies provides the foundation for weathering volatility without abandoning long term return objectives.

Rebalancing discipline helps investors avoid emotional decision making during market swings. Establishing predetermined thresholds for portfolio adjustments removes the temptation to time markets based on fear or greed. Systematic rebalancing sells strength and buys weakness, a contrarian approach that historically enhances long term returns.

Quality factor exposure offers defensive characteristics without sacrificing growth potential. Companies demonstrating strong balance sheets, consistent profitability, and sustainable business models tend to outperform during volatile periods. Quality stocks typically experience smaller drawdowns during corrections while participating in subsequent recoveries.

Options strategies including protective puts or collar structures can hedge downside risk for investors particularly concerned about near term volatility. While these strategies carry costs that reduce returns in benign markets, they provide insurance value during periods of elevated uncertainty.

Factor diversification beyond traditional market capitalization weighting adds another risk management dimension. Momentum, value, and low volatility factors have shown positive average returns during rate cutting cycles, though performance varies by individual cycle characteristics.

Preparing Your Portfolio for Rate Cut Volatility

History delivers a clear message: Federal Reserve rate cutting cycles correlate strongly with elevated market volatility and frequent corrections. The current environment presents particularly complex challenges given persistent above target inflation, weakening employment trends, and geopolitical uncertainties.

Investors should approach the remainder of 2025 with eyes wide open to potential turbulence while maintaining conviction in long term market appreciation. Short term corrections represent opportunities rather than catastrophes for those with appropriate time horizons and risk tolerance. The key lies in positioning portfolios for resilience through diversification, quality emphasis, and strategic asset allocation aligned with individual circumstances.

Powell's measured approach to monetary easing reflects the Fed's awareness that policy errors in either direction carry significant costs. Too rapid easing risks reigniting inflation, while insufficient support could push the economy into recession. Navigating this narrow path ensures continued uncertainty and likely market volatility.

Those who maintain discipline, avoid panic selling during inevitable drawdowns, and focus on fundamental investment principles will likely emerge from this period well positioned for the next expansion phase. Market history consistently rewards patience and penalizes emotional reactions during periods of heightened volatility. For more insights on navigating current market conditions, explore our latest financial market analysis.