Table of Contents

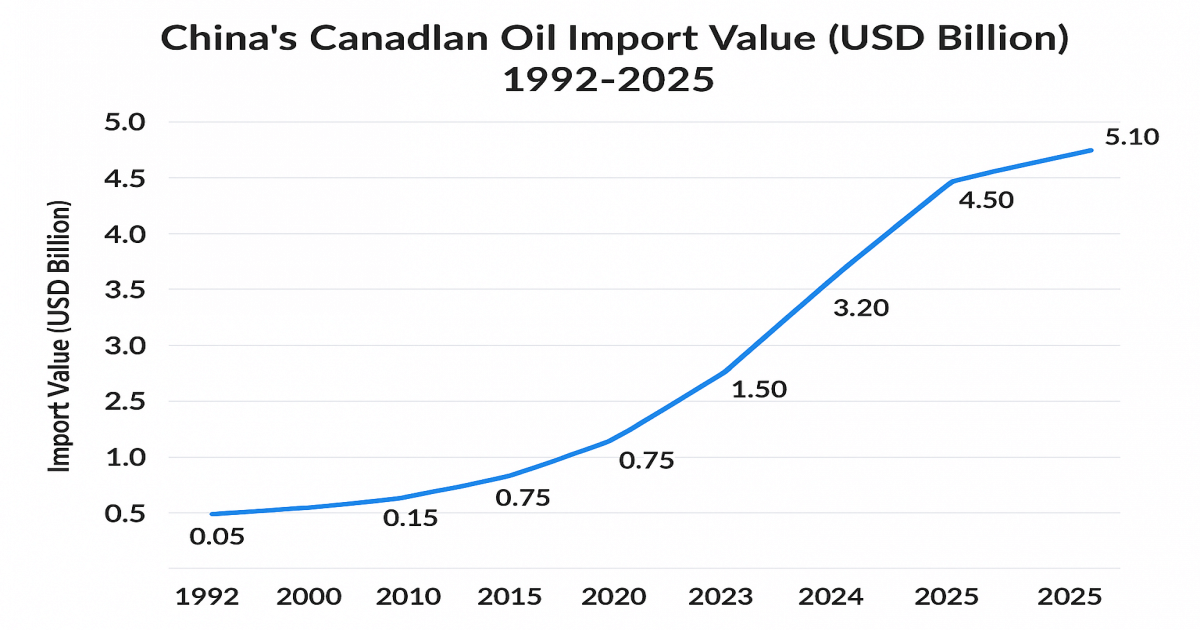

China’s crude oil imports from Canada have surged to an all-time high in October 2025, marking a pivotal shift in global energy dynamics. As Beijing distances itself from US crude amid escalating trade tensions, Canadian heavy oil is emerging as a preferred alternative for Chinese refiners.

Strategic Realignment: China Reduces US Crude Oil Dependence

China’s pivot away from US crude is not merely a reaction to short-term market fluctuations. It reflects a broader geopolitical strategy aimed at reducing reliance on American energy supplies. According to Vortexa ship tracking data, nearly 5 million barrels of Canadian crude have departed Vancouver for China in the first half of October alone. This volume represents 70 percent of all oil shipments from the British Columbia port, a dramatic increase compared to previous months.

The shift coincides with mounting trade frictions between Washington and Beijing, prompting Chinese refiners to seek more politically neutral suppliers. The move also aligns with China’s long-term energy security goals, which prioritize diversified sourcing and reduced exposure to US sanctions.

Canadian Heavy Crude Gains Favor in Asian Markets

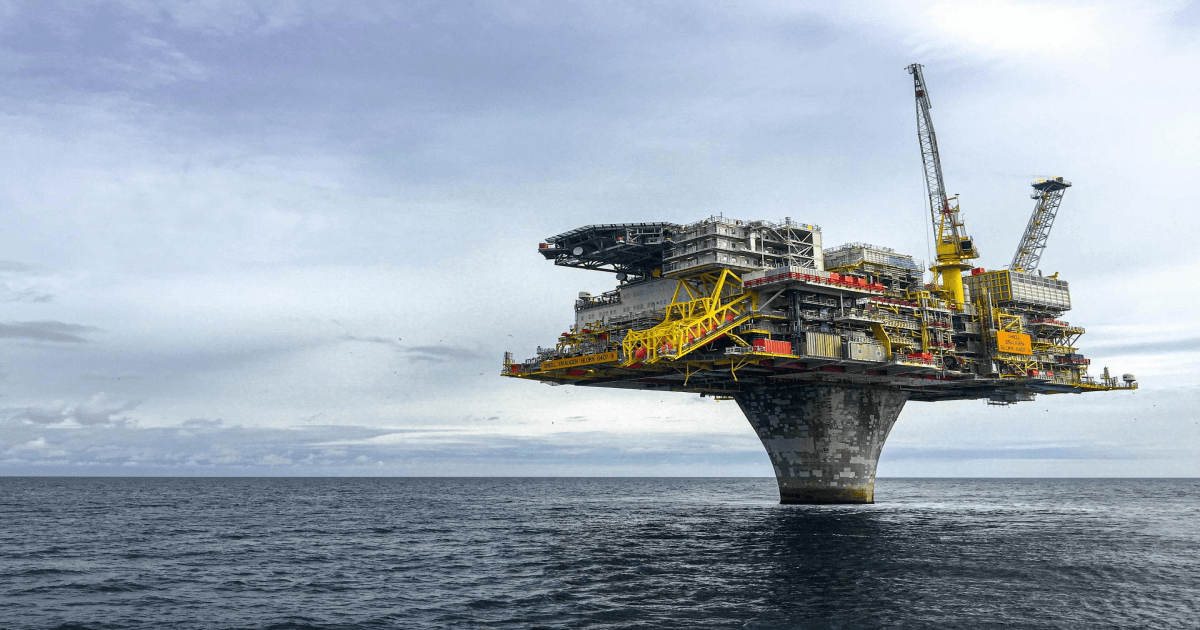

Canadian heavy crude, particularly from Alberta’s oil sands, has gained significant traction in Asian markets. The completion of the Trans Mountain Pipeline Expansion (TMX) in late 2023 has enabled greater export capacity to the Pacific coast, facilitating direct shipments to Asia.

This infrastructure boost has allowed Canadian crude to trade at a premium to Texas-loaded Canadian barrels for the first time since 2024. The price strength is driven by robust demand from Chinese refiners, who value the consistency and quality of Canadian blends. Vancouver’s strategic location and upgraded logistics have further enhanced Canada’s competitiveness in the global oil market.

China’s Oil Import Strategy: Diversification and Cost Optimization

China’s broader oil import strategy includes aggressive stockpiling of discounted Russian and Iranian crude. However, Canadian oil offers a stable and politically safer alternative. Chinese buyers have been importing over half a million barrels per day of foreign crude, balancing cost efficiency with geopolitical risk management.

The diversification effort is also a hedge against potential disruptions in Middle Eastern supply chains and future sanctions. By increasing Canadian imports, China ensures a steady flow of high-quality crude while maintaining flexibility in its refining operations.

Implications for Global Oil Markets and Trade Flows

China’s record-breaking Canadian oil imports are reshaping global trade flows. The redirection of crude shipments from North America to Asia is influencing shipping logistics, pricing benchmarks, and refinery configurations. Analysts expect this trend to continue as China deepens its energy ties with Canada and other non US suppliers.

For Canada, the surge in exports represents a strategic win, reinforcing its role as a reliable energy partner in Asia. For the US, the decline in Chinese demand could pressure domestic producers and alter export strategies.

Canada Emerges as a Key Player in China’s Energy Future

China’s record imports of Canadian crude in October 2025 underscore a significant transformation in global energy trade. As Beijing reconfigures its sourcing strategy, Canada stands to benefit from increased demand, stronger pricing, and enhanced geopolitical relevance.

This development not only reflects current market realities but also signals long-term shifts in how nations approach energy security, trade alliances, and supply chain resilience.