Table of Contents

- Private Sector Financing Package Stalls Amid Collateral Concerns

- Treasury Department Scrambles to Address Banking Sector Hesitation

- Market Impact and Investor Sentiment Turn Negative

- Political Dimensions of US Financial Support for Argentina

- Sovereign Debt Concerns and IMF Coordination Issues

- Banking Sector Perspectives on Argentine Credit Risk

- Economic Reform Progress Under Milei Administration

- Peso Stabilization Efforts and Currency Market Intervention

- Outlook for Argentine Financial Markets

Private Sector Financing Package Stalls Amid Collateral Concerns

A consortium of major Wall Street banks, including JPMorgan Chase, Bank of America, Goldman Sachs, and Citigroup, is struggling to finalize a $20 billion loan facility for Argentina as lenders demand concrete collateral assurances or explicit US government guarantees. The standoff threatens to derail the second component of a larger $40 billion stabilization package designed to support President Javier Milei's economic reform agenda ahead of critical midterm elections.

Treasury Department Scrambles to Address Banking Sector Hesitation

Treasury Secretary Scott Bessent announced last week that the department was working with banks and investment funds to create a $20 billion facility to invest in Argentina's sovereign debt. However, bankers are waiting on guidance from the Treasury Department on what collateral Argentina would be able to provide or if Washington would plan to backstop the facility on its own.

The loan facility represents the private sector component of a broader US financial intervention in South America. The administration has already finalized a $20 billion currency swap agreement with Argentina's central bank, allowing it to exchange its local currency for the US dollar, effectively providing immediate liquidity support to the struggling economy.

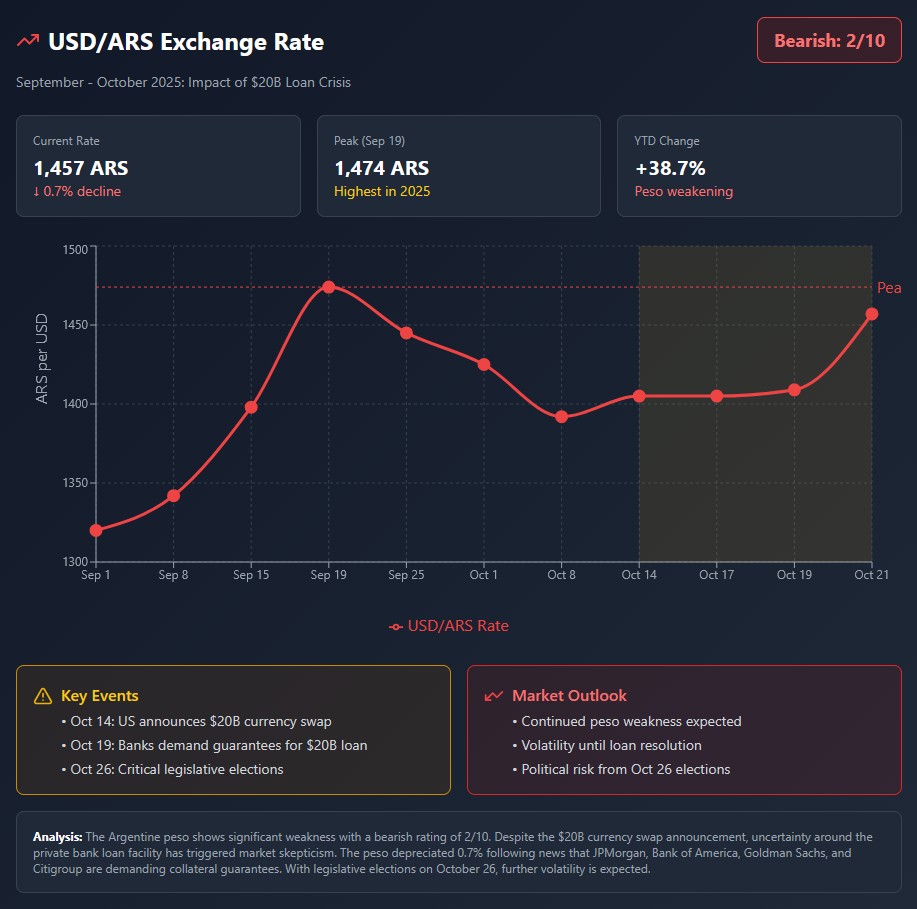

Market Impact and Investor Sentiment Turn Negative

The market impact of this uncertainty is highly negative for Argentine assets, as the $20 billion bank loan is a critical component of the government's $40 billion stabilisation plan. Financial analysts warn that this public hesitation from Wall Street's biggest banks injects severe scepticism into the market, confirming fears that private capital remains unwilling to take on Argentine risk without an explicit US government guarantee.

The timing could not be worse for President Milei, whose government faces legislative elections on October 26. The next legislative elections in Argentina take place on October 26, and the outcome will determine whether Milei can maintain sufficient political support to continue implementing his libertarian economic reforms.

Political Dimensions of US Financial Support for Argentina

Treasury Secretary Scott Bessent said an additional $20 billion in private sector loans for Argentina could effectively double the value of a US rescue plan. The Trump administration has explicitly tied continued support to Milei's political success, with President Donald Trump stating during their White House meeting that US generosity depends on electoral outcomes.

Trump and Bessent are making a bet on a nation that's defaulted and devalued repeatedly over the past several decades, with the goal to help their political ally President Javier Milei notch a win in October. This political dimension has drawn criticism from opposition parties and Democratic lawmakers who question the wisdom of committing billions to a foreign government while domestic economic challenges remain unresolved.

Sovereign Debt Concerns and IMF Coordination Issues

Beyond the collateral question, the US facilities are raising the possibility of a conflict between the IMF and Treasury Department, with officials from the fund concerned that the Trump administration could pressure Argentina to put the US liabilities ahead of the IMF's sizable loans. Argentina already has substantial obligations to the International Monetary Fund, which provided a separate $20 billion agreement in April 2025.

The coordination challenge highlights broader concerns about debt prioritization. If Argentina provides collateral or guarantees to secure the private bank loans, questions arise about how those commitments might affect repayment of existing IMF obligations or other creditors.

Banking Sector Perspectives on Argentine Credit Risk

Banks including JPMorgan, Bank of America, Goldman Sachs, and Citigroup are in talks with the US Treasury to provide up to $20 billion in loans to Argentina. However, the banks are discussing an emergency loan backed by Argentine assets, while cautioning that talks are ongoing and specific collateral is still being ironed out.

Goldman Sachs President John Waldron, speaking at a financial summit, declined to comment specifically on the Argentine situation but noted that banks generally try to provide capital when it aligns with US government interests. The cautious response from banking leadership reflects broader industry concerns about lending to a country with a troubled financial history.

Economic Reform Progress Under Milei Administration

Milei, an economist, voiced hope that the midterm elections would increase his base to allow him to pursue his policies, stating he has no intention of changing course until the end of his term and remains committed to the agenda of lowering taxes, deregulating and keeping the economy growing.

The Argentine president has enacted sweeping budget cuts since taking office in 2023, aiming to combat inflation and stabilize the economy. His libertarian approach has garnered both praise from free market advocates and fierce opposition from those affected by austerity measures. The upcoming elections will serve as a referendum on whether voters support continuing this economic direction.

Peso Stabilization Efforts and Currency Market Intervention

The US directly purchased pesos, a move that follows unsuccessful efforts by Argentine authorities to stabilize the exchange rate on their own. Bessent characterized Argentina's woes as a moment of acute illiquidity, suggesting he doesn't see a fundamental issue with its ability to make good on its debt.

Despite these stabilization efforts, currency markets remain volatile. Recent trading sessions showed the peso weakening approximately 0.7% against the dollar, reflecting ongoing market uncertainty about Argentina's economic trajectory and the ultimate resolution of the private sector financing package.

Outlook for Argentine Financial Markets

The report concluded that the loan facility has not been finalised and might not come together if the banks' concerns over collateral are not resolved. This uncertainty will likely increase pressure on sovereign bond prices, widen risk spreads, and potentially weaken the peso further as investors reassess the government's financial backstop.

Financial market participants are closely monitoring developments in Washington and Buenos Aires. The resolution of the collateral question, the outcome of the October 26 elections, and the broader trajectory of US support will all play crucial roles in determining whether Argentina can successfully navigate its current economic challenges and maintain market confidence going forward.

The coming weeks will prove critical for Argentina's economic stabilization efforts. Without resolution on the private sector loan component, the country may struggle to meet upcoming debt obligations, potentially triggering renewed market turmoil despite the initial $20 billion currency swap from the US Treasury.