Table of Contents

- China Commerce Ministry Announces Unchanged Oil Import Allocation

- Understanding China's Teapot Refinery Sector

- Market Signal: Weak Demand Expectations for 2026

- Global Oil Demand Growth Slows Significantly

- Challenges Facing Independent Refineries

- Strategic Implications for Global Oil Markets

- Petrochemical Sector Becomes Primary Growth Driver

- Policy Framework and Application Requirements

- Price Outlook and Market Balance

- Conclusion: Cautious Optimism Amid Structural Change

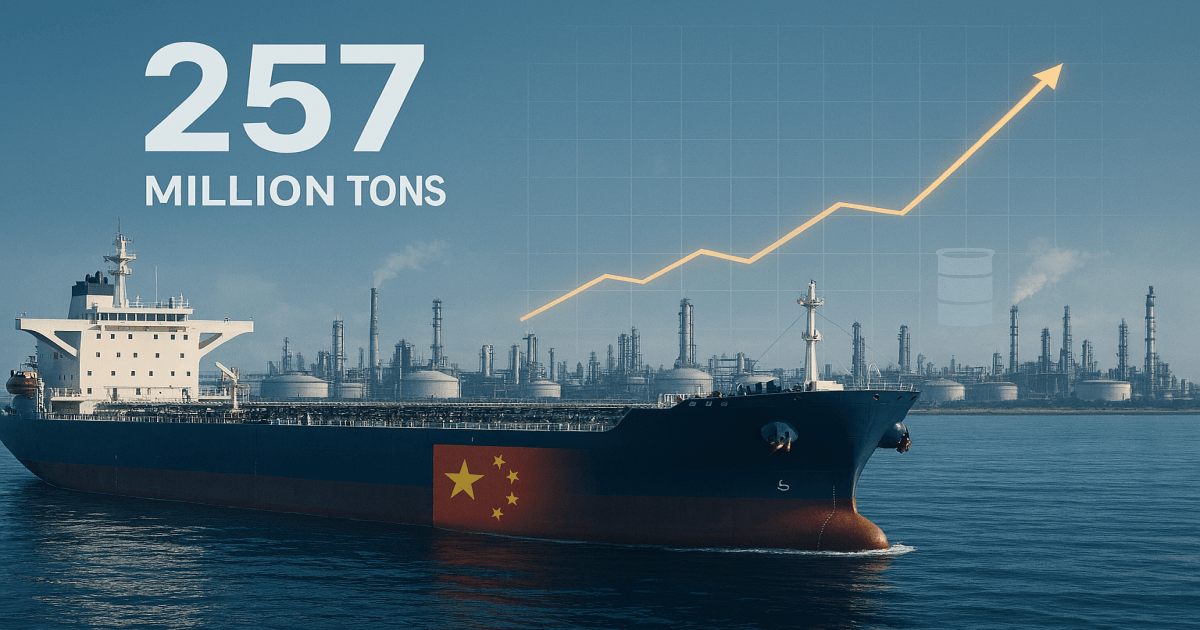

China Commerce Ministry Announces Unchanged Oil Import Allocation

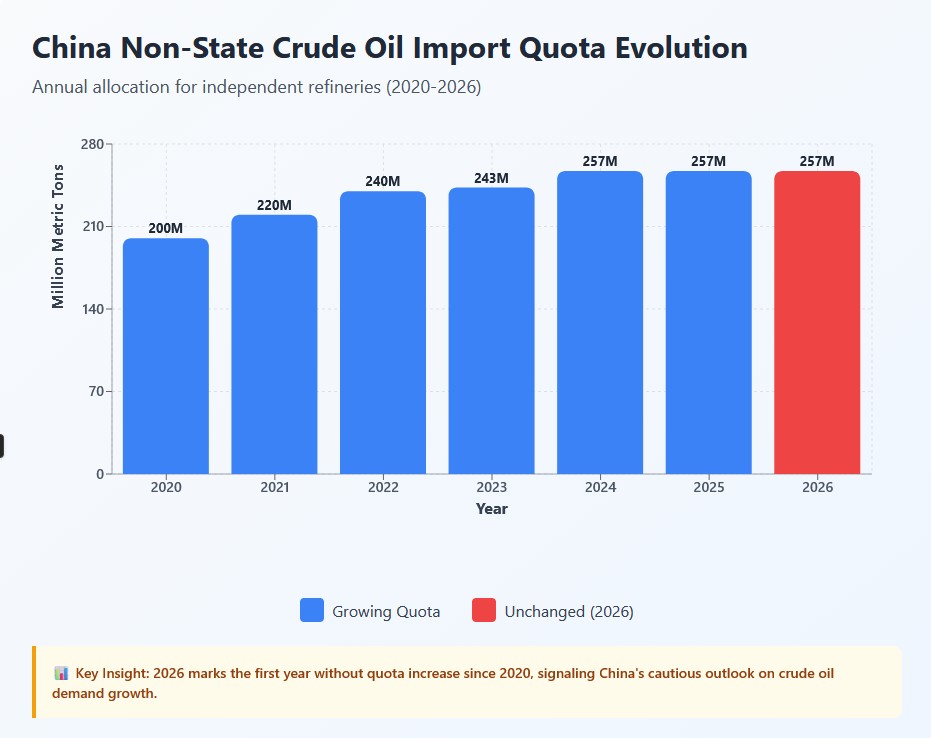

China's Commerce Ministry has announced the 2026 crude oil import quota for non-state traders at 257 million metric tons, keeping allocations unchanged from 2025 levels. This decision signals a cautious outlook on domestic demand growth and represents a critical development for global oil markets as traders assess China's economic trajectory and energy consumption patterns.

The quota allocation, equivalent to approximately 5.14 million barrels per day, will be distributed among roughly 40 independent refineries, predominantly located in Shandong province. These private refiners, known as teapots, are distinct from state-owned giants such as Sinopec and PetroChina, which do not require import quotas.

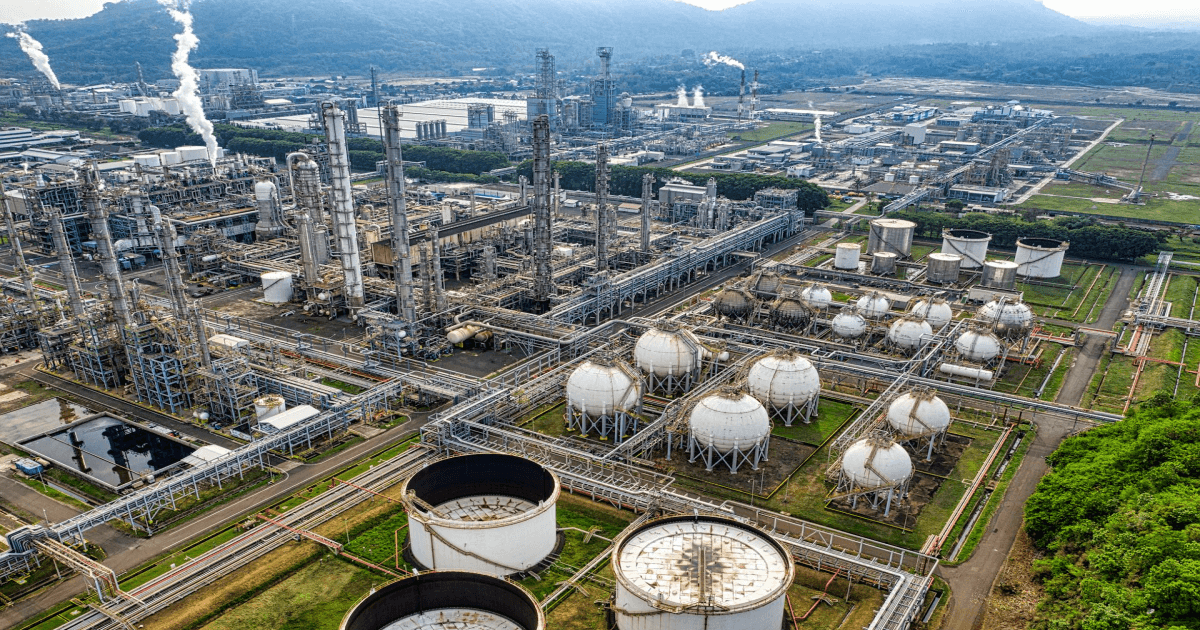

Understanding China's Teapot Refinery Sector

China's teapot refiners collectively represent a massive force in the global oil market, characterized by their price sensitivity and operational agility. These independent facilities have historically purchased crude from diverse suppliers, adapting quickly to market conditions and geopolitical shifts affecting global oil trade flows.

The teapots account for approximately one third of China's total refining capacity and one fifth of the country's crude oil imports, making them crucial players despite operating in the shadows of national oil companies. Their influence extends beyond simple refining operations, as they have become deeply integrated with downstream industries and employ creative strategies to maintain profitability amid challenging market conditions.

Market Signal: Weak Demand Expectations for 2026

The unchanged quota level carries significant implications for oil price forecasts. Industry analysts view this decision as Beijing signaling expectations of weak domestic demand, potentially reflecting high existing stockpiles that reduce the need for additional imports.

Recent data supports this cautious stance. China has absorbed substantial oil imports throughout 2025, filling storage tanks and underground caverns, which has supported global oil prices. However, global oil balances have shown a 1.9 million barrels per day surplus since the start of 2025, with crude prices fluctuating around 70 dollars per barrel.

Crude oil inventories in China increased by approximately 900,000 barrels per day between January and August 2025, effectively removing barrels from global markets and supporting prices. This massive stockpiling effort raises questions about future import requirements and suggests China may already possess sufficient reserves to meet near-term demand.

Global Oil Demand Growth Slows Significantly

The broader context reveals structural challenges for oil consumption growth. Global oil demand rose by 750,000 barrels per day year over year in the third quarter of 2025, with projections showing oil use will remain subdued through 2025 and 2026, resulting in annual gains forecast around 700,000 barrels per day in both years.

This represents a sharp deceleration from historical trends, driven by challenging macroeconomic conditions and accelerating transport electrification. China has been central to this demand transformation, with electric vehicle adoption reaching unprecedented levels that fundamentally alter fuel consumption patterns.

China's oil demand is expected to follow a stronger trajectory in 2026 as robust refining activity and petrochemical expansion offset structural challenges in fuel consumption, though independent teapot refineries may face restrictions from limited crude import quotas.

Challenges Facing Independent Refineries

The unchanged quota level may present operational difficulties for certain teapot refineries. Independent oil refiners have seen only modest increases in crude processing rates while facing mounting pressure from sluggish domestic fuel demand, rising geopolitical tensions, and sanctions.

Since January 2025, Beijing has allowed teapots to offset only 40% to 80% of their consumption tax on fuel oil imports, raising import costs by 2 dollars per barrel and limiting access to crucial feedstock for refiners without import quotas. These policy adjustments have created financial strain, with some facilities idling operations or seeking acquisition partners.

Based in Shandong province, teapots account for roughly 25% of China's refining capacity and are key buyers of discounted crude from Iran, Russia, and Venezuela. Sanctions affecting these supply sources add further complexity to their procurement strategies.

Strategic Implications for Global Oil Markets

The quota decision arrives as global markets navigate oversupply concerns. The oil market has been in surplus since the start of 2025, with stock builds concentrated in crude in China and gas liquids in the United States. Middle East production increases, combined with robust flows from the Americas, have created substantial inventories that may pressure prices lower.

OPEC expects global oil demand to grow by approximately 1.3 million barrels per day in 2025, reaching an average of 105.1 million barrels per day, driven by expectations of 1.2 million barrels per day demand growth in China, India, and other Asian markets. However, this optimistic forecast contrasts sharply with more conservative projections from other agencies.

Petrochemical Sector Becomes Primary Growth Driver

While transport fuel demand shows signs of peaking in China, petrochemical feedstock requirements continue expanding. The launch of new naphtha fed ethylene units is expected to lift naphtha demand by more than 200,000 barrels per day in 2026, providing crucial support for overall consumption.

This shift reflects China's strategic transition from fuel production to chemicals manufacturing, aligning with economic development priorities that emphasize higher value industrial output. The unchanged quota may be sufficient if growth concentrates in petrochemical applications rather than transportation fuels.

Policy Framework and Application Requirements

The Commerce Ministry statement outlines specific criteria for quota recipients. Companies with no import record in recent two years will not be granted any quotas, and the ministry will add and adjust quotas based on companies' demand and new capacity.

The first batch of import quotas will be given to qualified applicants by the end of 2024, with later adjustments based on operational requirements. This flexible framework allows authorities to respond to changing market conditions while maintaining overall volume discipline.

Price Outlook and Market Balance

Looking forward, inventory dynamics will play a crucial role in price determination. Although global oil inventory builds are estimated to accelerate, averaging 2.2 million barrels per day from the fourth quarter of 2025 through 2026, the portion that will show up in visible inventories and influence prices remains uncertain.

Forecasts suggest Brent crude oil prices could fall from an average of 68 dollars per barrel in September to an average of 52 dollars per barrel in the first quarter of 2026, when global oil inventory builds are estimated to peak. However, geopolitical risks, trade policies, and additional sanctions on major exporters could alter these projections significantly.

Conclusion: Cautious Optimism Amid Structural Change

China's decision to maintain the 2026 crude oil import quota at 257 million metric tons reflects careful assessment of demand prospects amid ongoing economic and energy transitions. The unchanged allocation suggests authorities anticipate adequate supply availability while managing oversupply risks and supporting domestic refining sector consolidation.

For global oil markets, this decision reinforces expectations of modest demand growth and persistent inventory builds. Independent refineries face continued operational pressures, requiring strategic adaptation to survive in an increasingly challenging environment. Petrochemical expansion offers growth opportunities, but the era of robust transport fuel demand appears to be ending as electrification reshapes mobility across the world's largest oil importing nation.

Market participants will closely monitor quarterly quota adjustments and actual import volumes throughout 2026 to gauge whether this conservative allocation proves sufficient or requires upward revision as economic conditions evolve.