Table of Contents

- US President Halts Bilateral Trade Negotiations Following Controversial Ontario Campaign

- The Reagan Advertisement Controversy: What Triggered the Trade Talks Collapse

- Political Fallout and Diplomatic Freeze

- Economic Impact Assessment: Quantifying the Trade War Costs

- Immediate Market Reactions and Currency Volatility

- Trade Flow Disruption: Measuring Bilateral Commerce Decline

- Sectoral Analysis: Industries Facing Maximum Exposure

- Long-Term Economic Projections: Bank of Canada Scenario Analysis

- GDP Growth Implications

- Cross-Border Impact: US Economic Consequences

- Strategic Responses: Canada's Diversification Initiative

- Export Diversification Strategy

- Existing Trade Infrastructure and Future Opportunities

- Financial Market Implications: Investment Strategy Considerations

- Currency Trading Opportunities

- Equity Sector Rotation

- Fixed Income Considerations

- Political Context: Historical Trade Relations and Current Tensions

- Sovereignty Concerns and Annexation Rhetoric

- USMCA Review Process and 2026 Deadline

- Path Forward: Scenarios for Resolution

- Optimistic Scenario: Negotiated Settlement

- Pessimistic Scenario: Prolonged Trade War

- Neutral Scenario: Partial Agreements on Key Sectors

- Investment Recommendations: Navigating Trade Uncertainty

- Portfolio Positioning Strategies

- Risk Management Considerations

- Conclusion: Structural Shift in North American Trade Architecture

US President Halts Bilateral Trade Negotiations Following Controversial Ontario Campaign

In a dramatic escalation of bilateral tensions, President Donald Trump terminated all trade negotiations with Canada on Thursday evening, citing what he called a "fraudulent" advertisement featuring former President Ronald Reagan's voice criticizing tariffs. The abrupt decision threatens to destabilize the $2.5 billion daily trade relationship between the world's most integrated economies and sends shockwaves through financial markets on both sides of the border.

The Reagan Advertisement Controversy: What Triggered the Trade Talks Collapse

The government of Ontario launched a $75 million television ad campaign featuring audio clips from Reagan's April 1987 radio address on free and fair trade. The advertisement, which aired on major US networks including Fox, NBC, and Newsmax, strategically targeted Republican voters with Reagan's own words warning against protectionist policies.

Reagan's original five-minute speech railed against tariffs, expressing full-throated support for free and fair trade. However, the Ronald Reagan Presidential Foundation and Institute claimed the ad "misrepresents" the late president's radio address by using selective audio and video rather than airing the full remarks. The foundation stated it did not grant permission for the use of Reagan's voice and announced it was reviewing legal options.

Political Fallout and Diplomatic Freeze

Trump posted on Truth Social that Canada had "fraudulently" used the advertisement and accused Ottawa of attempting to interfere with the US Supreme Court's decision on tariff challenges. His declaration that "ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED" marks one of the most severe diplomatic ruptures between the neighboring allies in recent history.

Following the announcement, Ontario Premier Doug Ford said Friday the province would pause airing the television ads after World Series games this weekend so that US-Canada trade talks could resume. This tactical retreat demonstrates the high economic stakes at play for Canadian provinces heavily dependent on cross-border commerce.

Economic Impact Assessment: Quantifying the Trade War Costs

Immediate Market Reactions and Currency Volatility

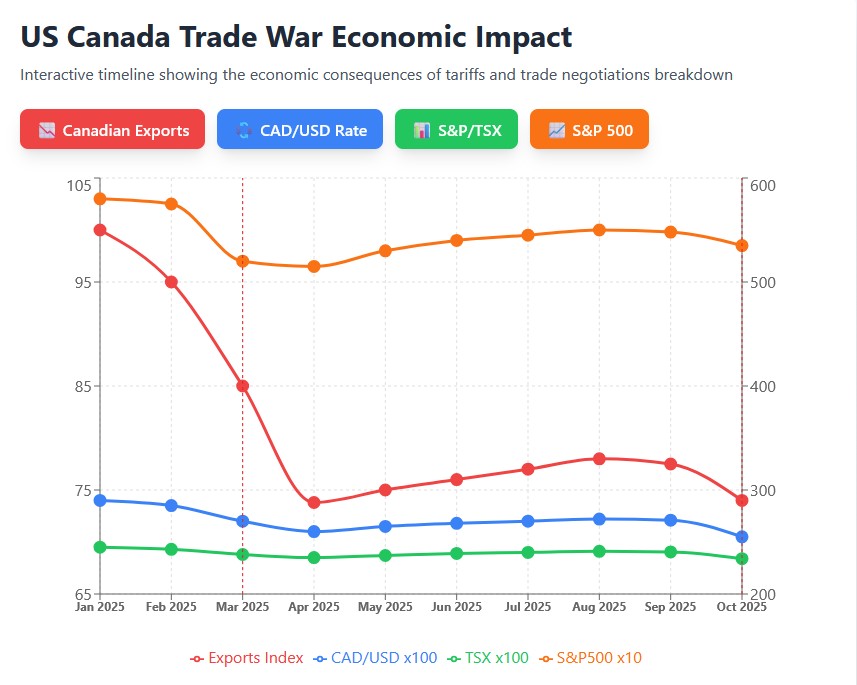

The termination of trade talks introduces substantial uncertainty into North American markets. During previous trade tensions in March 2025, the S&P 500 fell over 10 percent in two days following Trump's tariff announcements, marking its worst week since the COVID-19 recession of 2020. Canadian and Mexican markets demonstrated greater resilience during that period, with Canada's benchmark S&P/TSX maintaining relatively stable levels.

The Bank of Canada has warned that tariffs will ultimately lead to a weaker Canadian dollar, lower incomes, disrupted supply chains, and higher inflation. Currency depreciation compounds inflationary pressures by increasing the cost of all imported goods and services, creating a challenging environment for central bank monetary policy.

Trade Flow Disruption: Measuring Bilateral Commerce Decline

In April 2025, goods exports to the United States dropped 15.7 percent, a third consecutive monthly decline, with exports down 26.2 percent since their January 2025 peak. These figures illustrate the tangible economic damage already inflicted by tariff implementation and trade uncertainty.

Canada and the United States have the world's most comprehensive and dynamic trading relationship, with US$2.5 billion worth of goods and services crossing the border every day. This massive daily exchange supports millions of jobs across both nations and underpins supply chains in critical industries including automotive manufacturing, steel production, aluminum processing, and energy distribution.

Sectoral Analysis: Industries Facing Maximum Exposure

Nearly one-fifth (18.1 percent) of all Canadian businesses expect tariffs imposed by the United States on imports from Canada to have a high impact on their operations. The sectors facing the most severe challenges include:

Steel and Aluminum Manufacturing: Bea Bruske, president of the Canadian Labour Congress, stated 23,000 steel jobs and another 9,500 aluminum jobs would be impacted within days if negotiations fail. These industries face double exposure through both direct tariffs and retaliatory measures.

Automotive Sector: Canada announced twenty-five percent tariffs on non-CUSMA compliant fully assembled vehicles imported from the United States, along with twenty-five percent tariffs on non-Canadian and non-Mexican content of CUSMA compliant vehicles. This complex tariff structure creates substantial compliance costs and pricing pressure throughout integrated North American supply chains.

Agricultural Exports: Canadian farmers face significant headwinds, with Trump claiming that "Canada has long cheated on tariffs, charging our farmers as much as 400 percent". Agricultural products remain particularly vulnerable to retaliatory measures and shifting trade policies.

Long-Term Economic Projections: Bank of Canada Scenario Analysis

The Bank of Canada has developed comprehensive scenarios to assess potential tariff impacts on Canadian economic growth, employment, and inflation.

GDP Growth Implications

In the Bank of Canada's January projection with no tariffs, growth of about 1.8 percent was forecast for both 2025 and 2026, but in their tariff scenario, the level of Canadian output falls almost 3 percent over two years, effectively wiping out growth for those two years. This represents a severe economic contraction that would push unemployment higher and strain government finances.

Over time, the decline in business investment significantly reduces potential GDP in Canada, leading to a permanent decline in GDP, while inflation generally rises despite weaker demand. This stagflationary outcome presents policymakers with difficult choices between supporting growth and controlling price increases.

Cross-Border Impact: US Economic Consequences

American businesses and consumers also face substantial costs from escalating trade tensions. The Budget Lab at Yale estimates that 2025 tariffs to date would cause US real GDP growth to be 0.5 percentage points lower in both 2025 and 2026, with the economy persistently 0.4 percent smaller in the long run, equivalent to $125 billion annually in 2024 dollars.

The unemployment rate is projected to rise 0.3 percentage points by the end of 2025 and 0.7 percentage points by the end of 2026, with payroll employment 505,000 lower by year end. Manufacturing sectors may expand under tariff protection, but these gains are more than offset by contractions in construction, agriculture, and mining sectors.

Strategic Responses: Canada's Diversification Initiative

Recognizing the structural shift in US trade policy, Canadian leadership has announced ambitious plans to reduce dependence on American markets.

Export Diversification Strategy

Canadian Prime Minister Mark Carney says he's setting a goal for the country to double its non-US exports in the next decade, stating that Canada's former strengths based on close ties to the United States have become vulnerabilities. This represents a fundamental reorientation of Canadian trade strategy after decades of deepening economic integration with the United States.

According to Carney, the decades-long process of an ever-closer economic relationship between the Canadian and US economies is now over, with the US fundamentally changing its approach to trade and raising tariffs to levels last seen during the Great Depression.

Existing Trade Infrastructure and Future Opportunities

Canada currently has free trade agreements covering more than 50 countries that together cover two-thirds of the global economy and about 1.5 billion consumers, with more deals in the works. These existing frameworks provide potential pathways for Canadian exporters seeking to reduce American market exposure.

However, geographic proximity, linguistic commonality, regulatory alignment, and decades of supply chain integration make the US market difficult to replace. Diversification will require substantial investment in new trade relationships, logistics infrastructure, and market development initiatives.

Financial Market Implications: Investment Strategy Considerations

Currency Trading Opportunities

The Canadian dollar faces sustained downward pressure from trade uncertainty and weakening economic fundamentals. Currency traders should monitor several key factors:

- Trade Balance Trends: Monthly merchandise trade data provides real-time indicators of tariff impact severity

- Central Bank Policy Divergence: Interest rate differential changes between the Bank of Canada and Federal Reserve influence exchange rate dynamics

- Commodity Price Correlations: Energy and mineral exports remain crucial Canadian dollar drivers despite trade tensions

Equity Sector Rotation

Investors should consider defensive positioning in sectors most exposed to trade disruption while identifying beneficiaries of Canadian diversification strategies:

Defensive Sectors: Domestic-focused utilities, telecommunications, and consumer staples offer relative insulation from trade war escalation

Opportunity Areas: Companies with diversified export markets, European exposure, or Asia-Pacific trade relationships may outperform domestically-focused competitors

Fixed Income Considerations

Government bond yields in both countries reflect changing economic growth expectations and inflation dynamics. Canada's retaliatory tariffs on all goods imported from the United States have a direct and indirect impact on consumer prices, with roughly 13 percent of Canada's CPI basket made up of goods imported from the United States. This inflationary pressure complicates monetary policy and influences bond market pricing.

Political Context: Historical Trade Relations and Current Tensions

The current dispute occurs against a backdrop of broader US-Canada tensions that extend beyond traditional trade policy disagreements.

Sovereignty Concerns and Annexation Rhetoric

Trump made repeated calls for Canada to be annexed by the United States as its "51st state," saying that while he would not use military coercion, he could use "economic force" to bring about Canadian annexation. These provocative statements have fundamentally altered Canadian public perception of the bilateral relationship.

Canadian leadership has consistently rejected annexation suggestions as threats to national sovereignty, with former Prime Minister Justin Trudeau previously stating that Canadian annexation "never going to happen." However, the economic leverage implied in Trump's "economic force" comments adds urgency to diversification efforts.

USMCA Review Process and 2026 Deadline

The tariffs could affect negotiations on renewing the USMCA, for which a review is due in 2026, with Canadian officials growing concerned that Trump may threaten tariffs to force changes to the agreement. This scheduled review creates a natural deadline for resolving outstanding trade disputes or potentially restructuring North American trade architecture.

Path Forward: Scenarios for Resolution

Optimistic Scenario: Negotiated Settlement

Historical precedent suggests Trump's trade talk terminations may be tactical rather than permanent. This is not the first time trade talks between Canada and the US have stalled, with previous suspensions on June 27 following Canada's Digital Services Tax announcement. Previous disruptions were ultimately resolved through continued diplomatic engagement.

On Friday, Ontario Premier Doug Ford said that after speaking with Canadian Prime Minister Mark Carney, the US ad campaign would pause on Monday so that trade talks could resume, though not before running during MLB's World Series games over the weekend. This compromise demonstrates both sides' interest in finding face-saving solutions that allow negotiations to continue.

Pessimistic Scenario: Prolonged Trade War

If negotiations remain suspended through the USMCA review period, both economies face sustained damage. Canada has borne the brunt of damage from US tariffs so far, with its long-run economy projected to be 2.1 percent smaller in real terms. However, American consumers and businesses also suffer through higher prices, disrupted supply chains, and lost export markets.

Neutral Scenario: Partial Agreements on Key Sectors

A more likely outcome involves sectoral agreements that address specific tariff disputes while leaving broader trade framework questions unresolved until the 2026 USMCA review. Dominic LeBlanc, the Canadian trade minister, said negotiators for both countries had left with directions to "quickly land deals" on steel, aluminum and energy prior to the advertisement controversy.

Investment Recommendations: Navigating Trade Uncertainty

Portfolio Positioning Strategies

- Geographic Diversification: Increase exposure to Canadian companies with established European or Asian revenue streams

- Currency Hedging: Consider hedging Canadian dollar exposure in equity portfolios given fundamental weakness

- Quality Focus: Emphasize companies with strong balance sheets capable of absorbing tariff costs without severe margin compression

- Sector Selection: Overweight domestic Canadian services and infrastructure; underweight export-dependent manufacturing

Risk Management Considerations

Trade policy volatility requires dynamic portfolio management and continuous monitoring of several key indicators:

- Monthly trade balance data from Statistics Canada

- Bank of Canada monetary policy statements and forward guidance

- White House social media announcements and official trade policy releases

- Provincial government responses and counter-tariff implementations

Conclusion: Structural Shift in North American Trade Architecture

The termination of trade talks over the Reagan advertisement controversy represents more than a diplomatic spat over political messaging. It reflects fundamental tensions in the North American trade relationship that have been building throughout Trump's second term.

For financial market participants, the key takeaway is that decades of deepening economic integration may be reversing. Companies and investors who assumed continued frictionless trade between the US and Canada must reassess these assumptions and develop strategies for a more fragmented North American market.

The coming weeks will reveal whether the advertising controversy serves as a temporary obstacle to ongoing negotiations or a more permanent rupture requiring fundamental restructuring of cross-border commercial relationships. Either outcome carries significant implications for equity valuations, currency markets, and fixed income pricing across North American financial markets.

Market participants should prepare for continued volatility as this situation develops, maintaining flexibility to adjust positions as new information emerges regarding the trajectory of US-Canada trade relations and the broader implications for North American economic integration.