Table of Contents

- Strategic Alliance Reshapes Digital Commerce Landscape

- Breaking Down the Partnership Structure

- PayPal Financial Impact Analysis

- Immediate Market Response and Valuation

- Q3 2025 Financial Performance

- Revenue Growth Drivers and Future Projections

- Strategic Positioning in Agentic Commerce

- Capital Allocation and Shareholder Returns

- OpenAI Financial Impact Analysis

- Revenue Acceleration Through Commerce Integration

- Addressing Profitability Challenges

- Infrastructure Investment and Capital Requirements

- Market Implications and Competitive Dynamics

- Disrupting Traditional E Commerce

- Competitive Response and Industry Evolution

- Risk Factors and Challenges

- Adoption Uncertainty

- Regulatory and Compliance Considerations

- Technology Execution Risk

- Investment Perspective

Strategic Alliance Reshapes Digital Commerce Landscape

PayPal Holdings Inc. and OpenAI have announced a landmark partnership that embeds PayPal's digital wallet directly into ChatGPT, marking a transformative moment in the evolution of agentic commerce. The deal, finalized on October 28, 2025, sent PayPal stock surging over 10% in early trading as investors recognized the strategic value of positioning the payments giant at the forefront of AI driven shopping experiences.

Breaking Down the Partnership Structure

The collaboration between PayPal and OpenAI creates a seamless payment infrastructure within ChatGPT through the adoption of the Agentic Commerce Protocol. Starting in 2026, the integration will enable ChatGPT's 700 million weekly active users to complete purchases without leaving the conversational interface. PayPal's digital wallet becomes the first embedded payment solution in ChatGPT, providing users with multiple funding options including bank accounts, credit cards, and stored balances.

The partnership extends beyond basic payment processing. PayPal will manage merchant routing, payment validation, and orchestration for its tens of millions of merchants, eliminating the need for individual merchant integrations with OpenAI. This creates a scalable infrastructure that brings product catalogs from small businesses and major retail brands across apparel, fashion, beauty, home improvement, and electronics sectors directly into ChatGPT commerce.

PayPal Financial Impact Analysis

Immediate Market Response and Valuation

The market's enthusiastic response to the OpenAI partnership reflects investor confidence in PayPal's strategic repositioning. The stock price jumped approximately 10% following the announcement, adding billions to the company's market capitalization in a single trading session. This surge came alongside PayPal's strong third quarter 2025 earnings results, creating a powerful dual catalyst for investor optimism.

Q3 2025 Financial Performance

PayPal's third quarter results demonstrated solid fundamentals that underpin the strategic value of the OpenAI partnership. The company reported revenue of $8.42 billion, representing 7% year over year growth and exceeding analyst expectations of $8.23 billion. Non GAAP earnings per share reached $1.34, surpassing the consensus estimate of $1.21 and marking 12% growth compared to the prior year period.

Transaction margin dollar growth, excluding interest on customer balances, accelerated to 7% in Q3, a critical metric that validates PayPal's shift toward profitable expansion. CEO Alex Chriss highlighted that the company is on pace for 6% to 7% transaction margin dollar growth for full year 2025, a dramatic reversal from negative growth just two years ago.

Revenue Growth Drivers and Future Projections

The OpenAI partnership positions PayPal to capture revenue from multiple expanding markets. The company's total payment volume reached $458 billion in Q3, growing 7% on a currency neutral basis. With ChatGPT processing potential transactions from hundreds of millions of users, PayPal gains access to an entirely new distribution channel that could significantly accelerate payment volume growth.

PayPal raised its full year 2025 guidance, projecting non GAAP EPS between $5.35 and $5.39, representing 15% to 16% growth. The company expects transaction margin dollars to reach $15.45 billion to $15.55 billion, indicating confidence in sustained momentum across its diversified business segments.

Strategic Positioning in Agentic Commerce

The partnership represents PayPal's strategic bet on agentic commerce becoming a fundamental shift in consumer behavior. The company has secured similar agreements with Google and Perplexity, creating a network effect where PayPal becomes the default payment infrastructure for AI powered shopping across multiple platforms. This first mover advantage in the emerging agentic commerce space could provide sustained competitive differentiation.

Management's willingness to invest in this opportunity signals long term conviction. PayPal indicated it will increase growth investments in Q4 2025, potentially creating near term headwinds to transaction margin dollars and earnings in 2026. However, the company frames these investments as necessary to capture massive long term opportunities in digital wallets, buy now pay later, and agentic commerce.

Capital Allocation and Shareholder Returns

PayPal announced its first ever dividend in its 27 year history, setting a quarterly dividend of $0.14 per share. This milestone reflects management's confidence in cash generation and long term profitability. The company also maintained its commitment to approximately $6 billion in share buybacks for fiscal year 2025, having returned $1.5 billion to stockholders through repurchases in Q3 alone.

OpenAI Financial Impact Analysis

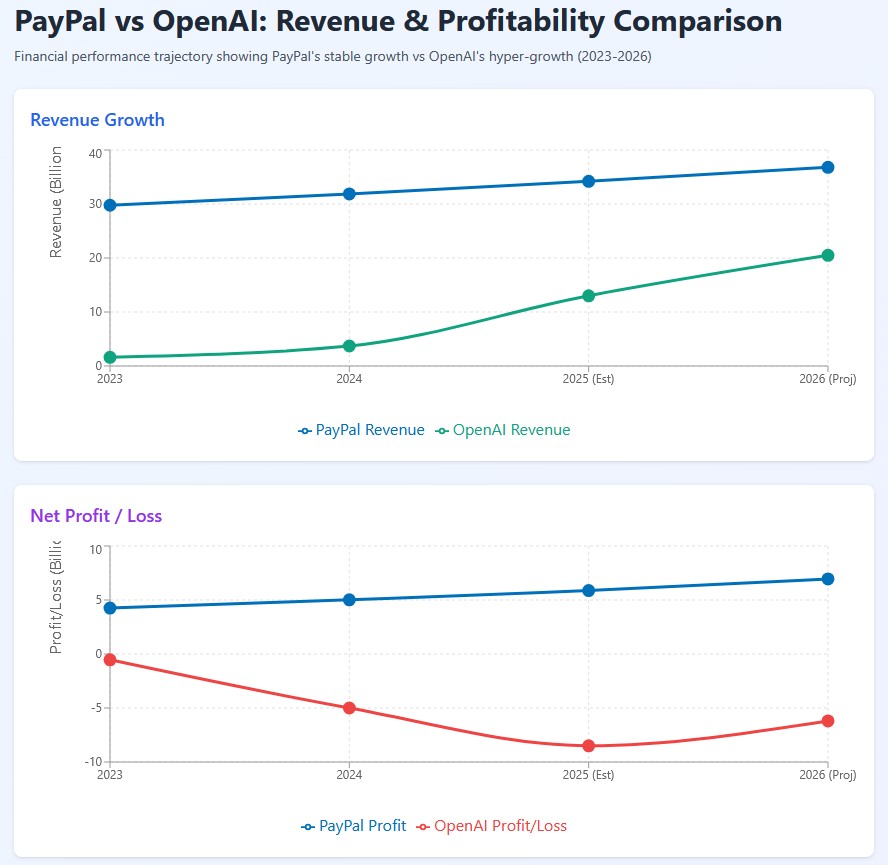

Revenue Acceleration Through Commerce Integration

OpenAI has achieved extraordinary revenue growth, reaching approximately $13 billion in annual recurring revenue as of October 2025. The company generated $4.3 billion in revenue during the first half of 2025, representing 16% growth over all of 2024. With 700 million weekly active users and over 3 million paying business customers, OpenAI has created one of the fastest scaling software businesses in history.

The PayPal partnership opens a new revenue stream beyond subscriptions and API usage. By enabling commerce transactions within ChatGPT, OpenAI can potentially capture transaction fees or commissions on purchases, creating high margin revenue that scales with user engagement. This diversification addresses investor concerns about OpenAI's reliance on subscription revenue, which currently accounts for approximately 70% of total revenue.

Addressing Profitability Challenges

Despite impressive revenue growth, OpenAI faces significant profitability challenges. The company posted an estimated $5 billion in losses during 2024, with cash burn projected to reach $8.5 billion for full year 2025. Research and development expenses totaled $6.7 billion in the first half of 2025 alone, as OpenAI invests heavily in training advanced AI models and scaling infrastructure to support ChatGPT's massive user base.

The commerce partnership with PayPal represents a strategic response to these financial pressures. By monetizing ChatGPT's user engagement through transaction based revenue rather than solely subscription fees, OpenAI can improve unit economics and accelerate the path to profitability. The company is targeting profitability by 2029, with long term revenue goals of $125 billion.

Infrastructure Investment and Capital Requirements

OpenAI has committed to spending over $1 trillion over the next decade on computing infrastructure, securing more than 26 gigawatts of datacenter capacity from Oracle, Nvidia, AMD, and Broadcom. These massive capital commitments require OpenAI to rapidly scale revenue and diversify income streams beyond its core products.

The PayPal partnership provides validation for OpenAI's commerce strategy without requiring significant upfront capital investment. PayPal handles the complex payment infrastructure, fraud prevention, and regulatory compliance, allowing OpenAI to focus on enhancing the shopping experience within ChatGPT while potentially earning revenue from successful transactions.

Market Implications and Competitive Dynamics

Disrupting Traditional E Commerce

The PayPal OpenAI partnership signals a fundamental shift in how consumers discover and purchase products online. Traditional e commerce relies on users navigating to specific websites or marketplaces. Agentic commerce, by contrast, enables AI assistants to understand preferences, research options, compare prices, and execute purchases within a conversational interface.

This model threatens established e commerce platforms by reducing their direct traffic and customer relationships. However, it creates opportunities for merchants to reach customers through an entirely new channel. PayPal's merchant network gains access to ChatGPT's massive user base, while OpenAI provides a curated shopping experience that could command higher conversion rates than traditional search or display advertising.

Competitive Response and Industry Evolution

PayPal's aggressive moves in agentic commerce force competitors to respond. Visa and Mastercard, traditional payment network competitors, must consider how they position themselves in an AI driven commerce environment. Digital wallet competitors like Apple Pay and Google Pay face pressure to develop similar AI shopping integrations or risk losing relevance as consumer behavior evolves.

For OpenAI, the partnership strengthens its competitive position against Anthropic's Claude, Google's Gemini, and other large language model competitors. By embedding commerce capabilities, ChatGPT becomes more than an information tool; it becomes a transaction platform with direct revenue potential and increased user stickiness.

Risk Factors and Challenges

Adoption Uncertainty

The success of the PayPal OpenAI partnership depends on consumer willingness to shift purchasing behavior toward AI assistants. While ChatGPT has massive user engagement, converting free users to paying customers and then to active shoppers within the platform remains unproven at scale. Market adoption may take longer than anticipated, delaying revenue realization for both companies.

Regulatory and Compliance Considerations

Integrating payments into AI platforms raises questions about consumer protection, data privacy, and financial regulation. Regulators may scrutinize how AI assistants present product recommendations, handle consumer data, and process financial transactions. Both companies must navigate evolving regulatory frameworks while maintaining rapid innovation.

Technology Execution Risk

Delivering seamless commerce experiences within conversational AI interfaces presents technical challenges. The system must accurately understand purchase intent, match users with appropriate products, handle complex transactions, and provide reliable customer support. Any failures in user experience could undermine adoption and damage both brands.

Investment Perspective

The PayPal OpenAI partnership represents a high conviction bet on the future of commerce. For PayPal, the deal validates its strategy to position itself as payment infrastructure for the next generation of shopping experiences. The company's improved financial performance, combined with strategic positioning in agentic commerce, creates a compelling investment narrative despite near term investment headwinds.

For OpenAI, the partnership demonstrates progress toward sustainable profitability by diversifying revenue beyond subscriptions. While the company remains private, the deal signals increasing maturity in monetization strategy and validates the commercial potential of large language models beyond pure software licensing.

Investors should monitor user adoption metrics, transaction volume growth, and the competitive response from other payment and AI companies to assess the partnership's long term value creation potential. Similar to the recent trends in Asian markets and tech sector developments, the October 2025 announcement marks an early stage inflection point in agentic commerce, with meaningful financial impact likely emerging over the next 12 to 24 months as the integration scales.