Table of Contents

- Landmark Agreement Could Transform Access to Weight Loss Medications

- Understanding the Deal Structure and Pricing Framework

- Medicare Coverage Expansion Breaks New Ground

- Most Favored Nation Pricing Strategy

- Market Impact and Financial Implications

- Pharmaceutical Company Responses and Investments

- Oral Formulations and Future Pipeline

- Public Health Context and Obesity Crisis

- Broader Economic Ripple Effects

- Implementation Timeline and Access Mechanisms

- Challenges and Considerations

- Conclusion

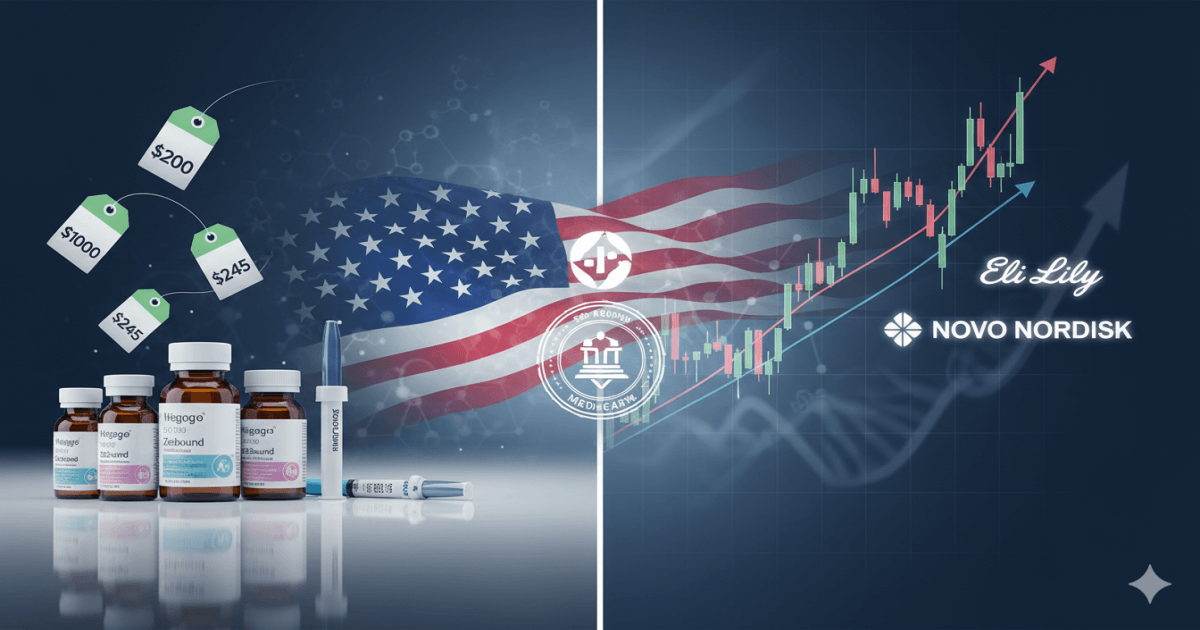

Landmark Agreement Could Transform Access to Weight Loss Medications

President Donald Trump announced a groundbreaking pharmaceutical agreement on Thursday, November 6, 2025, that promises to dramatically reshape the obesity treatment landscape in America. The deals with Eli Lilly and Novo Nordisk will lower prices of GLP-1 drugs on Medicare and Medicaid and offer the treatments directly to consumers at a discount on a website the Trump administration is launching in January 2026 called TrumpRx.gov.

This announcement represents one of the most significant healthcare policy developments of the administration, potentially bringing life changing medications to millions of Americans who previously found them financially out of reach.

Understanding the Deal Structure and Pricing Framework

Novo Nordisk and Eli Lilly have agreed to cut the price Medicare pays for GLP-1s it already covers for diabetes and other indications, along with those drugs for obesity, to $245 per month. This represents a dramatic reduction from the current list prices, which typically range from $1,000 to $1,350 monthly before insurance coverage.

The pricing model introduces a tiered approach designed to maximize accessibility. Starting doses of existing injections like Novo's Wegovy and Lilly's Zepbound will be $350 per month on TrumpRX, but will "trend down" to $245 per month over a two year period. For Medicare beneficiaries, the financial burden becomes even lighter, with Medicare beneficiaries paying a co-pay of just $50 per month.

The agreement also extends beyond obesity medications. Eli Lilly will provide Emgality, a treatment for migraines, at $299 per pen, a discount of $443 off of the list price, and Eli Lilly will provide Trulicity, a commonly used diabetes medicine, at $389 per month, a discount of $598 off of the list price. Novo Nordisk will provide widely used insulin products, including NovoLog and Tresiba, at $35 per month of supply.

Medicare Coverage Expansion Breaks New Ground

Perhaps the most transformative aspect of this deal involves Medicare coverage expansion. Wegovy and Zepbound have not been covered by Medicare for weight loss, and they've only rarely been covered by Medicaid. This policy shift opens access for millions of older Americans struggling with obesity and related health complications.

Senior administration officials said people on Medicare and Medicaid will be eligible for coverage if they are overweight or obese and meet certain criteria, such as having heart disease, kidney disease or severe obesity. This targeted approach aims to balance broad access with fiscal responsibility, ensuring the medications reach those who will benefit most clinically.

Most Favored Nation Pricing Strategy

The Trump administration's approach centers on the Most Favored Nation initiative, which seeks to align American drug prices with those paid by comparable developed nations. President Trump signed an Executive Order titled "Delivering Most Favored Nation Prescription Drug Pricing to American Patients" directing the Administration to take numerous actions to bring American drug prices in line with those paid by similar nations.

As part of the deals, Eli Lilly and Novo Nordisk also made similar pledges to the ones other drugmakers have made as part of Trump's most favored nation agreements. The companies will guarantee most favored nation pricing on all new medicines they bring to market, provide that pricing to every state Medicaid program, offer at least U.S. net prices or most favored nation pricing on nearly all primary care drugs on TrumpRx and share savings from foreign drug price increases on existing products.

Market Impact and Financial Implications

The obesity drug market has emerged as one of the pharmaceutical industry's most lucrative segments. J.P. Morgan Research forecasts that the GLP-1 market will exceed $100 bn by 2030, driven equally by diabetes and obesity usage. Total GLP-1 users in the U.S. may number 30 mn by 2030, or around 9% of the overall population.

However, this explosive growth has created significant financial pressures for insurers and healthcare systems. Blue Cross Blue Shield of Massachusetts ended 2024 with a staggering $400 million operating loss, its worst financial performance on record. The health plan cited GLP-1 drugs as the single largest driver of increased costs, accounting for more than $300 million in 2024, 20% of the insurer's total pharmacy costs, and double the amount spent in the prior year.

These cost pressures have forced many employers and insurers to implement restrictive coverage policies or discontinue coverage entirely, making the Trump administration's intervention particularly timely for millions of Americans seeking treatment.

Pharmaceutical Company Responses and Investments

Both pharmaceutical giants have responded positively to the agreement while committing to substantial domestic manufacturing investments. Novo Nordisk has committed an additional $10 billion investment to strengthen its domestic footprint, including producing the Wegovy tablet, if approved, end to end in the U.S. Under President Trump's leadership, Eli Lilly has announced at least $27 billion in new U.S. manufacturing investments.

David Ricks, Eli Lilly's chair and CEO, emphasized the milestone's significance: "Today marks a pivotal moment in U.S. health care policy and a defining milestone for Lilly, made possible through collaboration with the Trump administration. As we expand access to obesity treatments for more Americans and advance one of the most innovative obesity pipelines, we remain focused on improving outcomes, strengthening the U.S. health care system, and contributing to the health of our nation for generations to come."

Oral Formulations and Future Pipeline

The agreement includes provisions for next generation oral formulations, which could further revolutionize treatment accessibility. Novo Nordisk's oral version of its obesity injection Wegovy could enter the market by year end, while Eli Lilly's pill orforglipron could launch next year. The Food and Drug Administration on Thursday said it has awarded priority review vouchers, which expedite the review timelines of new potential drugs, to the two pills.

The deal mentioned that starting doses of GLP-1 pills will cost $149. This pricing point could make treatment accessible to an even broader patient population once these oral alternatives receive FDA approval.

Public Health Context and Obesity Crisis

The timing of this deal addresses a critical public health emergency. The Centers for Disease Control and Prevention (CDC) estimate the prevalence of obesity among American adults to be 40%. Obesity is one of the key drivers of chronic disease, increasing the risk of type 2 diabetes, hypertension, heart disease, strokes, and certain cancers, among other conditions.

The scale of this crisis has profound economic implications beyond healthcare costs. An estimated 2% of U.S. adults, approximately 5 million people, were taking GLP-1s as of a May 2025 report from non-profit Fair Health. This figure is expected to grow substantially with improved pricing and coverage.

Broader Economic Ripple Effects

The proliferation of obesity medications is already creating widespread economic impacts across multiple sectors. A 2024 Cornell University study found that households with at least one GLP-1 user cut their grocery spend by 5.3% within six months of adoption, with that rate rising to 8.2% among higher income households.

The pharmaceutical sector itself is experiencing unprecedented dealmaking activity. Obesity is the hottest sector of the biopharma market, driven by the explosive growth of GLP-1 therapies and the associated dealmaking activity. 2024 alone saw over $30 billion in alliances and acquisitions.

Implementation Timeline and Access Mechanisms

The full implementation of these agreements will occur in phases. Medicare patients could see the new pricing as soon as mid 2026. Medicaid pricing and timing will be dependent by state as they opt in. The TrumpRx platform, scheduled to launch in January 2026, will serve as the primary distribution mechanism for discounted medications purchased with cash.

The administration has positioned this deal as part of a broader pharmaceutical pricing strategy. Since September 30, 2025, President Trump has announced five deals with major pharmaceutical manufacturers to bring prices in line with those paid in other developed nations, which will provide substantial price relief on numerous products taken by millions of Americans.

Challenges and Considerations

Despite the optimistic outlook, significant questions remain about long term sustainability and patient adherence. One study showed that 50% of patients with obesity actually discontinued their GLP-1s after 12 months, and a potential outcome of this discontinuation is significant weight regain.

Insurance industry experts also warn about the broader fiscal implications. The prospect of offering blanket coverage for GLP-1 treatments to all individuals living with obesity is likely financially unsustainable, as the sheer volume of potential recipients can overwhelm healthcare budgets. Similar concerns have been raised about the impact of rising pharmaceutical costs on global markets, highlighting the interconnected nature of healthcare policy and economic stability.

Conclusion

The Trump administration's agreement with Eli Lilly and Novo Nordisk represents a watershed moment in American healthcare policy. By dramatically reducing costs and expanding access to obesity medications, this deal has the potential to address one of the nation's most pressing health crises while creating ripple effects throughout the economy.

The success of this initiative will ultimately depend on implementation execution, patient adherence, and the development of complementary lifestyle interventions. Nevertheless, this agreement establishes a new precedent for government negotiation power in pharmaceutical pricing and could serve as a model for future drug price negotiations.

As the January 2026 launch of TrumpRx approaches, millions of Americans may finally gain access to medications that were previously financially unattainable, potentially reshaping the trajectory of the obesity epidemic and setting new standards for pharmaceutical affordability in the United States.