Table of Contents

United Airlines has reported stronger than expected third quarter earnings for 2025, while revenue narrowly missed Wall Street forecasts. The airline is now betting heavily on premium flyers and loyalty programs to fuel record revenue through the end of the year.

United Airlines Q3 2025 Earnings Results

United Airlines posted adjusted earnings per share of $2.78, surpassing analyst expectations of around $2.66. Net income came in at $949 million, or $2.90 per share, compared with $967 million a year earlier. Revenue reached $15.23 billion, up 2.6 percent year over year, but slightly below the $15.3 billion consensus estimate.

The airline increased capacity by more than 7 percent compared with last year, but unit passenger revenue fell 3.3 percent domestically and 7.1 percent internationally. Despite this, United’s premium cabin revenue rose 6 percent, while loyalty program sales jumped 9 percent, highlighting the company’s strategic focus on higher margin segments.

Premium Flyers and Loyalty Programs as Growth Engines

United Airlines is targeting affluent travelers who are willing to pay more for comfort and exclusive services. The company has invested in refreshed cabins, new lounges, and complimentary inflight Wi-Fi, which CEO Scott Kirby says are helping to secure long term brand loyalty.

The airline’s MileagePlus loyalty program continues to deliver strong results, with double digit growth in recent quarters. This segment is increasingly important as it provides stable, recurring revenue less exposed to fluctuations in ticket pricing.

United Airlines Q4 2025 Outlook

Looking ahead, United expects adjusted earnings between $3.00 and $3.50 per share in the fourth quarter, well above Wall Street’s forecast of $2.86. This guidance reflects confidence in premium demand, international expansion, and cost discipline.

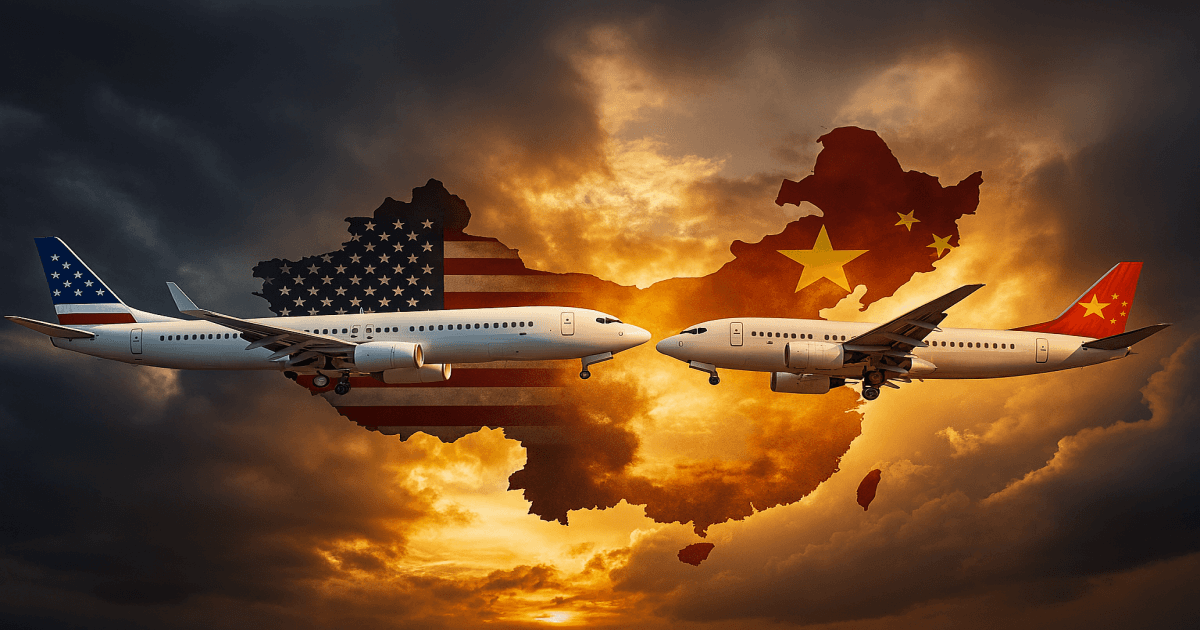

The airline is also expanding its global network with new destinations such as Greenland and Mongolia, aiming to capture demand from both leisure and business travelers.

Competitive Landscape in the Airline Industry

United’s strategy contrasts with rivals like Delta Air Lines, which have scaled back growth plans after excess capacity pressured fares earlier this year. By maintaining an aggressive expansion strategy, United is positioning itself to capture market share as demand stabilizes.

However, risks remain. A potential slowdown in consumer spending, volatile fuel prices, and geopolitical uncertainties could weigh on margins. Still, United’s focus on premium flyers and loyalty programs provides a buffer against these headwinds.

Key Takeaways for Investors

-

Earnings beat: Adjusted EPS of $2.78 vs. $2.66 expected

-

Revenue miss: $15.23 billion vs. $15.3 billion expected

-

Premium growth: Premium cabin revenue up 6 percent, loyalty program sales up 9 percent

-

Q4 guidance: $3.00 to $3.50 EPS, above analyst expectations

-

Strategic focus: Expansion of premium services, loyalty programs, and international routes

Conclusion

United Airlines delivered a mixed but promising Q3 2025 performance, with earnings strength offset by slightly weaker revenue. The airline’s premium travel strategy and loyalty program expansion are expected to drive record revenue in the coming quarters. For investors, United remains a key player in the airline sector, with upside potential if premium demand continues to outpace broader market trends.